Medicare Part IRMAA Brackets 2025

Medicare Part IRMAA Brackets 2025

Related Articles: Medicare Part IRMAA Brackets 2025

- NBC Winter Olympics 2025: A Blueprint For Unparalleled Winter Sports Coverage

- The 2025 Infiniti Q50: A Vision Of Luxury And Performance

- 2025 Subaru Forester Wallpaper: A Comprehensive Exploration

- The 2025 Nissan Titan Pro-4X: A Titan Of The Off-Road

- 2025-2026 School Year Calendar: A Comprehensive Overview

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Medicare Part IRMAA Brackets 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Medicare Part IRMAA Brackets 2025

Medicare Part IRMAA Brackets 2025

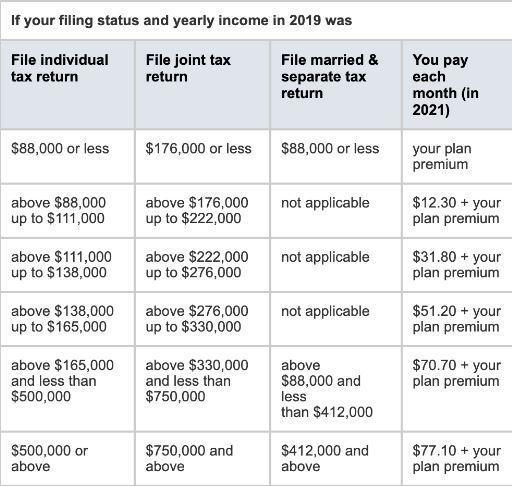

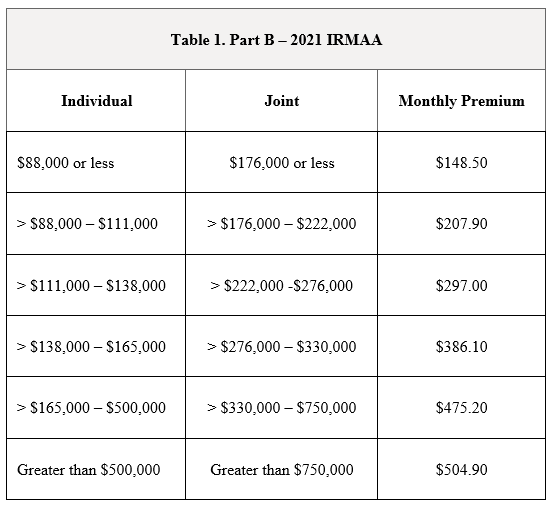

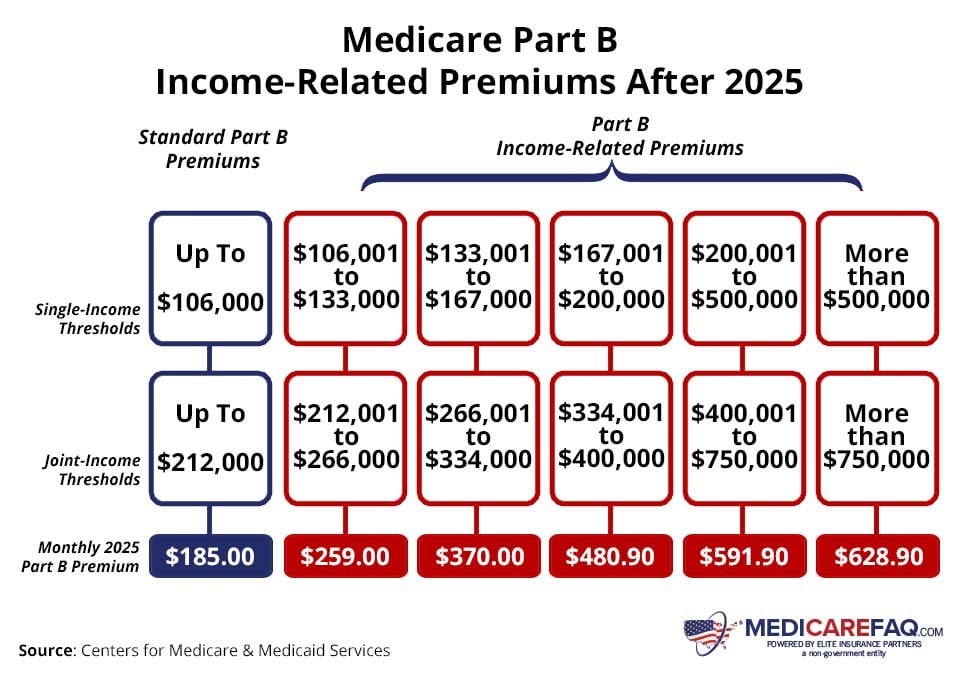

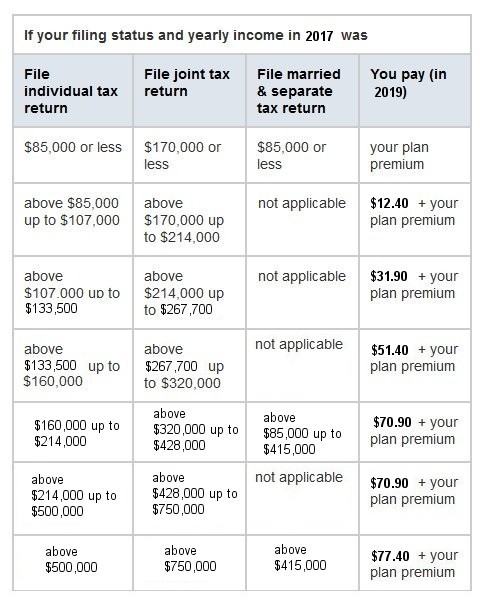

Medicare Part B is a type of health insurance that helps pay for medically necessary services, such as doctor visits, outpatient care, and durable medical equipment. Part B premiums are based on your income, and if your income is above a certain level, you will have to pay an additional amount known as the Income-Related Monthly Adjustment Amount (IRMAA).

The IRMAA brackets for 2025 have been released by the Centers for Medicare & Medicaid Services (CMS). The brackets are based on your modified adjusted gross income (MAGI) from two years prior. For 2025, the IRMAA brackets are as follows:

| Filing Status | MAGI Range | IRMAA Surcharge |

|---|---|---|

| Single | $97,000 – $129,000 | $56.20 |

| Single | $129,000 – $161,000 | $112.40 |

| Single | $161,000 – $193,000 | $168.60 |

| Single | Over $193,000 | $224.80 |

| Married Filing Jointly | $194,000 – $258,000 | $56.20 |

| Married Filing Jointly | $258,000 – $322,000 | $112.40 |

| Married Filing Jointly | $322,000 – $386,000 | $168.60 |

| Married Filing Jointly | Over $386,000 | $224.80 |

| Married Filing Separately | $97,000 – $129,000 | $28.10 |

| Married Filing Separately | $129,000 – $161,000 | $56.20 |

| Married Filing Separately | $161,000 – $193,000 | $84.30 |

| Married Filing Separately | Over $193,000 | $112.40 |

If your MAGI is above the threshold for your filing status, you will have to pay the IRMAA surcharge in addition to your regular Part B premium. The IRMAA surcharge is added to your Part B premium each month.

For example, if you are single and your MAGI is $130,000, you will have to pay the IRMAA surcharge of $56.20 in addition to your regular Part B premium. Your total Part B premium for 2025 would be $170.90 per month ($114.70 + $56.20).

The IRMAA surcharge is designed to help offset the cost of Part B benefits for higher-income individuals. The surcharge is calculated based on your income, and it is not tax-deductible.

If you are concerned about the cost of Part B premiums, you can take steps to reduce your MAGI. Some ways to reduce your MAGI include:

- Contributing to a retirement account. Contributions to a traditional IRA or 401(k) plan can reduce your MAGI.

- Making deductible expenses. Deductible expenses, such as medical expenses and charitable contributions, can also reduce your MAGI.

- Claiming certain tax credits. Some tax credits, such as the Earned Income Tax Credit and the Child Tax Credit, can reduce your MAGI.

If you have questions about the IRMAA surcharge or how to reduce your MAGI, you can contact Medicare at 1-800-633-4227.

Additional Resources

- Medicare Part B Premiums and Deductibles

- Income-Related Monthly Adjustment Amount (IRMAA)

- How to Lower Your Medicare Part B Premiums

Closure

Thus, we hope this article has provided valuable insights into Medicare Part IRMAA Brackets 2025. We hope you find this article informative and beneficial. See you in our next article!