The New Estate Plan 2025: A Comprehensive Guide

The New Estate Plan 2025: A Comprehensive Guide

Related Articles: The New Estate Plan 2025: A Comprehensive Guide

- Project 2025: A Blueprint For American Renewal

- Battery 2032 Near Me: A Comprehensive Guide To Finding The Right Battery

- 2025 School Calendar: A Comprehensive Guide For Students And Parents

- New Video Games From 2025: A Glimpse Into The Future Of Gaming

- The Big Switch Off 2025: Preparing For The Transition To Digital Terrestrial Television

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The New Estate Plan 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The New Estate Plan 2025: A Comprehensive Guide

The New Estate Plan 2025: A Comprehensive Guide

Introduction

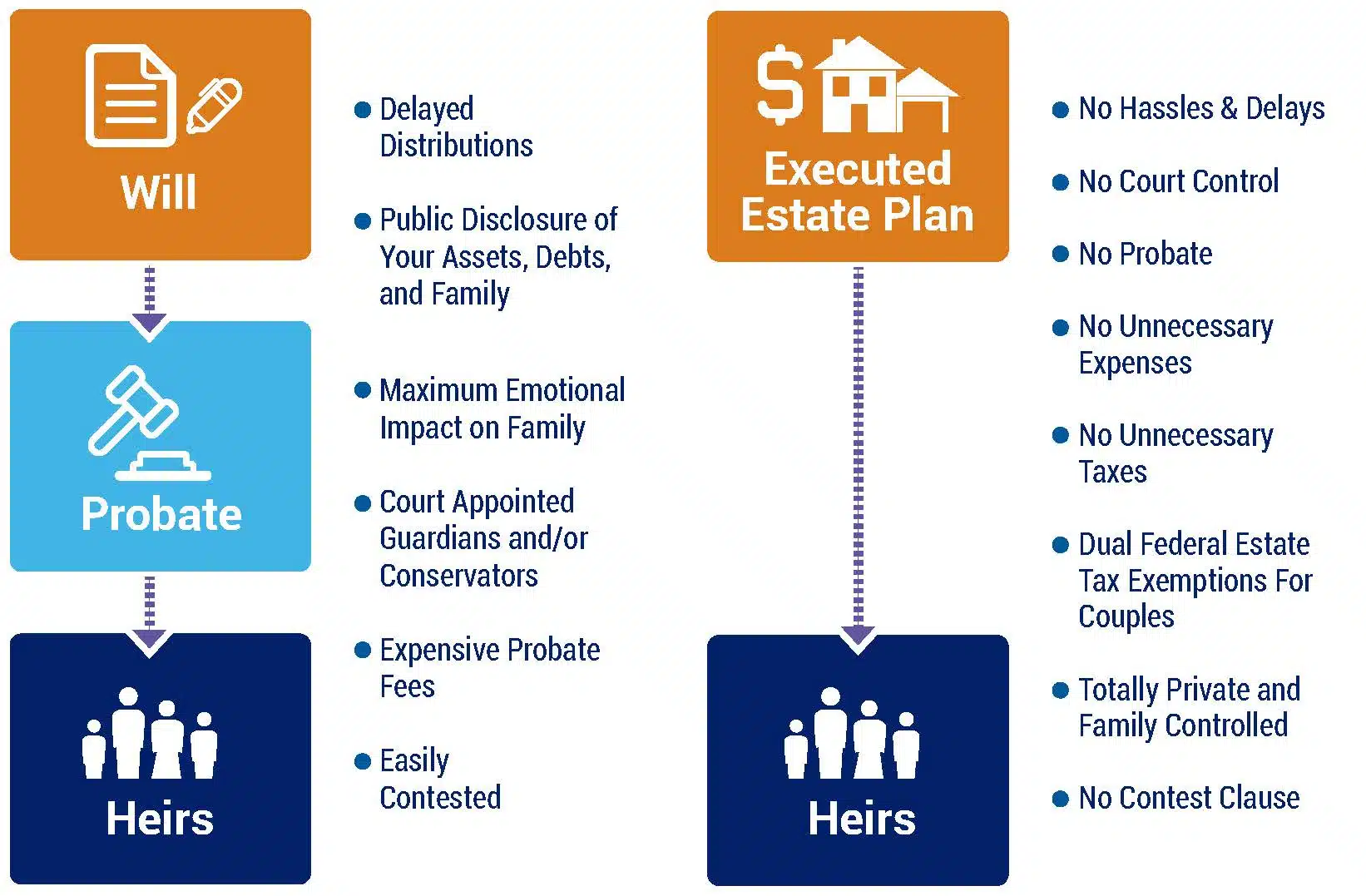

Estate planning is a crucial aspect of financial management that ensures the orderly distribution of an individual’s assets and property after their death. With the ever-changing legal and tax landscape, it is essential to periodically review and update estate plans to align with the latest regulations and best practices. This article provides a comprehensive guide to the New Estate Plan 2025, highlighting key changes and strategies to optimize asset management and minimize tax liabilities.

Changes in the Estate Tax Exemption

The most significant change in the New Estate Plan 2025 is the increase in the federal estate tax exemption. For individuals dying in 2023, the exemption amount is $12.92 million. This amount is scheduled to increase to $13.18 million in 2024 and $13.4 million in 2025. The increased exemption means that a larger portion of an individual’s estate can pass to heirs without being subject to estate tax.

Portability of Estate Tax Exemption

The New Estate Plan 2025 also introduces portability of the estate tax exemption between spouses. This provision allows surviving spouses to utilize any unused portion of their deceased spouse’s estate tax exemption. For example, if a deceased spouse had an estate worth $11 million and an estate tax exemption of $13 million, the surviving spouse can inherit the remaining $2 million exemption, increasing their own exemption to $15 million.

Increased Gift Tax Exemption

In addition to the changes in the estate tax exemption, the New Estate Plan 2025 also increases the federal gift tax exemption. For gifts made in 2023, the exemption amount is $17,000 per individual and $34,000 per married couple. This exemption is scheduled to increase to $18,000 per individual and $36,000 per married couple in 2024 and $19,000 per individual and $38,000 per married couple in 2025.

Unified Credit

The unified credit is a dollar-for-dollar reduction in estate and gift taxes. The New Estate Plan 2025 increases the unified credit, which is equivalent to the estate tax exemption. This means that individuals can transfer more assets during their lifetime or upon death without incurring estate or gift taxes.

Trusts

Trusts remain an essential tool for estate planning. They can be used to reduce estate taxes, avoid probate, and protect assets from creditors. The New Estate Plan 2025 introduces several changes to trust laws, including:

- Elimination of the Generation-Skipping Tax (GST): The GST is a tax on transfers of assets to individuals who are two or more generations below the transferor. The New Estate Plan 2025 eliminates the GST, allowing for more efficient transfer of assets to future generations.

- Modification of the Crummey Trust Rules: Crummey trusts are irrevocable trusts that allow the grantor to make annual gifts to beneficiaries without triggering gift tax consequences. The New Estate Plan 2025 modifies the Crummey trust rules, making it easier to establish and administer these trusts.

- Expansion of Dynasty Trusts: Dynasty trusts are trusts that can continue for multiple generations, allowing for the preservation of wealth over a longer period of time. The New Estate Plan 2025 expands the use of dynasty trusts, providing greater flexibility in estate planning.

Other Considerations

In addition to the changes outlined above, the New Estate Plan 2025 also includes several other important considerations, such as:

- Digital Assets: The plan addresses the increasing prevalence of digital assets, such as social media accounts, online banking, and cryptocurrency. It provides guidance on how to manage and distribute these assets after death.

- Charitable Giving: The plan encourages charitable giving by providing tax incentives for donations to qualified organizations.

- Long-Term Care Planning: The plan recognizes the importance of long-term care planning and provides strategies for financing and managing long-term care expenses.

Conclusion

The New Estate Plan 2025 represents a significant update to estate planning laws and regulations. By incorporating the latest changes and strategies, individuals can optimize asset management, minimize tax liabilities, and ensure the orderly distribution of their wealth after death. It is recommended to consult with an experienced estate planning attorney to create or update an estate plan that aligns with the New Estate Plan 2025 and meets the specific needs and goals of each individual.

Closure

Thus, we hope this article has provided valuable insights into The New Estate Plan 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!