Lucid Stock Prediction 2025: A Comprehensive Analysis

Lucid Stock Prediction 2025: A Comprehensive Analysis

Related Articles: Lucid Stock Prediction 2025: A Comprehensive Analysis

- Super Bowl 2025: A Comprehensive Guide To The Host City And Stadium

- IR 2025: New Version Of Brazil’s Income Tax Return Software

- Movies 2025: The Most Anticipated Upcoming Films

- New Zealand Flights 2025: Premium Economy Takes Flight

- Is Form K-2 Required For 2025? A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Lucid Stock Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Lucid Stock Prediction 2025: A Comprehensive Analysis

Lucid Stock Prediction 2025: A Comprehensive Analysis

Introduction

Lucid Group, Inc. (LCID) is an American electric vehicle manufacturer based in Newark, California. The company was founded in 2007 and went public in 2021 through a merger with Churchill Capital Corp IV. Lucid Motors is known for its luxury electric vehicles, including the Lucid Air sedan and the upcoming Lucid Gravity SUV.

Predicting the future stock performance of any company is a challenging task, but it is especially difficult for a young company like Lucid Motors. The company has only been publicly traded for a short period of time, and it has not yet achieved profitability. However, there are a number of factors that can be used to make an educated guess about the company’s future stock price.

Factors to Consider

When making a stock prediction, it is important to consider a number of factors, including:

- Financial performance: A company’s financial performance is a key indicator of its future prospects. Lucid Motors has yet to achieve profitability, but it is expected to do so in the coming years. The company’s revenue and earnings are expected to grow significantly in the coming years, as it ramps up production of its electric vehicles.

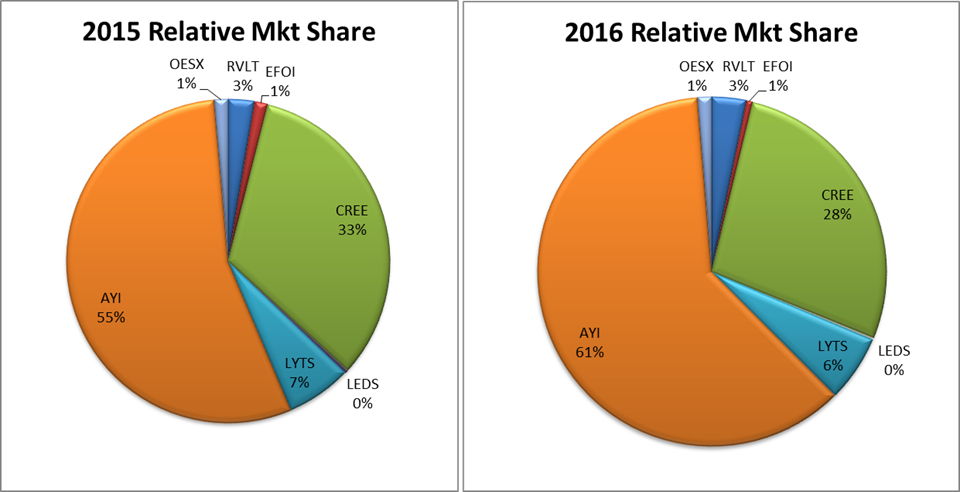

- Market share: Lucid Motors is a relatively new entrant to the electric vehicle market, but it has already gained a significant market share. The company’s vehicles have been well-received by critics and consumers alike, and it is expected to continue to gain market share in the coming years.

- Competition: Lucid Motors faces competition from a number of established automakers, including Tesla, General Motors, and Ford. However, the company believes that its superior technology and luxury vehicles will allow it to compete effectively with these rivals.

- Industry trends: The electric vehicle industry is growing rapidly, and Lucid Motors is well-positioned to benefit from this trend. The company is investing heavily in research and development, and it is expected to release new electric vehicles in the coming years.

Stock Price Targets

A number of analysts have published stock price targets for Lucid Motors. These targets range from $15 to $50 per share. The average target price is $25 per share.

Risks

There are a number of risks that could impact Lucid Motors’ stock price, including:

- Production delays: Lucid Motors has experienced some production delays in the past, and it is possible that these delays could continue in the future. This could impact the company’s revenue and earnings, and it could also lead to a decline in its stock price.

- Competition: Lucid Motors faces competition from a number of established automakers, including Tesla, General Motors, and Ford. These rivals have a significant advantage in terms of scale and experience, and they could make it difficult for Lucid Motors to gain market share.

- Regulatory changes: The electric vehicle industry is heavily regulated, and changes in these regulations could impact Lucid Motors’ business. For example, if the government provides subsidies for electric vehicles, it could boost demand for Lucid Motors’ vehicles. However, if the government imposes new regulations on electric vehicles, it could increase Lucid Motors’ costs and make it more difficult for the company to compete.

Conclusion

Lucid Motors is a promising young company with a bright future. The company’s financial performance is expected to improve in the coming years, and it is expected to continue to gain market share in the electric vehicle market. However, there are a number of risks that could impact Lucid Motors’ stock price, including production delays, competition, and regulatory changes. Investors should be aware of these risks before making a decision about whether to invest in Lucid Motors.

Disclaimer

The information contained in this article is for informational purposes only and should not be construed as investment advice. Please consult with a financial advisor before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Lucid Stock Prediction 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!