L2035 TSP Fund: A Comprehensive Guide To Secure Your Retirement

L2035 TSP Fund: A Comprehensive Guide to Secure Your Retirement

Related Articles: L2035 TSP Fund: A Comprehensive Guide to Secure Your Retirement

- 2025 Winnebago Revel 44E: The Ultimate Adventure Van

- Honda Accord 2025: A Comprehensive Overview

- 2025 Ford Edge Replacement: A Comprehensive Overview

- FAST 2025: Advancing Transportation Innovation For A Sustainable Future

- 2024 Subaru Forester: Significant Updates Enhance Performance And Style

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to L2035 TSP Fund: A Comprehensive Guide to Secure Your Retirement. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about L2035 TSP Fund: A Comprehensive Guide to Secure Your Retirement

L2035 TSP Fund: A Comprehensive Guide to Secure Your Retirement

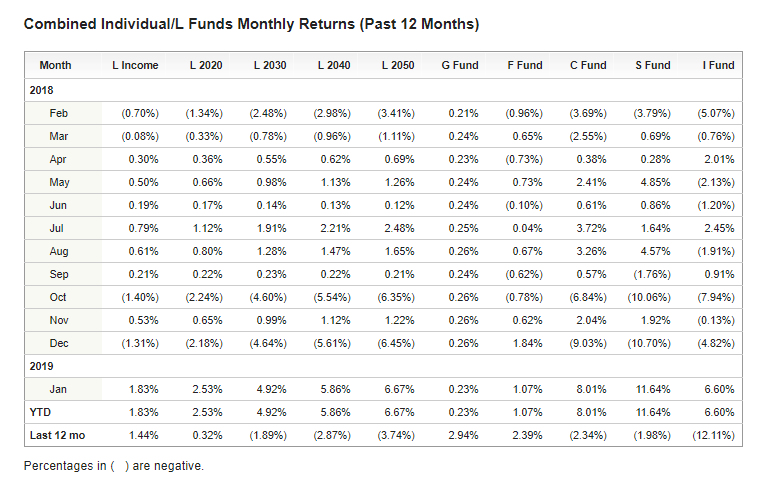

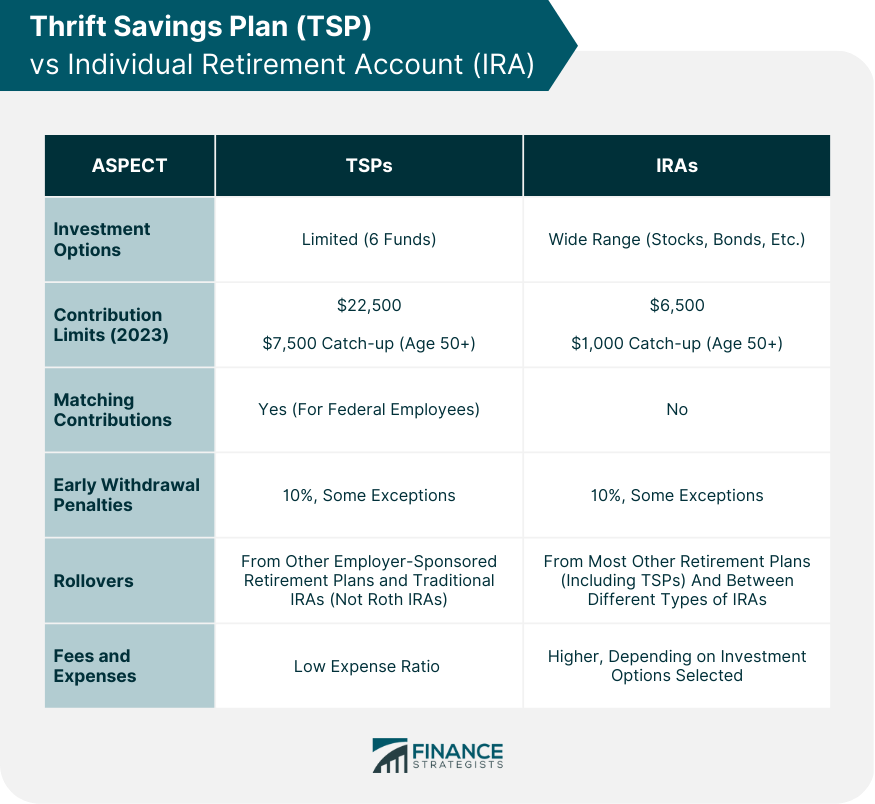

The Thrift Savings Plan (TSP) is a retirement savings and investment program for federal employees and members of the uniformed services. Established in 1986, the TSP offers a variety of investment options, including the L Funds, which are target-date funds that automatically adjust their asset allocation based on the investor’s age and retirement date.

Among the L Funds, the L 2035 TSP Fund is designed for investors who plan to retire around the year 2035. It provides a diversified portfolio of stocks, bonds, and other investments that is managed by professional investment managers. The fund’s asset allocation is gradually adjusted over time, becoming more conservative as the investor approaches retirement.

Investment Strategy

The L 2035 TSP Fund follows a lifecycle investment strategy, which means that the asset allocation of the fund changes as the investor ages. The fund’s initial asset allocation is approximately 60% stocks and 40% bonds. As the investor approaches retirement, the fund’s asset allocation gradually shifts towards more conservative investments, such as bonds and stable value funds. This strategy is designed to help investors maximize their growth potential while also reducing their risk as they near retirement.

Target Retirement Date

The target retirement date for the L 2035 TSP Fund is the year 2035. However, investors can choose to retire at any age. If an investor retires before 2035, the fund’s asset allocation will be more aggressive, with a higher percentage of stocks. Conversely, if an investor retires after 2035, the fund’s asset allocation will be more conservative, with a higher percentage of bonds.

Investment Options

The L 2035 TSP Fund is invested in a diversified portfolio of stocks, bonds, and other investments. The fund’s investment options include:

- Common Stock Index Fund (C Fund): This fund invests in a broad index of large-cap U.S. stocks.

- Small Cap Stock Index Fund (S Fund): This fund invests in a broad index of small-cap U.S. stocks.

- International Stock Index Fund (I Fund): This fund invests in a broad index of international stocks.

- Government Securities Investment Fund (G Fund): This fund invests in U.S. Treasury securities, which are considered very safe investments.

- Fixed Income Index Investment Fund (F Fund): This fund invests in a broad index of U.S. bonds.

Fees

The L 2035 TSP Fund has an annual operating expense ratio (OER) of 0.049%, which is very low compared to other target-date funds. The OER is a measure of the fund’s annual operating costs, which are deducted from the fund’s returns.

Benefits

Investing in the L 2035 TSP Fund offers several benefits, including:

- Automatic asset allocation: The fund’s asset allocation is automatically adjusted based on the investor’s age and retirement date, which can help investors stay on track for retirement.

- Diversification: The fund’s diversified portfolio of stocks, bonds, and other investments helps reduce risk.

- Low fees: The fund’s low OER helps investors keep more of their returns.

- Tax advantages: TSP contributions are made on a pre-tax basis, which can reduce an investor’s current tax liability. TSP withdrawals are taxed as ordinary income, but they may be eligible for favorable tax treatment if taken after age 59½.

Risks

Investing in the L 2035 TSP Fund also involves some risks, including:

- Market risk: The fund’s investments are subject to the ups and downs of the financial markets.

- Interest rate risk: The fund’s bond investments are subject to interest rate fluctuations.

- Inflation risk: The fund’s investments may not keep pace with inflation, which can erode the purchasing power of the investor’s savings.

Who Should Invest in the L 2035 TSP Fund?

The L 2035 TSP Fund is a suitable investment option for federal employees and members of the uniformed services who are planning to retire around the year 2035. The fund’s lifecycle investment strategy and diversified portfolio can help investors maximize their growth potential while also reducing their risk as they approach retirement.

Conclusion

The L 2035 TSP Fund is a valuable retirement savings tool for federal employees and members of the uniformed services. The fund’s automatic asset allocation, diversification, and low fees can help investors achieve their retirement goals. However, it is important to remember that all investments involve some risk, and investors should carefully consider their individual circumstances before investing in the L 2035 TSP Fund or any other investment product.

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings] (2022)](https://governmentworkerfi.com/wp-content/uploads/2022/01/TSP-L-2050-Fund-vs-private-sector.jpg)

Closure

Thus, we hope this article has provided valuable insights into L2035 TSP Fund: A Comprehensive Guide to Secure Your Retirement. We hope you find this article informative and beneficial. See you in our next article!