When Will Interest Rates Drop In 2025? A Comprehensive Analysis

When Will Interest Rates Drop in 2025? A Comprehensive Analysis

Related Articles: When Will Interest Rates Drop in 2025? A Comprehensive Analysis

- What Is The Best Thing About The Year 2025?

- Days Until Thanksgiving 2025: A Countdown To Gratitude

- 2025 Movie Release Date: A Comprehensive Guide To Upcoming Cinematic Masterpieces

- 2025 Ramadan Dates: A Comprehensive Guide To The Holy Month

- Dodge Stealth: An American Sports Car With Japanese Roots

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to When Will Interest Rates Drop in 2025? A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about When Will Interest Rates Drop in 2025? A Comprehensive Analysis

When Will Interest Rates Drop in 2025? A Comprehensive Analysis

Introduction

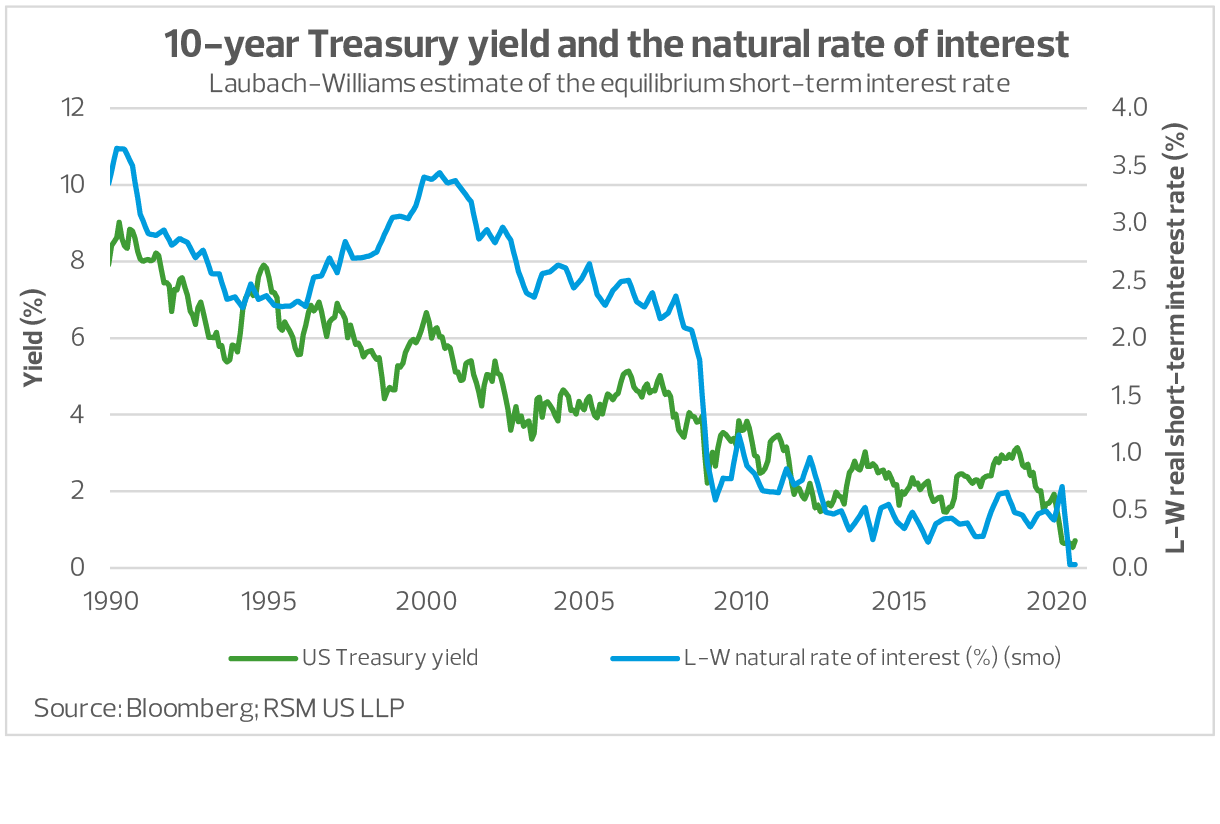

Interest rates play a pivotal role in shaping the economic landscape, influencing borrowing costs, investment decisions, and overall economic growth. In recent years, interest rates have been on an upward trajectory, driven by a combination of factors, including rising inflation, geopolitical tensions, and the Federal Reserve’s efforts to curb economic overheating. As we approach 2025, the question of when interest rates will drop has become a topic of intense speculation and analysis. This article aims to provide a comprehensive assessment of the potential factors that could influence interest rate movements in 2025 and offer informed projections on their trajectory.

Factors Influencing Interest Rate Decisions

The Federal Reserve, the central bank of the United States, holds primary responsibility for setting interest rates. Its decisions are guided by a dual mandate of price stability and maximum employment. The following factors typically influence the Fed’s interest rate decisions:

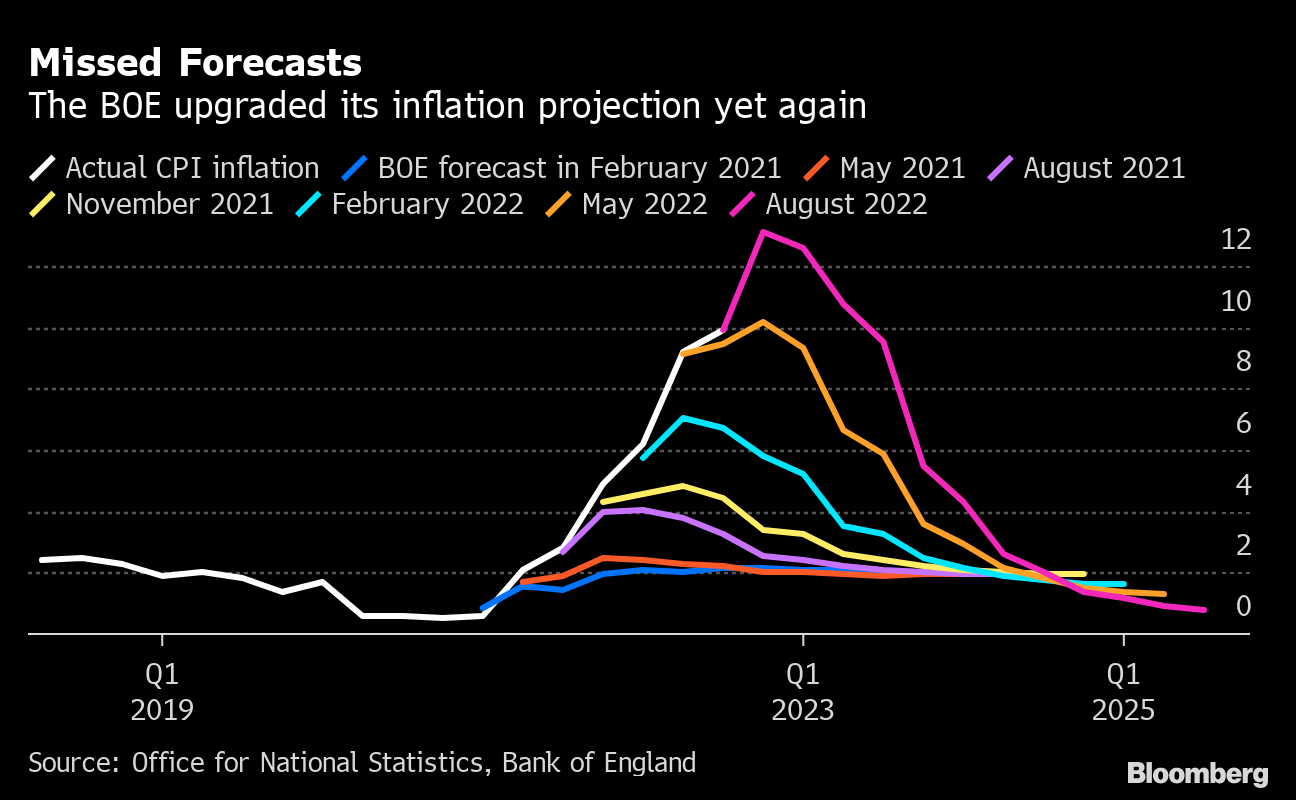

- Inflation: Rising inflation erodes the purchasing power of money and can lead to economic instability. The Fed typically raises interest rates to combat inflation by making borrowing more expensive and slowing down economic activity.

- Economic Growth: Strong economic growth can lead to increased demand for goods and services, potentially driving up inflation. The Fed may raise interest rates to prevent the economy from overheating and to keep inflation under control.

- Unemployment: High unemployment rates indicate economic weakness and reduced demand. The Fed may lower interest rates to stimulate economic activity and encourage job creation.

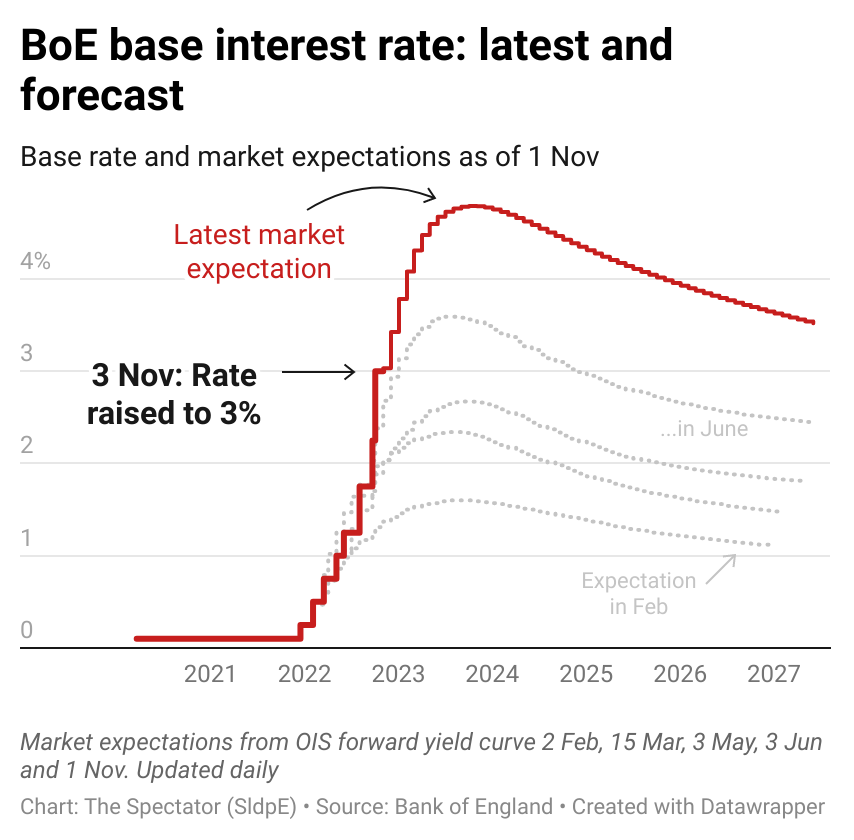

- Global Economic Conditions: Global economic conditions can also impact interest rates in the United States. For example, if the global economy slows down, the Fed may lower interest rates to support domestic economic growth.

Current Economic Landscape

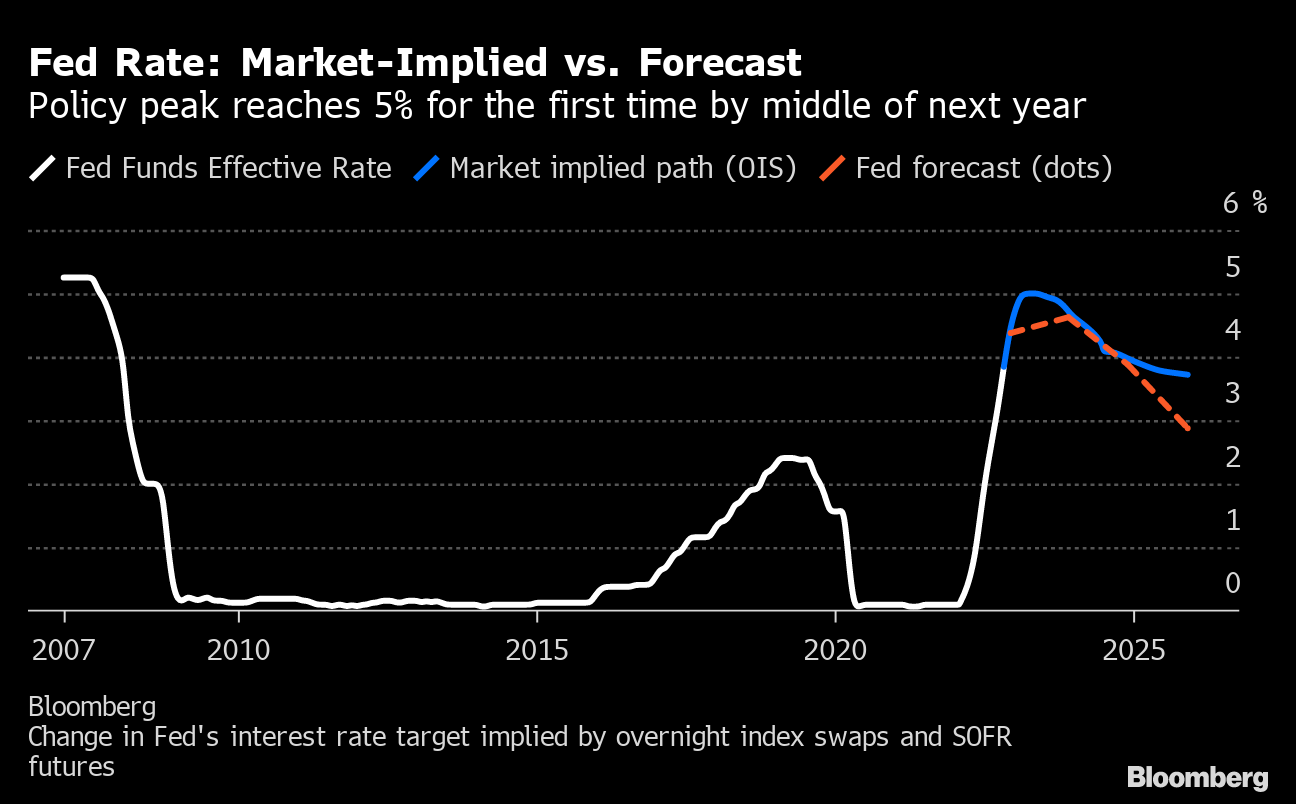

As of mid-2023, the U.S. economy is experiencing a period of elevated inflation, with the Consumer Price Index (CPI) rising at a rate of 8.6% year-over-year. The Federal Reserve has responded by aggressively raising interest rates, with the target range for the federal funds rate currently set at 4.25% to 4.50%. The Fed has also indicated that further rate hikes are likely in the coming months.

Projections for 2025

Predicting the exact timing of interest rate drops in 2025 is challenging, as it depends on a multitude of factors that are difficult to forecast with certainty. However, based on current economic conditions and the Fed’s stated goals, it is possible to make some informed projections:

- Inflationary Pressures: The Fed’s primary focus in the near term will be to bring inflation back down to its target of 2%. If inflation remains stubbornly high, the Fed may continue to raise interest rates beyond 2023. However, if inflation starts to moderate, the Fed may pause its rate-hiking cycle in 2024 or early 2025.

- Economic Growth: The pace of economic growth will also influence the Fed’s decision-making. If the economy continues to grow at a moderate pace, the Fed may be less likely to raise interest rates aggressively. However, if the economy shows signs of overheating, the Fed may need to raise rates further to prevent inflation from spiraling out of control.

- Unemployment: The unemployment rate is currently at a historically low level of 3.6%. If unemployment starts to rise significantly, the Fed may consider lowering interest rates to support economic growth and job creation.

- Global Economic Conditions: The global economic outlook will also play a role in the Fed’s decision-making. If the global economy slows down, the Fed may lower interest rates to support domestic economic growth. Conversely, if the global economy remains strong, the Fed may be more likely to keep interest rates elevated.

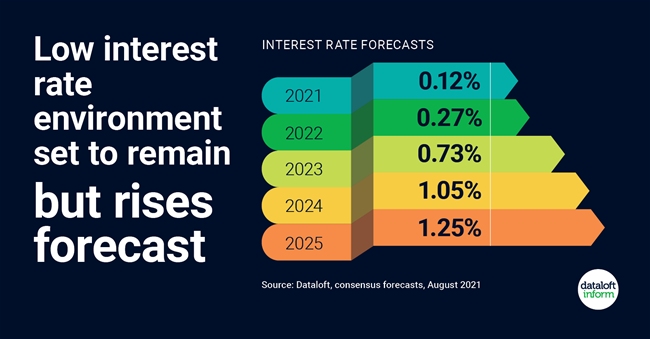

Consensus Forecasts

Based on these factors, a consensus is emerging among economists that interest rates may start to drop in late 2024 or early 2025. However, the timing and magnitude of the rate cuts will depend on the actual path of inflation, economic growth, and other relevant factors. Some analysts predict that the federal funds rate could fall to around 3.5% by the end of 2025, while others believe that rates may remain higher for a longer period of time.

Implications for Businesses and Consumers

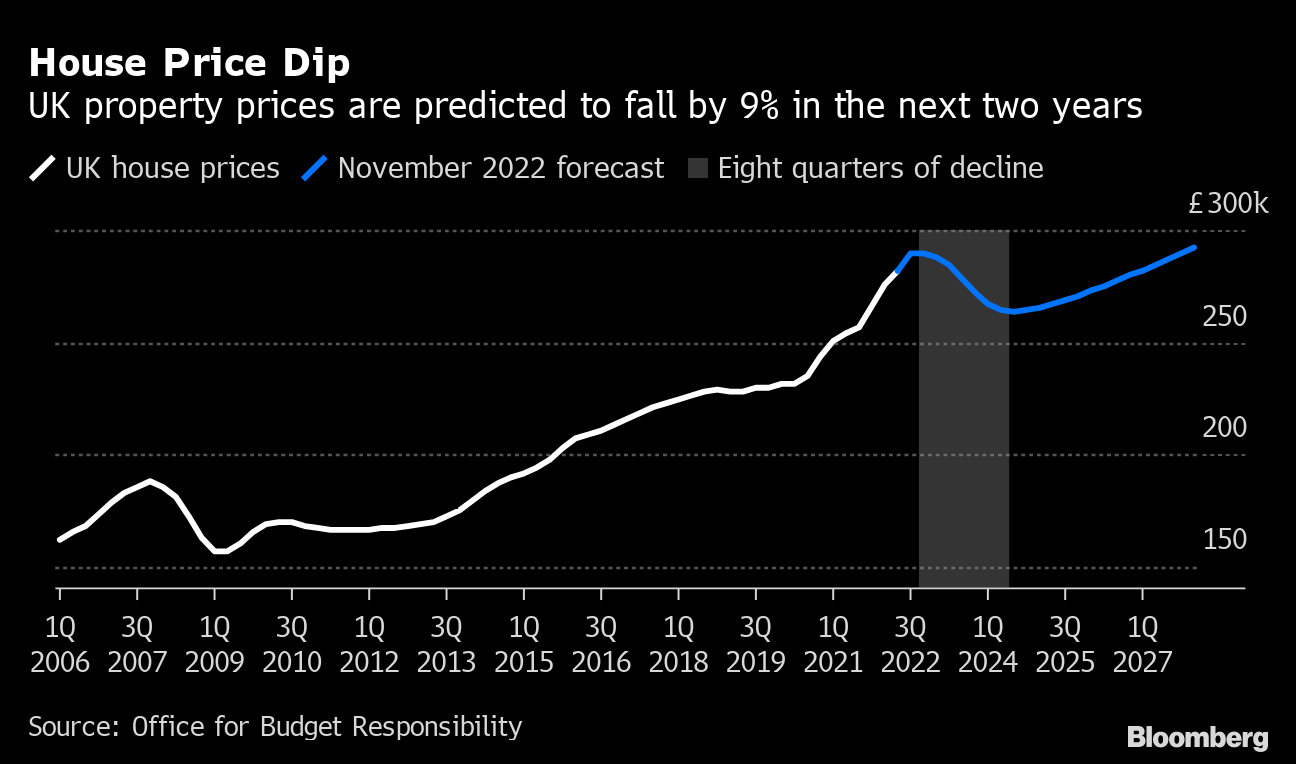

Interest rate movements have significant implications for businesses and consumers alike. Higher interest rates can make it more expensive for businesses to borrow money and invest in expansion. This can lead to slower economic growth and reduced job creation. For consumers, higher interest rates can make it more expensive to finance mortgages, auto loans, and other types of debt. This can reduce consumer spending and slow down economic activity.

Conversely, lower interest rates can stimulate economic growth by making it cheaper for businesses to borrow money and for consumers to spend. However, if interest rates are lowered too quickly or too aggressively, it can lead to inflation and other economic problems.

Conclusion

The timing of interest rate drops in 2025 remains uncertain and will depend on a complex interplay of economic factors. However, based on current conditions and the Fed’s stated goals, it is likely that interest rates will start to decline in late 2024 or early 2025. The pace and magnitude of the rate cuts will be influenced by the path of inflation, economic growth, unemployment, and global economic conditions. Businesses and consumers should closely monitor interest rate developments and adjust their financial plans accordingly.

Closure

Thus, we hope this article has provided valuable insights into When Will Interest Rates Drop in 2025? A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!