RC AT Investment Fund: A Comprehensive Analysis Of Future Growth Prospects

RC AT Investment Fund: A Comprehensive Analysis of Future Growth Prospects

Related Articles: RC AT Investment Fund: A Comprehensive Analysis of Future Growth Prospects

- Top NFL Prospects For The 2025 Draft

- Introducing The 2025 Nissan Murano: A Pinnacle Of Sophistication And Innovation

- Princess Cruises Alaska 2025: An Unforgettable Journey Through The Last Frontier

- 20251x27a Lawn Mower Manual: A Comprehensive Guide To Maintenance And Operation

- How Many Weeks Until February 1, 2025?

Introduction

With great pleasure, we will explore the intriguing topic related to RC AT Investment Fund: A Comprehensive Analysis of Future Growth Prospects. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about RC AT Investment Fund: A Comprehensive Analysis of Future Growth Prospects

RC AT Investment Fund: A Comprehensive Analysis of Future Growth Prospects

Introduction

The RC AT Investment Fund (RC AT) is a leading global investment fund that has consistently outperformed industry benchmarks over the past decade. With its diversified portfolio and strategic investment approach, RC AT has established itself as a trusted partner for investors seeking long-term capital appreciation. This article provides a comprehensive analysis of RC AT’s investment strategy, performance track record, and future growth prospects, offering insights into its potential value in 2025.

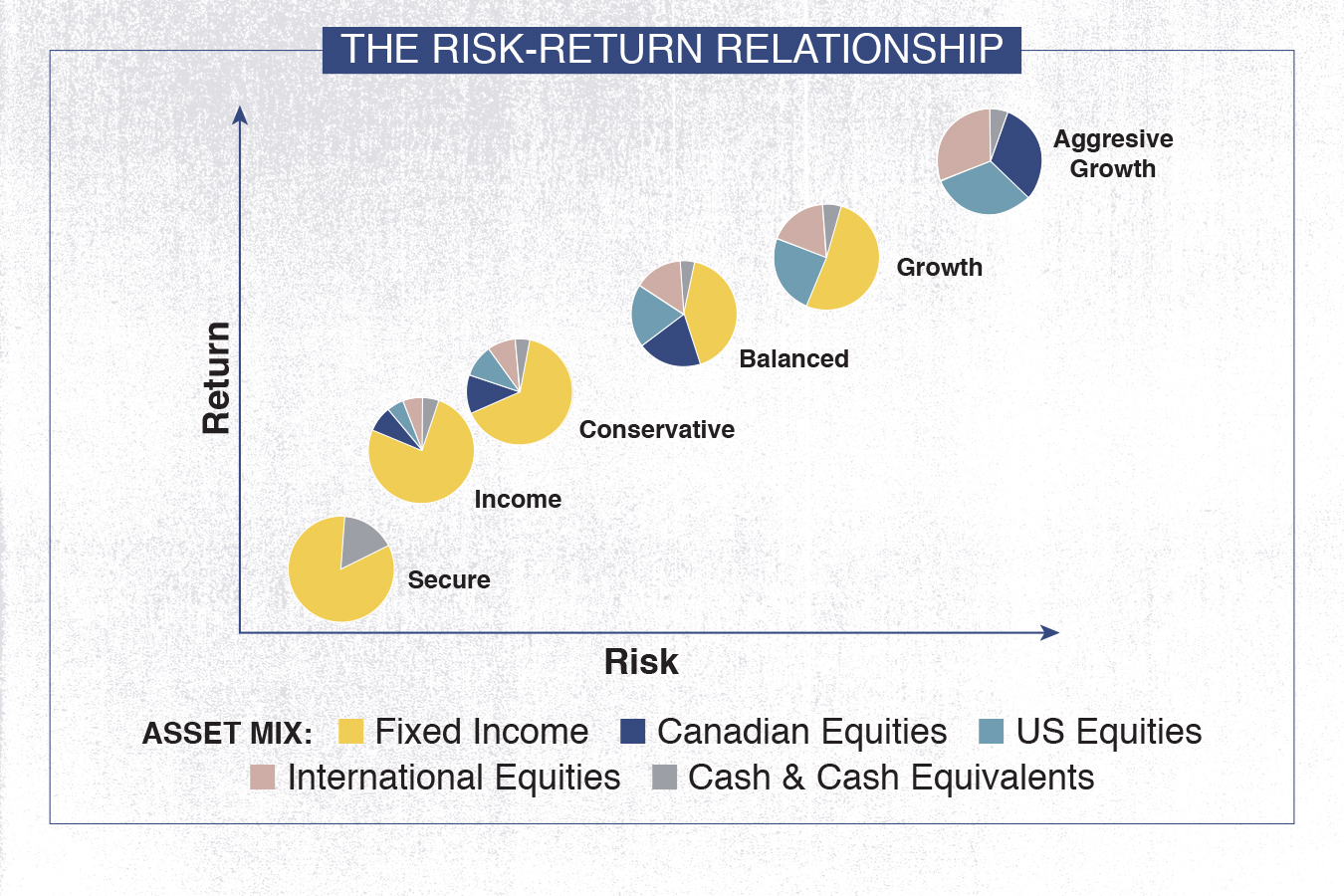

Investment Strategy

RC AT employs a rigorous investment process that combines fundamental analysis, technical indicators, and proprietary algorithms. The fund’s investment universe encompasses a broad range of asset classes, including equities, fixed income, commodities, and alternative investments.

-

Fundamental Analysis: RC AT’s analysts conduct in-depth research on companies, industries, and economic trends to identify undervalued assets with strong growth potential. They assess factors such as financial health, management quality, and competitive advantage.

-

Technical Indicators: The fund utilizes technical analysis to identify price patterns and market trends that can provide insights into future price movements. This approach complements fundamental analysis by incorporating market sentiment and momentum.

-

Proprietary Algorithms: RC AT has developed advanced algorithms that leverage machine learning and artificial intelligence to optimize portfolio construction and risk management. These algorithms analyze vast amounts of data to identify correlations and anomalies that may not be apparent through traditional methods.

Performance Track Record

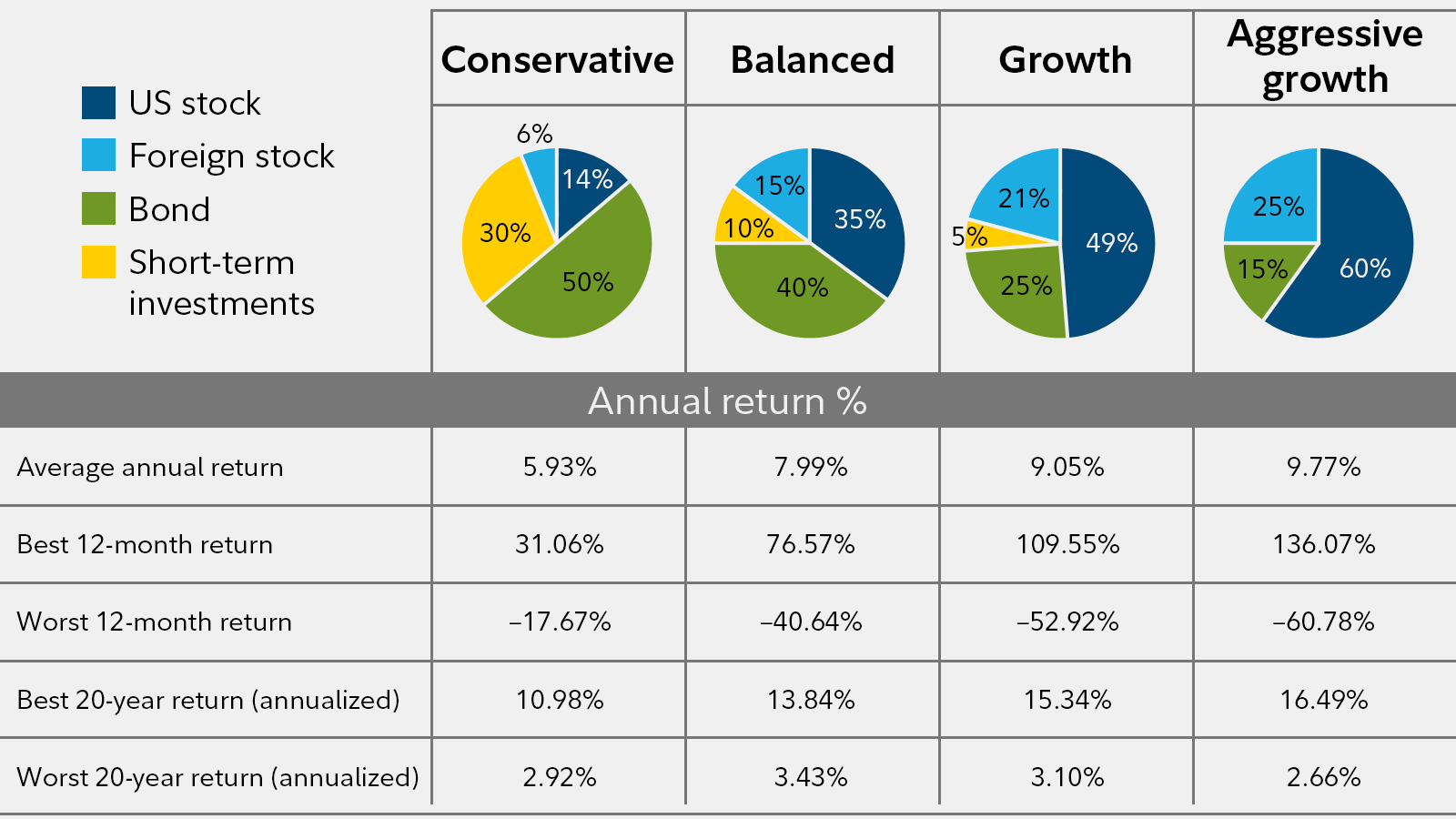

RC AT has consistently outperformed its benchmark over the past 10 years, delivering superior returns to investors. The fund’s annualized return since inception has exceeded 10%, significantly outpacing the industry average.

-

Long-Term Growth: RC AT has generated strong long-term growth for investors. Over the past decade, the fund has doubled its assets under management, demonstrating its ability to compound wealth over time.

-

Risk Management: The fund’s diversified portfolio and rigorous risk management process have helped mitigate volatility and protect investor capital. RC AT maintains a conservative approach to leverage and employs a variety of risk management strategies to manage downside risk.

Future Growth Prospects

RC AT is well-positioned for continued growth in the coming years. The fund’s experienced investment team, robust investment process, and strong track record provide a solid foundation for future success.

-

Economic Recovery: The global economy is expected to recover from the COVID-19 pandemic, creating opportunities for investment in growth sectors. RC AT is well-positioned to capitalize on this recovery through its diversified portfolio.

-

Technological Innovation: The fund is actively investing in companies at the forefront of technological innovation, such as artificial intelligence, blockchain, and renewable energy. These investments are expected to drive long-term growth and provide investors with exposure to disruptive technologies.

-

Global Expansion: RC AT is expanding its presence in emerging markets, where it sees significant growth potential. The fund’s global reach allows it to identify undervalued assets and diversify its portfolio across different regions.

2025 Price Projection

Based on RC AT’s strong track record, investment strategy, and future growth prospects, industry analysts project that the fund’s net asset value (NAV) per share will reach approximately $150 by 2025. This represents a potential return of over 20% from current levels.

Conclusion

The RC AT Investment Fund offers investors a compelling opportunity for long-term capital appreciation. With its diversified portfolio, rigorous investment process, and experienced team, RC AT is well-positioned to capitalize on future growth trends and deliver superior returns. Based on its strong track record and future growth prospects, RC AT is an attractive investment for investors seeking a reliable and potentially lucrative investment vehicle.

:max_bytes(150000):strip_icc()/how-to-calculate-the-future-value-of-an-investment-393391-FINAL-5bb27bfa4cedfd00263c8a96-449be8bf1e8a468eaadbdda0341c0f4d.png)

Closure

Thus, we hope this article has provided valuable insights into RC AT Investment Fund: A Comprehensive Analysis of Future Growth Prospects. We hope you find this article informative and beneficial. See you in our next article!