Will Interest Rates Drop By 2025?

Will Interest Rates Drop by 2025?

Related Articles: Will Interest Rates Drop by 2025?

- Loctite 20252: The Ultimate Adhesive For Bonding Metal To Composite Materials

- New Zealand Flights 2025: Premium Economy Takes Flight

- Jeep Renegade 2025: Unveiling The Future Of Compact SUVs

- Las Vegas Raiders 2024 Printable Schedule

- National And Local Elections 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Will Interest Rates Drop by 2025?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Will Interest Rates Drop by 2025?

Will Interest Rates Drop by 2025?

Introduction

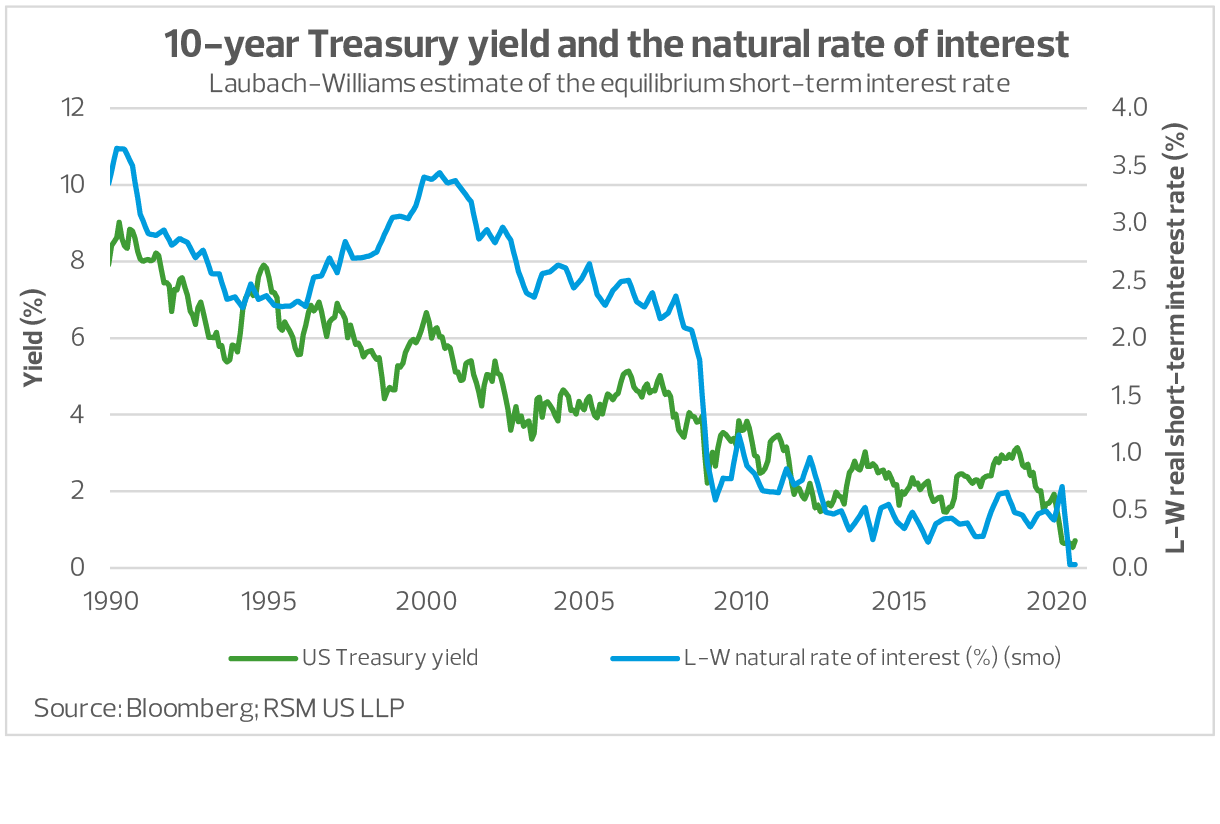

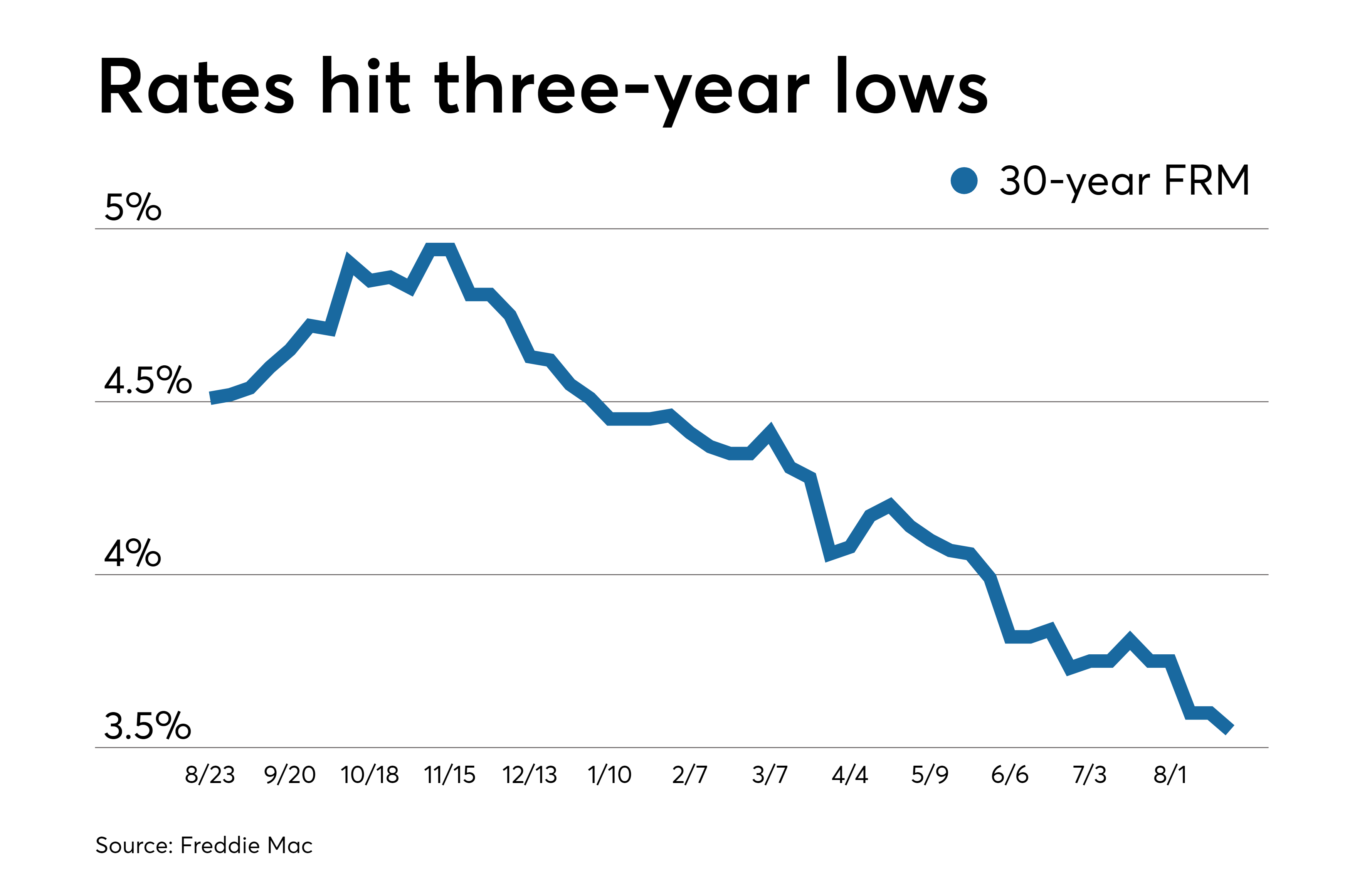

Interest rates have been on a downward trend for decades, with the Federal Reserve (Fed) lowering its benchmark rate to near zero in 2020 in response to the COVID-19 pandemic. As the economy recovers, many analysts are wondering whether interest rates will continue to fall or if they will start to rise again.

Factors Affecting Interest Rates

Several factors influence interest rates, including:

- Inflation: When inflation is high, the Fed typically raises interest rates to cool the economy and bring inflation under control.

- Economic growth: When the economy is growing strongly, the Fed may raise interest rates to prevent it from overheating.

- Demand for borrowing: When demand for borrowing is high, interest rates tend to rise as lenders charge more to compensate for the increased risk.

- Government borrowing: When the government borrows heavily, it can put upward pressure on interest rates as it competes with other borrowers for funds.

Current Economic Conditions

The current economic outlook is uncertain. While the economy is recovering from the pandemic, there are still concerns about inflation, supply chain disruptions, and the potential for new COVID-19 variants. The Fed has indicated that it will likely start raising interest rates in 2022, but the pace and magnitude of those increases will depend on economic conditions.

Forecasts for Interest Rates

Analysts have varying opinions on where interest rates will go in the coming years. Some believe that rates will continue to fall, citing low inflation and a slow economic recovery. Others believe that rates will start to rise as the economy strengthens and inflation becomes a greater concern.

The Fed’s Stance

The Fed has stated that it will keep interest rates low until the economy has made "substantial further progress" towards its goals of maximum employment and price stability. However, the Fed has also acknowledged that inflation is a risk and that it may need to raise rates sooner than expected if inflation does not moderate.

Implications for Borrowers and Investors

The direction of interest rates has significant implications for borrowers and investors. For borrowers, higher interest rates mean higher borrowing costs, which can make it more expensive to buy a home, take out a loan, or invest in a business. For investors, lower interest rates make it less attractive to save money in traditional savings accounts and bonds, but they can also make it cheaper to borrow money for investments.

Conclusion

The future of interest rates is uncertain, but several factors will influence their direction. The Fed’s stance, economic conditions, and inflation will all play a role in determining whether interest rates will continue to fall or start to rise. Borrowers and investors should monitor the situation closely and make decisions based on their individual circumstances and risk tolerance.

Additional Considerations

In addition to the factors mentioned above, several other considerations could affect interest rates in the coming years:

- Global economic conditions: The global economy can influence interest rates in the United States, as changes in demand for borrowing and investment can affect the supply and demand for dollars.

- Fiscal policy: The government’s fiscal policy, including spending and tax cuts, can also impact interest rates.

- Technological advancements: Technological advancements could lead to increased productivity and economic growth, which could put downward pressure on interest rates.

- Unforeseen events: Unforeseen events, such as natural disasters or geopolitical crises, can also affect interest rates.

Ultimately, the direction of interest rates is a complex issue that depends on a variety of factors. By understanding the factors that influence interest rates and monitoring the latest economic data, borrowers and investors can make informed decisions about their financial futures.

Closure

Thus, we hope this article has provided valuable insights into Will Interest Rates Drop by 2025?. We thank you for taking the time to read this article. See you in our next article!