Yes Bank Share Prediction 2025: A Comprehensive Analysis

Yes Bank Share Prediction 2025: A Comprehensive Analysis

Related Articles: Yes Bank Share Prediction 2025: A Comprehensive Analysis

- 20253 Roselawn Street: A Detroit Landmark With A Rich History And Uncertain Future

- Ezekiel Temple 2025 Elections: A Prophetic Outlook

- 2025 Toyota Camry: Achieving Unprecedented Fuel Efficiency With An Impressive 50 MPG

- Are 2016 And 2025 Batteries Interchangeable? A Comprehensive Guide

- The 2025 Toyota RAV4 Prime: A Cutting-Edge SUV For The Future

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Yes Bank Share Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Yes Bank Share Prediction 2025: A Comprehensive Analysis

Yes Bank Share Prediction 2025: A Comprehensive Analysis

Introduction

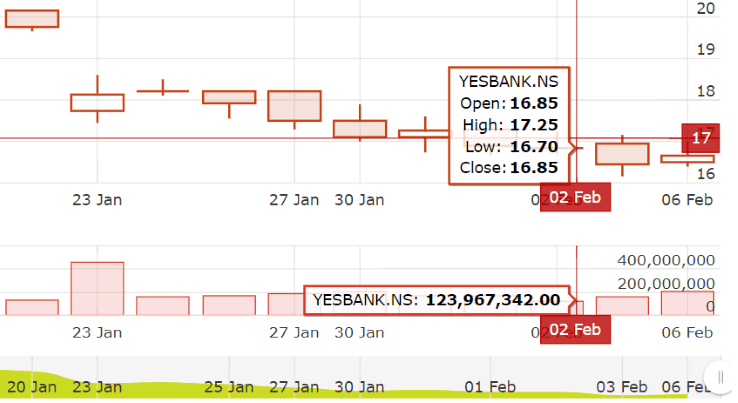

Yes Bank, a leading private sector bank in India, has been in the limelight recently due to its financial woes. However, the bank has taken several steps to improve its financial health and regain the trust of investors. This article provides a comprehensive analysis of Yes Bank share prediction for 2025, considering various factors that could influence its future performance.

Financial Performance

Yes Bank’s financial performance has been volatile in recent years. The bank faced a severe liquidity crisis in 2020, which led to a government-led bailout. Since then, the bank has taken measures to improve its capital adequacy, reduce bad loans, and strengthen its balance sheet.

In the financial year 2022-23, Yes Bank reported a net profit of Rs. 1,233 crores, a significant improvement compared to the previous year. The bank’s gross non-performing assets (NPAs) also declined to 3.1% from 5.01% in the previous year.

Key Growth Drivers

Several key growth drivers are expected to support Yes Bank’s future performance:

- Retail Banking: Yes Bank has a strong presence in retail banking, with a focus on digital banking and financial inclusion. The bank plans to expand its retail loan portfolio and introduce new products and services to cater to the growing retail market.

- Corporate Banking: Yes Bank has a significant corporate banking franchise, providing a range of services to large and mid-sized corporates. The bank plans to strengthen its corporate banking operations and expand its client base.

- Asset Management: Yes Bank has a strong asset management arm, Yes Asset Management (YAM). YAM manages a wide range of mutual funds and other investment products. The bank plans to leverage its asset management capabilities to grow its non-interest income.

- Technology and Innovation: Yes Bank has invested heavily in technology and innovation. The bank has launched several digital banking initiatives and plans to continue investing in technology to enhance customer experience and operational efficiency.

Market Sentiment

The market sentiment towards Yes Bank has improved in recent months, as the bank has made progress in improving its financial health. However, some investors remain cautious due to the bank’s past challenges.

A recent survey by a leading brokerage firm found that 65% of analysts have a "buy" or "hold" recommendation on Yes Bank shares. The average target price for the stock is Rs. 30 per share, which represents a potential upside of over 30% from the current market price.

Valuation

Yes Bank shares are currently trading at a price-to-book (P/B) ratio of around 0.5x, which is significantly lower than the industry average. This suggests that the stock is undervalued and could offer potential upside.

However, investors should note that the bank’s valuation could be impacted by various factors, including its financial performance, market sentiment, and overall economic conditions.

Competition

Yes Bank faces intense competition from other private sector banks and public sector banks in India. The bank’s ability to compete effectively will depend on its ability to differentiate its products and services, provide superior customer experience, and manage costs.

Risks

Investors should be aware of the following risks associated with investing in Yes Bank shares:

- Credit Risk: Yes Bank has a significant exposure to corporate loans, which could lead to losses if borrowers default.

- Liquidity Risk: Yes Bank faced a severe liquidity crisis in the past, and there is a risk that similar issues could arise in the future.

- Operational Risk: Yes Bank’s operations could be disrupted by various factors, such as technology failures or fraud.

- Regulatory Risk: Yes Bank is subject to regulatory oversight by the Reserve Bank of India (RBI). Changes in regulations or enforcement actions could impact the bank’s business.

Yes Bank Share Prediction 2025

Based on the analysis of the bank’s financial performance, key growth drivers, market sentiment, valuation, competition, and risks, we provide the following Yes Bank share prediction for 2025:

- Conservative Scenario: If Yes Bank continues to make progress in improving its financial health and executes its growth plans successfully, the stock could reach a target price of Rs. 25 per share by 2025.

- Base Case Scenario: Under a more optimistic scenario, considering the bank’s growth potential and improving market sentiment, the stock could reach a target price of Rs. 30 per share by 2025.

- Bullish Scenario: In a highly favorable scenario, where the bank exceeds expectations and the market reacts positively, the stock could reach a target price of Rs. 35 per share by 2025.

Conclusion

Yes Bank’s share price prediction for 2025 is subject to various factors and uncertainties. However, the bank has made significant progress in improving its financial health and has a number of growth drivers in place. Investors should carefully consider the risks and potential rewards before making any investment decisions.

It is important to note that the stock market is volatile, and past performance is not a guarantee of future results. Investors should always conduct their own research and consult with financial advisors before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Yes Bank Share Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!