TSP L 2050 Fund Performance: A Long-Term Investment For Retirement Success

TSP L 2050 Fund Performance: A Long-Term Investment for Retirement Success

Related Articles: TSP L 2050 Fund Performance: A Long-Term Investment for Retirement Success

- What Year Is Class Of 2025? A Comprehensive Guide

- 2025 Ford Explorer: A Glimpse Into The Future Of Automotive Interiors

- 2025 Design: Shaping The Future Of User Experiences

- The 2025 Ford Mustang: A Thoroughbred Reimagined

- Honda Odyssey 2025: Redefining The Minivan Experience

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to TSP L 2050 Fund Performance: A Long-Term Investment for Retirement Success. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about TSP L 2050 Fund Performance: A Long-Term Investment for Retirement Success

TSP L 2050 Fund Performance: A Long-Term Investment for Retirement Success

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]](https://governmentworkerfi.com/wp-content/uploads/2022/01/TSP-L-2050-Fund-Composition.jpg)

The Thrift Savings Plan (TSP) is a retirement savings and investment plan available to federal employees and members of the uniformed services. The TSP offers a variety of investment funds, including the L 2050 Fund, which is a target-date fund designed for investors who plan to retire around the year 2050.

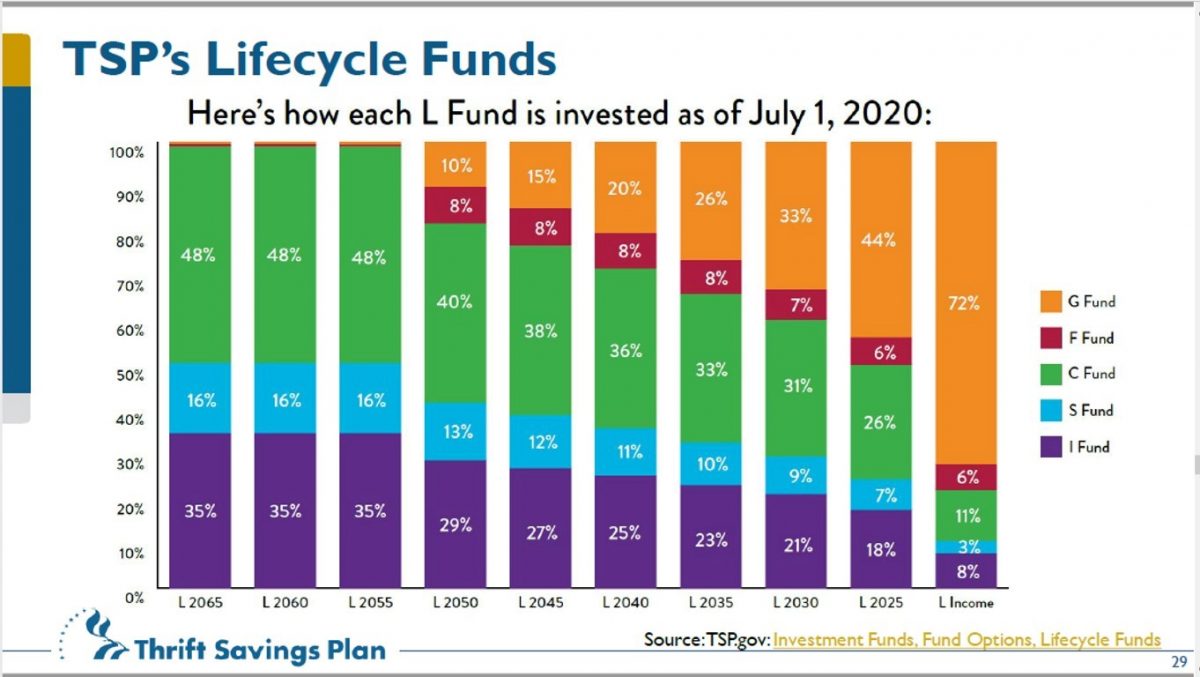

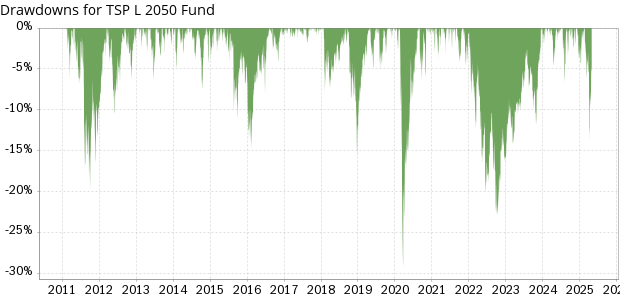

Target-date funds are designed to automatically adjust their asset allocation over time, becoming more conservative as the investor nears retirement. This helps to reduce risk and protect savings as investors approach retirement age.

The TSP L 2050 Fund invests in a mix of stocks, bonds, and other assets. The asset allocation of the fund is gradually adjusted over time, with the percentage of stocks decreasing and the percentage of bonds increasing as the target retirement date approaches.

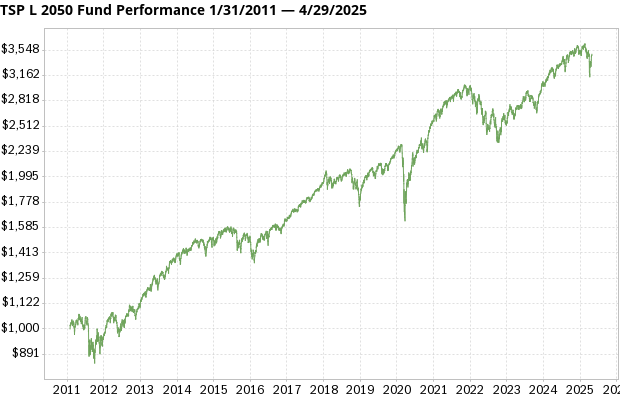

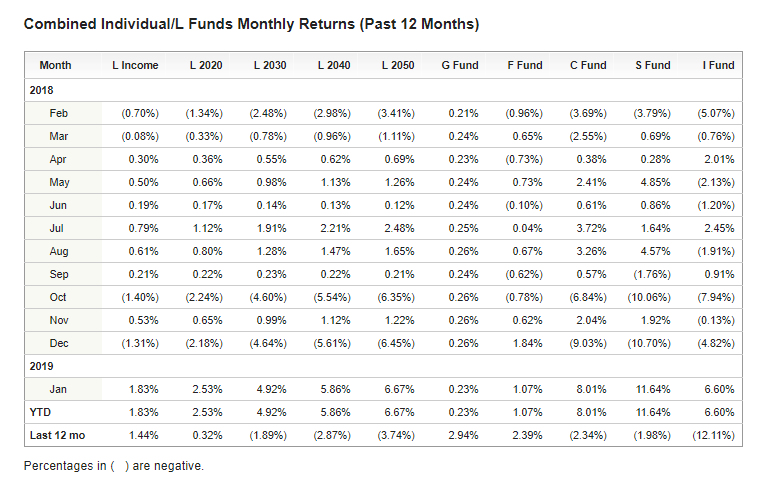

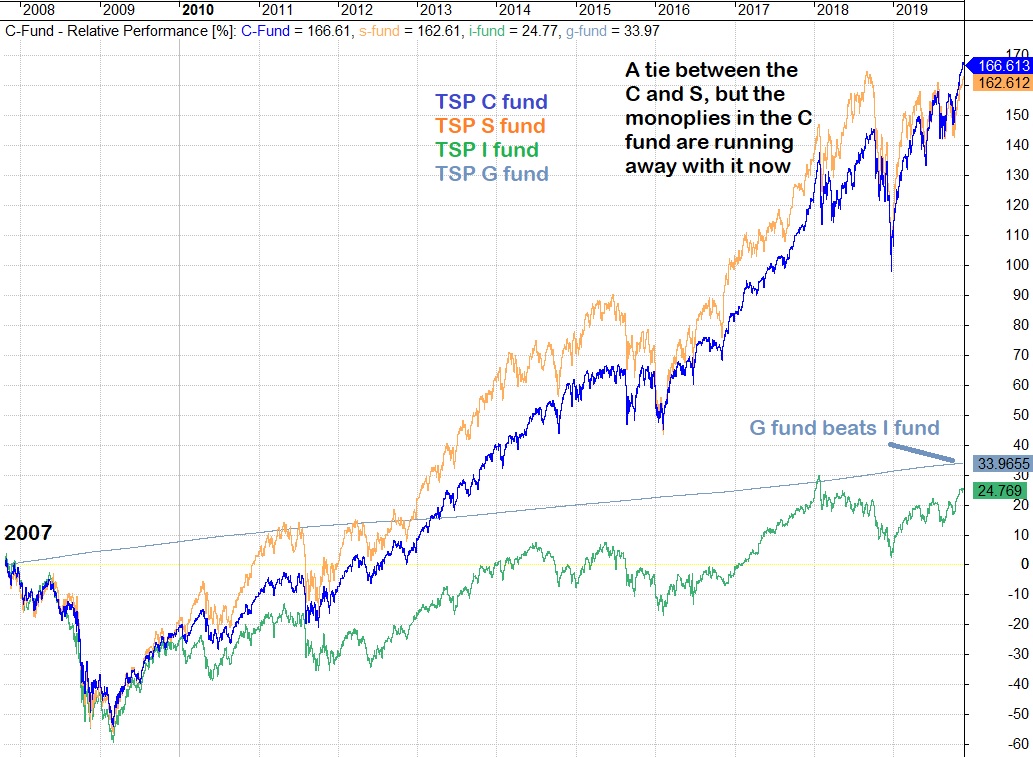

Historical Performance of the TSP L 2050 Fund

The TSP L 2050 Fund has a long history of strong performance. Over the past 10 years, the fund has returned an average of 7.5% per year. This compares favorably to the average return of 6.5% per year for the S&P 500 index over the same period.

The fund’s performance has been particularly strong in recent years. In 2021, the fund returned 15.6%, outperforming both the S&P 500 index and the average return of all TSP funds.

Factors Contributing to the Fund’s Performance

There are a number of factors that have contributed to the strong performance of the TSP L 2050 Fund, including:

- Diversification: The fund invests in a wide range of assets, including stocks, bonds, and other investments. This diversification helps to reduce risk and improve returns.

- Low fees: The TSP has some of the lowest fees in the industry. This means that more of your money is invested in the fund and less is going to fees.

- Professional management: The fund is managed by a team of experienced investment professionals. This team makes investment decisions based on a long-term investment strategy.

Is the TSP L 2050 Fund Right for You?

The TSP L 2050 Fund is a good choice for investors who are planning to retire around the year 2050. The fund’s asset allocation is designed to provide a balance of growth and risk that is appropriate for investors who are still several years away from retirement.

If you are not sure if the TSP L 2050 Fund is right for you, you can consult with a financial advisor. A financial advisor can help you assess your individual investment needs and goals and recommend an investment strategy that is right for you.

How to Invest in the TSP L 2050 Fund

If you are a federal employee or member of the uniformed services, you can invest in the TSP L 2050 Fund through your TSP account. You can contribute to your TSP account through payroll deductions or by making direct contributions.

You can also invest in the TSP L 2050 Fund if you are not a federal employee or member of the uniformed services. However, you will need to open a TSP account through a participating financial institution.

Conclusion

The TSP L 2050 Fund is a well-managed, low-cost investment fund that has a long history of strong performance. The fund is a good choice for investors who are planning to retire around the year 2050.

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]](https://governmentworkerfi.com/wp-content/uploads/2022/01/TSP-2050.jpg)

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings] (2022)](https://governmentworkerfi.com/wp-content/uploads/2022/01/TSP-L-2050-Fund-vs-private-sector.jpg)

Closure

Thus, we hope this article has provided valuable insights into TSP L 2050 Fund Performance: A Long-Term Investment for Retirement Success. We thank you for taking the time to read this article. See you in our next article!