Projected 2026 Tax Brackets: Anticipating Changes In Income Tax Rates

Projected 2026 Tax Brackets: Anticipating Changes in Income Tax Rates

Related Articles: Projected 2026 Tax Brackets: Anticipating Changes in Income Tax Rates

- DV Lottery 2025 Guidelines: A Comprehensive Overview

- 2025-2026 School Year Calendar: A Comprehensive Overview

- 2025 Buick Enclave Review: A Refined And Sophisticated SUV

- 2025 Calendar Images: A Visual Journey Through The Year

- Ramadan 2025: A Time For Spiritual Renewal And Community

Introduction

With great pleasure, we will explore the intriguing topic related to Projected 2026 Tax Brackets: Anticipating Changes in Income Tax Rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Projected 2026 Tax Brackets: Anticipating Changes in Income Tax Rates

Projected 2026 Tax Brackets: Anticipating Changes in Income Tax Rates

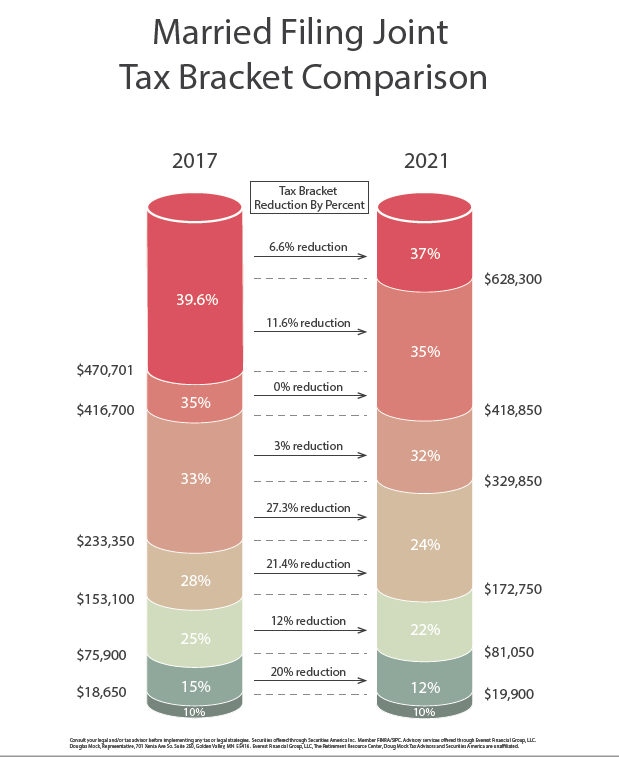

The tax brackets for a given year determine the amount of income that is subject to each tax rate. These brackets are adjusted periodically to account for inflation and changes in the economy. The projected tax brackets for 2026, as released by the Internal Revenue Service (IRS), provide insights into the anticipated income tax rates for the upcoming year.

Understanding Tax Brackets

Tax brackets are a series of income ranges that correspond to specific tax rates. When an individual’s taxable income falls within a particular bracket, they are subject to the tax rate associated with that bracket. The higher the taxable income, the higher the tax rate.

The tax brackets for 2026 are projected to be as follows:

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single | $0 – $12,550 | 10% |

| Single | $12,550 – $41,775 | 12% |

| Single | $41,775 – $89,075 | 22% |

| Single | $89,075 – $170,050 | 24% |

| Single | $170,050 – $215,950 | 32% |

| Single | $215,950 – $539,900 | 35% |

| Single | $539,900 and above | 37% |

Changes from 2025 Tax Brackets

The projected tax brackets for 2026 represent a slight increase from the tax brackets for 2025. The income ranges for each bracket have been adjusted upwards to account for inflation.

The most notable change is the increase in the top tax bracket from $523,600 to $539,900. This means that individuals with taxable incomes exceeding $539,900 will be subject to the highest tax rate of 37%.

Implications for Taxpayers

The projected tax brackets for 2026 provide taxpayers with an indication of the income tax rates they can expect to pay in the upcoming year. These brackets can be used to estimate tax liability and plan financial strategies accordingly.

For individuals with taxable incomes within the lower brackets, the projected changes are likely to have a minimal impact on their tax liability. However, individuals with taxable incomes in the higher brackets may experience a slight increase in their tax payments.

Additional Considerations

It is important to note that the projected tax brackets for 2026 are subject to change. The IRS may make adjustments based on economic conditions and other factors. Taxpayers should consult the IRS website or consult with a tax professional for the most up-to-date information.

In addition to the tax brackets, taxpayers should also consider other factors that affect their tax liability, such as deductions, credits, and exemptions. These factors can significantly reduce the amount of tax owed.

Conclusion

The projected tax brackets for 2026 provide taxpayers with a valuable tool for estimating their tax liability and making informed financial decisions. While the changes from the 2025 tax brackets are relatively minor, taxpayers should be aware of the potential impact on their tax payments. By understanding the tax brackets and considering all relevant factors, taxpayers can effectively plan for their tax obligations and minimize their tax burden.

Closure

Thus, we hope this article has provided valuable insights into Projected 2026 Tax Brackets: Anticipating Changes in Income Tax Rates. We hope you find this article informative and beneficial. See you in our next article!