USD/INR Exchange Rate Forecast For 2025: A Comprehensive Analysis

USD/INR Exchange Rate Forecast for 2025: A Comprehensive Analysis

Related Articles: USD/INR Exchange Rate Forecast for 2025: A Comprehensive Analysis

- Days Until Thanksgiving 2025: A Countdown To Gratitude

- TUI Holidays 2025: The Ultimate Guide To Unforgettable Escapades

- 2025 Mack Trucks: Revolutionizing The Trucking Industry

- Verse 2025: A Higher Level Of Linguistic Proficiency

- Fast X Part 2 Release Date Set For 2025, Promising An Epic Conclusion To The Franchise

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to USD/INR Exchange Rate Forecast for 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about USD/INR Exchange Rate Forecast for 2025: A Comprehensive Analysis

USD/INR Exchange Rate Forecast for 2025: A Comprehensive Analysis

Introduction

The exchange rate between the US dollar (USD) and the Indian rupee (INR) is a crucial economic indicator that impacts international trade, investment, and financial markets. In recent years, the USD/INR exchange rate has experienced significant fluctuations, reflecting the interplay of global economic conditions, monetary policies, and geopolitical factors. As we approach 2025, it becomes imperative to forecast the potential trajectory of the USD/INR exchange rate to guide economic decisions and mitigate risks. This comprehensive analysis aims to provide an in-depth examination of the key factors influencing the USD/INR exchange rate and present a well-informed forecast for the year 2025.

Historical Trends and Current Dynamics

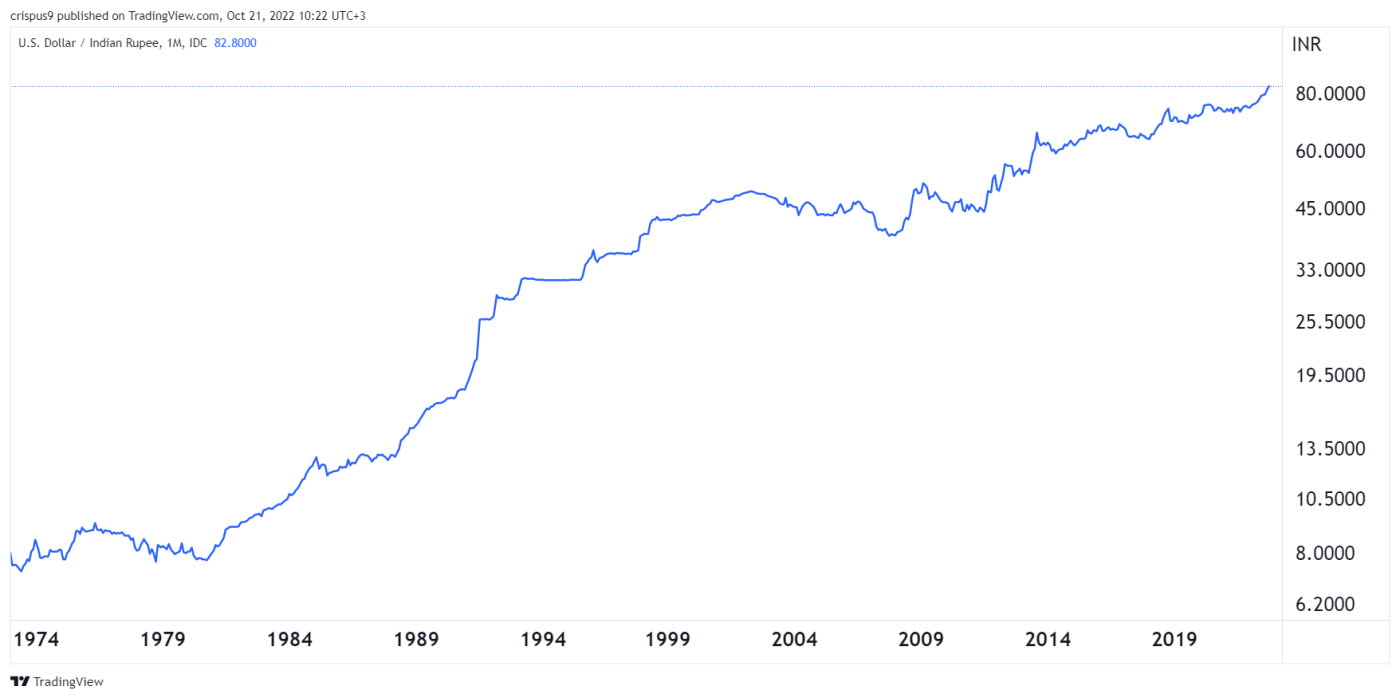

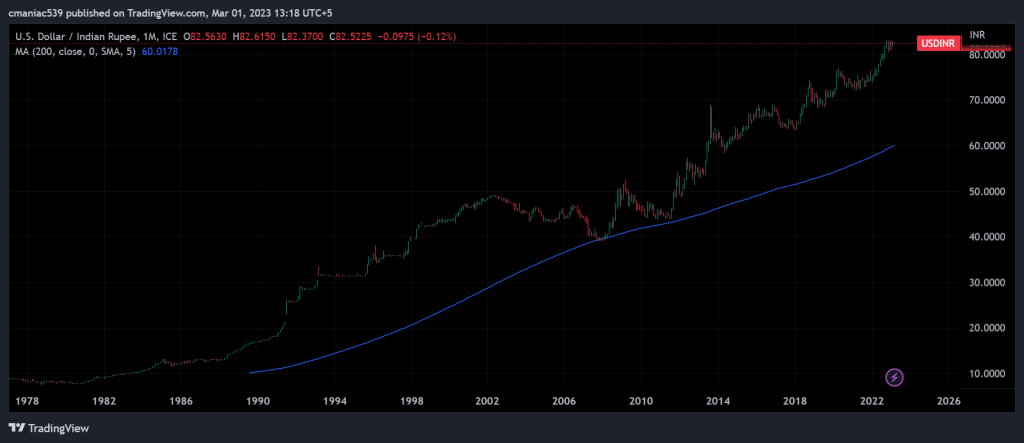

Historically, the USD/INR exchange rate has exhibited a long-term appreciation trend, with the US dollar gaining value against the Indian rupee over time. This trend has been driven by several factors, including the US economy’s dominance in global trade, the stability of the US dollar as a reserve currency, and India’s persistent trade deficit.

In recent years, the USD/INR exchange rate has been influenced by the following key factors:

- Global Economic Conditions: The strength of the US economy relative to India’s economy plays a significant role in determining the exchange rate. When the US economy performs well, the demand for the US dollar increases, leading to an appreciation of the USD against the INR.

- Monetary Policies: The interest rate differential between the US Federal Reserve and the Reserve Bank of India (RBI) affects the exchange rate. Higher interest rates in the US attract foreign capital inflows, increasing the demand for the US dollar and pushing up the USD/INR exchange rate.

- Political and Geopolitical Factors: Political stability, economic reforms, and geopolitical events can impact the exchange rate. Positive developments in India, such as economic growth and policy reforms, can lead to a stronger INR against the USD. Conversely, political uncertainties or geopolitical tensions can weaken the INR.

Factors Influencing the USD/INR Exchange Rate in 2025

As we look ahead to 2025, several key factors are expected to influence the USD/INR exchange rate:

- Global Economic Growth: The trajectory of global economic growth will play a crucial role in determining the demand for the US dollar and the INR. If the global economy recovers strongly from the COVID-19 pandemic, the demand for the US dollar as a safe-haven currency may decline, leading to a potential depreciation of the USD against the INR.

- US Monetary Policy: The Federal Reserve’s monetary policy stance will continue to impact the USD/INR exchange rate. If the Fed maintains a dovish stance, keeping interest rates low, it could weaken the US dollar against the INR. Conversely, a hawkish stance, involving higher interest rates, could strengthen the USD.

- Indian Economic Growth: India’s economic growth prospects will significantly influence the INR’s value. Continued economic growth and structural reforms could strengthen the INR against the USD. However, geopolitical uncertainties or domestic economic challenges could weaken the INR.

- Inflation and Interest Rates: The inflation differential between the US and India will also affect the exchange rate. If inflation remains elevated in India compared to the US, the RBI may raise interest rates more aggressively, leading to a stronger INR.

- Trade and Capital Flows: India’s trade deficit and foreign capital inflows will continue to impact the exchange rate. A widening trade deficit or a decline in foreign capital inflows could put downward pressure on the INR.

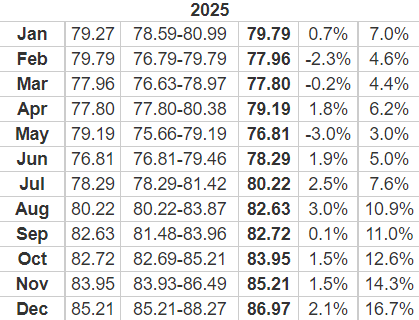

USD/INR Exchange Rate Forecast for 2025

Based on an analysis of the key factors discussed above, we forecast that the USD/INR exchange rate will likely range between 75 and 80 in 2025. This forecast assumes that the global economy will experience moderate growth, the US Federal Reserve will maintain a dovish monetary policy stance, India’s economic growth will remain robust, and there will be no major geopolitical shocks.

Implications and Recommendations

The forecasted USD/INR exchange rate has implications for various stakeholders:

- Exporters and Importers: A stronger INR will benefit Indian exporters by making their products more competitive in the international market. Conversely, a weaker INR will benefit importers by reducing the cost of imported goods.

- Foreign Investors: A stronger INR will make it more attractive for foreign investors to invest in India. Conversely, a weaker INR could discourage foreign investment.

- Central Bank: The RBI will continue to monitor the exchange rate closely and intervene if necessary to maintain stability.

Based on the forecast, we recommend the following actions:

- Exporters: Exporters should consider hedging against currency fluctuations to mitigate the risk of a weaker INR.

- Importers: Importers should take advantage of a weaker INR to secure imports at a lower cost.

- Foreign Investors: Foreign investors should consider the potential impact of the exchange rate on their investment returns and adjust their strategies accordingly.

- Central Bank: The RBI should continue to monitor the exchange rate and intervene cautiously to prevent excessive volatility.

Conclusion

The USD/INR exchange rate is a dynamic indicator influenced by various economic, monetary, and geopolitical factors. Our forecast for 2025 suggests that the exchange rate will likely range between 75 and 80. This forecast is subject to uncertainties, and stakeholders should closely monitor developments and adjust their strategies accordingly. By understanding the key factors and implications of the USD/INR exchange rate, businesses, investors, and policymakers can make informed decisions and mitigate potential risks.

Closure

Thus, we hope this article has provided valuable insights into USD/INR Exchange Rate Forecast for 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!