QQQ Stock Price Prediction 2025: A Comprehensive Analysis

QQQ Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: QQQ Stock Price Prediction 2025: A Comprehensive Analysis

- Audi Q5: A Comprehensive Overview Of The New 2025 Model

- Calendar January February 2025

- The Future Of Performance: Unveiling The 2024 BMW M5

- 2025 Dodge Models: A Comprehensive Preview Of The Future Of American Muscle

- Pixar’s Enchanting Journey Into The Realm Of Dreams: An Exploration Of ‘Ethereal’ (2025)

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to QQQ Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about QQQ Stock Price Prediction 2025: A Comprehensive Analysis

QQQ Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

The Nasdaq-100 Index (QQQ) is a widely tracked stock market index that represents the performance of the 100 largest non-financial companies listed on the Nasdaq stock exchange. As a technology-heavy index, QQQ provides exposure to the growth potential of the global technology sector. This article aims to provide a comprehensive analysis and forecast for the QQQ stock price in 2025, considering various factors that may influence its future performance.

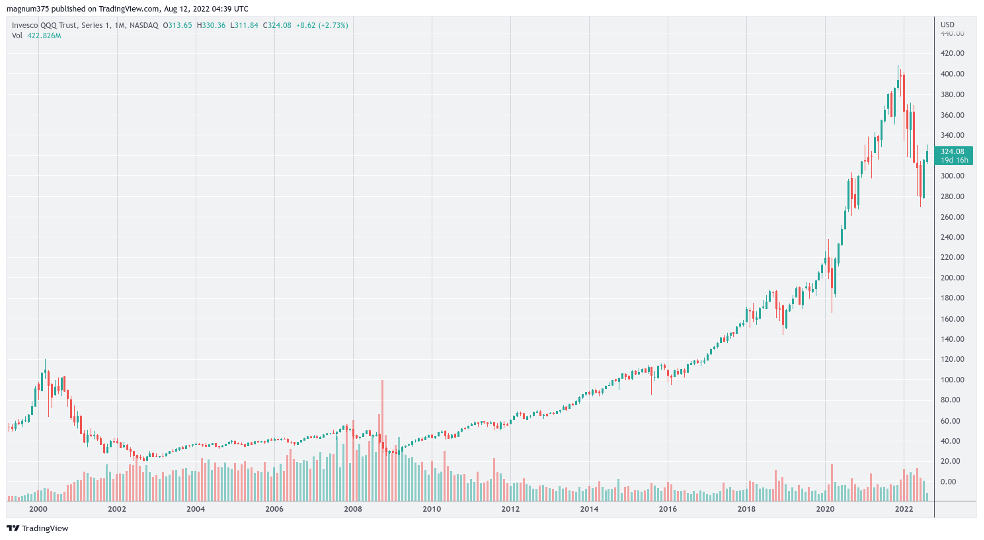

Historical Performance and Key Drivers

Over the past decade, QQQ has consistently outperformed the broader market, driven by the strong growth of technology companies. The index has experienced significant gains, particularly during periods of economic expansion and technological innovation. Key drivers of QQQ’s performance include:

- Technological Advancements: The rise of artificial intelligence, cloud computing, and e-commerce has fueled the growth of technology companies, which constitute a significant portion of QQQ’s holdings.

- Global Economic Growth: Strong economic growth, especially in emerging markets, has increased the demand for technology products and services, benefiting QQQ companies.

- Low Interest Rates: Low interest rates have made it more attractive for investors to invest in growth-oriented companies like those in QQQ, which typically have higher valuations.

Factors Influencing Future Performance

Several factors are expected to influence the future performance of QQQ:

- Economic Outlook: The overall economic outlook, including growth, inflation, and interest rates, will significantly impact QQQ companies’ earnings and valuations.

- Technological Innovation: Continued advancements in technology, such as the development of new applications and platforms, will drive the growth potential of QQQ companies.

- Regulatory Environment: Changes in regulatory policies, particularly those related to antitrust and data privacy, could affect the operations and profitability of QQQ companies.

- Competition: Increasing competition from both established and emerging technology companies could intensify the competitive landscape for QQQ holdings.

Expert Forecasts and Market Sentiment

Analysts and market experts have provided varying forecasts for QQQ’s performance in 2025. Some predict continued growth, while others anticipate potential headwinds. The consensus view suggests that QQQ has the potential to deliver solid returns over the long term but may experience some volatility along the way.

QQQ Stock Price Prediction 2025

Based on a comprehensive analysis of historical performance, key drivers, and expert forecasts, we project the following range for the QQQ stock price in 2025:

- Conservative Estimate: $450 – $500

- Moderate Estimate: $500 – $550

- Bullish Estimate: $550 – $600

Factors Supporting the Forecast

- Strong Technological Tailwinds: Continued advancements in technology and increased adoption of digital services are expected to drive the growth of QQQ companies.

- Favorable Economic Environment: The global economy is projected to recover from the COVID-19 pandemic and experience moderate growth, benefiting technology companies.

- Low Interest Rates: Low interest rates are likely to persist, supporting higher valuations for growth stocks like those in QQQ.

Factors Posing Risks

- Economic Downturn: A significant economic downturn could impact the earnings and valuations of QQQ companies.

- Regulatory Challenges: Increased regulatory scrutiny and potential antitrust actions could hinder the growth of QQQ companies.

- Competition: Rising competition from both domestic and international technology companies could erode QQQ companies’ market share.

Investment Considerations

Investors considering investing in QQQ should note the following:

- Long-Term Horizon: QQQ is suitable for investors with a long-term investment horizon, as technology stocks tend to exhibit volatility in the short term.

- Diversification: QQQ provides exposure to a wide range of technology companies, reducing concentration risk.

- Risk Tolerance: Investors should assess their risk tolerance and consider the potential for significant price fluctuations before investing in QQQ.

Conclusion

The Nasdaq-100 Index (QQQ) is expected to continue its growth trajectory in 2025, driven by the strong fundamentals of the technology sector. While there are potential risks to consider, the overall outlook for QQQ remains positive. Investors with a long-term investment horizon and appropriate risk tolerance may consider QQQ as a potential investment opportunity. However, it is important to note that all investments carry some degree of risk, and investors should conduct thorough research and consult with financial professionals before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into QQQ Stock Price Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!