The IR 2025 Bareme: A Comprehensive Overview

The IR 2025 Bareme: A Comprehensive Overview

Related Articles: The IR 2025 Bareme: A Comprehensive Overview

- 20251x27a Lawn Mower Manual: A Comprehensive Guide To Maintenance And Operation

- 2025 Forester Touring Brown Leather: A Refined Wilderness Escape

- 2025 Federal Government Pay Raise: A Comprehensive Analysis

- Battery 2032 Near Me: A Comprehensive Guide To Finding The Right Battery

- 2025 Washington: A City Transformed By Innovation And Sustainability

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The IR 2025 Bareme: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The IR 2025 Bareme: A Comprehensive Overview

The IR 2025 Bareme: A Comprehensive Overview

Introduction

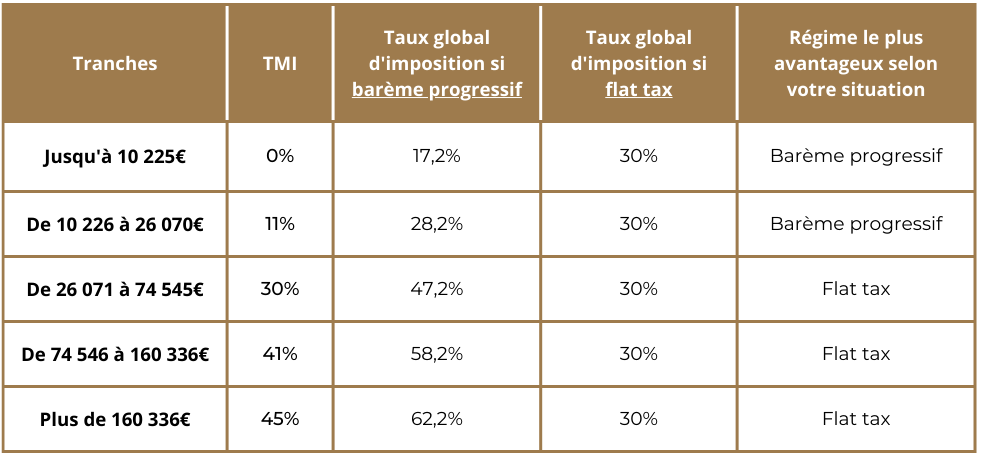

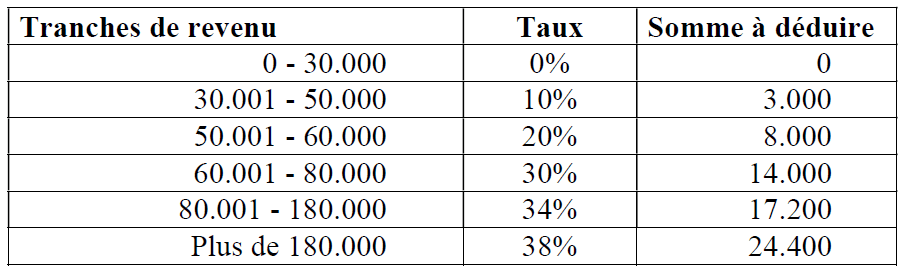

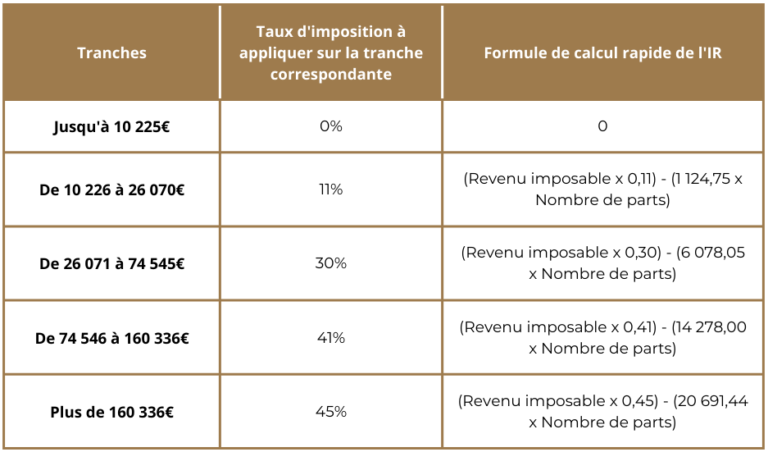

The IR 2025 Bareme is a critical tool used to determine the compensation and benefits of civil servants in the French public sector. It provides a standardized framework for calculating salaries, allowances, and other entitlements based on factors such as rank, seniority, and location. The IR 2025 Bareme was implemented in January 2025 and has since undergone several revisions to ensure its relevance and accuracy.

Structure and Components

The IR 2025 Bareme consists of several key components:

- Salary Scales: The Bareme defines salary scales for different grades and ranks within the civil service. These scales determine the minimum and maximum salaries that can be earned at each level.

- Age and Seniority Allowances: In addition to base salaries, civil servants are entitled to age and seniority allowances. These allowances are designed to compensate for increased experience and contributions over time.

- Family Allowances: The Bareme provides family allowances to civil servants with dependent children. These allowances vary based on the number and age of children.

- Housing Allowances: Civil servants in certain locations may be eligible for housing allowances to help cover the cost of housing. These allowances are typically higher in urban areas with higher living costs.

- Other Allowances: The Bareme also includes a range of other allowances, such as travel allowances, overtime pay, and bonuses.

Calculation of Compensation

The compensation of a civil servant is calculated based on their rank, seniority, and location. The following formula is used to determine the gross salary:

Gross Salary = Base Salary + Age Allowance + Seniority Allowance + Family Allowance + Housing Allowance + Other Allowances

The base salary is determined by the salary scale for the civil servant’s grade and rank. The age allowance is based on the civil servant’s age and years of service. The seniority allowance is based on the civil servant’s time in their current grade. The family allowance is based on the number and age of the civil servant’s dependent children. The housing allowance is determined by the location of the civil servant’s residence. Other allowances may be added based on the civil servant’s specific circumstances.

Revisions and Updates

The IR 2025 Bareme is subject to regular revisions and updates to ensure its accuracy and relevance. These revisions are typically based on changes in economic conditions, inflation rates, and government policies. The most recent revision to the Bareme was implemented in January 2023.

Impact on Civil Servants

The IR 2025 Bareme has a significant impact on the lives of civil servants. It determines their income, benefits, and overall financial well-being. The Bareme also plays a role in attracting and retaining qualified individuals to the civil service.

Conclusion

The IR 2025 Bareme is a comprehensive and essential tool for determining the compensation and benefits of civil servants in the French public sector. It provides a standardized framework for calculating salaries, allowances, and other entitlements based on factors such as rank, seniority, and location. The Bareme is subject to regular revisions and updates to ensure its accuracy and relevance. It has a significant impact on the lives of civil servants and plays a role in attracting and retaining qualified individuals to the civil service.

Closure

Thus, we hope this article has provided valuable insights into The IR 2025 Bareme: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!