Vanguard Target Retirement 2025 Investor: A Comprehensive Guide For Retirement Planning

Vanguard Target Retirement 2025 Investor: A Comprehensive Guide for Retirement Planning

Related Articles: Vanguard Target Retirement 2025 Investor: A Comprehensive Guide for Retirement Planning

- World 2025 Swiss Stage: A Glimpse Into The Future Of Esports

- Godzilla Returns: An Unprecedented Cinematic Event In 2025

- Oregon Legislature Short Session 2025: A Comprehensive Overview

- Soul Train Cruise 2014: A Musical Odyssey On The High Seas

- 2025 Ford Edge Replacement: A Comprehensive Overview

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Vanguard Target Retirement 2025 Investor: A Comprehensive Guide for Retirement Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard Target Retirement 2025 Investor: A Comprehensive Guide for Retirement Planning

Vanguard Target Retirement 2025 Investor: A Comprehensive Guide for Retirement Planning

Introduction

Retirement planning is a crucial aspect of financial well-being, and it’s never too early to start. The Vanguard Target Retirement 2025 Investor is a mutual fund designed to help investors save for retirement while minimizing risk as they approach retirement age. This article provides a comprehensive guide to this investment option, exploring its features, benefits, and suitability for various investors.

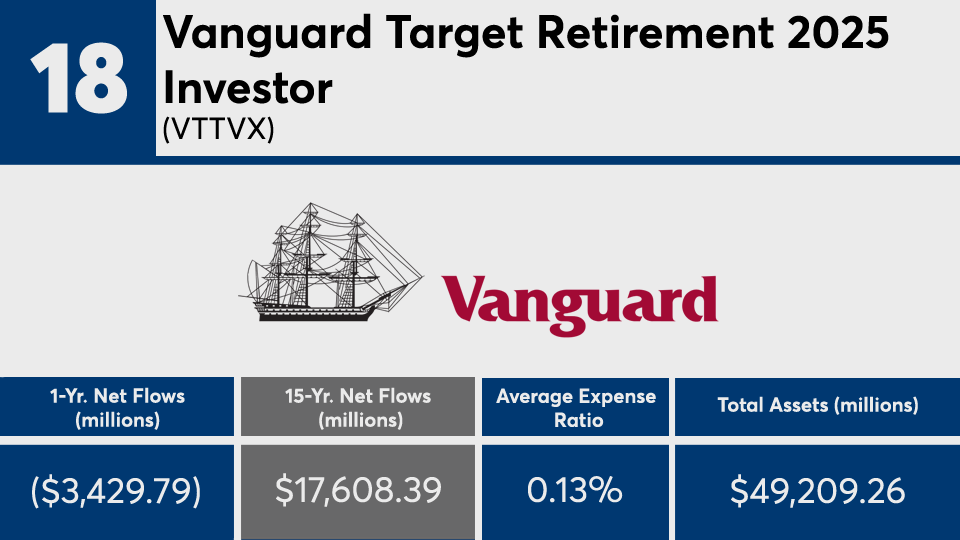

Overview of Vanguard Target Retirement 2025 Investor

The Vanguard Target Retirement 2025 Investor is a target-date fund that automatically adjusts its asset allocation based on the investor’s expected retirement date. As the target date approaches, the fund gradually shifts from growth-oriented assets (such as stocks) to more conservative assets (such as bonds). This glide path is designed to balance risk and return, ensuring that investors have a suitable asset mix for their age and risk tolerance.

Key Features

- Target Retirement Date: 2025

-

Asset Allocation:

- 60% stocks / 40% bonds (as of December 31, 2022)

- Expense Ratio: 0.08%

- Minimum Investment: $1,000

- Automatic Rebalancing: The fund’s asset allocation is automatically adjusted over time to maintain the target glide path.

- Diversification: The fund invests in a wide range of asset classes and sectors, providing diversification and reducing risk.

Benefits of Investing in Vanguard Target Retirement 2025 Investor

- Simplicity: Target-date funds offer a convenient and straightforward way to save for retirement. Investors can simply choose the fund that corresponds to their target retirement date and let the fund manage the asset allocation.

- Automatic Rebalancing: The fund’s automatic rebalancing ensures that the investor’s asset allocation remains aligned with their risk tolerance and target retirement date.

- Diversification: The fund’s diversified portfolio reduces risk and enhances the potential for long-term growth.

- Low Expense Ratio: The fund’s low expense ratio helps maximize investment returns.

- Professional Management: Vanguard’s experienced investment team manages the fund, providing investors with access to professional expertise.

Suitability of Vanguard Target Retirement 2025 Investor

The Vanguard Target Retirement 2025 Investor is suitable for investors who:

- Plan to retire in or around 2025

- Seek a balanced and diversified portfolio

- Are comfortable with a moderate level of risk

- Prefer a hands-off approach to retirement planning

Investment Considerations

- Target Retirement Date: Investors should carefully consider their actual retirement date and choose a target-date fund that aligns with their plans.

- Risk Tolerance: The fund’s asset allocation is based on a moderate risk tolerance. Investors with a higher or lower risk tolerance may need to adjust their investment strategy accordingly.

- Time Horizon: Target-date funds are designed for long-term investing. Investors should be prepared to hold their investment for at least 10 years, if not longer.

- Market Volatility: The fund’s value can fluctuate with market conditions. Investors should be aware of the potential for short-term losses.

Alternatives to Vanguard Target Retirement 2025 Investor

Investors may also consider the following alternatives to the Vanguard Target Retirement 2025 Investor:

- Other Target-Date Funds: Vanguard offers a range of target-date funds with different target retirement dates.

- Index Funds: Index funds track a specific market index, such as the S&P 500.

- Mutual Funds: Mutual funds offer a diversified portfolio of stocks or bonds.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on exchanges like stocks.

Conclusion

The Vanguard Target Retirement 2025 Investor is a well-suited investment option for individuals who are planning to retire in or around 2025 and seek a balanced and diversified portfolio. Its automatic rebalancing, low expense ratio, and professional management make it a convenient and cost-effective solution for retirement planning. Investors should carefully consider their target retirement date, risk tolerance, and time horizon before investing in any target-date fund. By choosing the appropriate investment option and adhering to a disciplined savings plan, investors can increase their chances of achieving a secure and comfortable retirement.

Closure

Thus, we hope this article has provided valuable insights into Vanguard Target Retirement 2025 Investor: A Comprehensive Guide for Retirement Planning. We appreciate your attention to our article. See you in our next article!