Is Form K-2 Required For 2025? A Comprehensive Guide

Is Form K-2 Required for 2025? A Comprehensive Guide

Related Articles: Is Form K-2 Required for 2025? A Comprehensive Guide

- 2025 Toyota Stout Hybrid: A Revolutionary Pickup Truck For The Future

- 2025 Calendar For July

- November 1, 2025: A Glimpse Into The Future

- Tax Bracket 2025 Vs 2025

- Toy Story 5: A Long-Awaited Reunion

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Is Form K-2 Required for 2025? A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Is Form K-2 Required for 2025? A Comprehensive Guide

Is Form K-2 Required for 2025? A Comprehensive Guide

Introduction

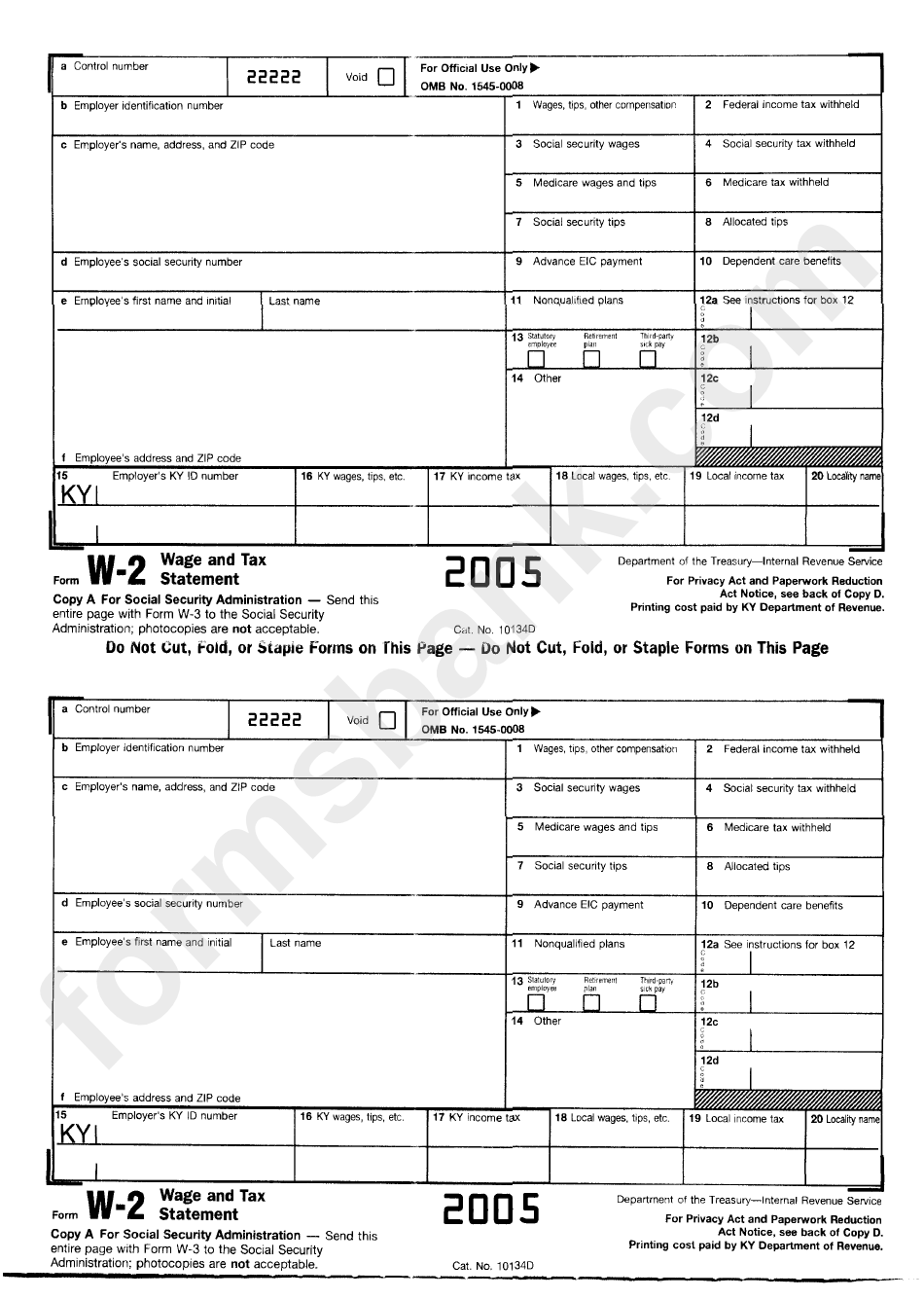

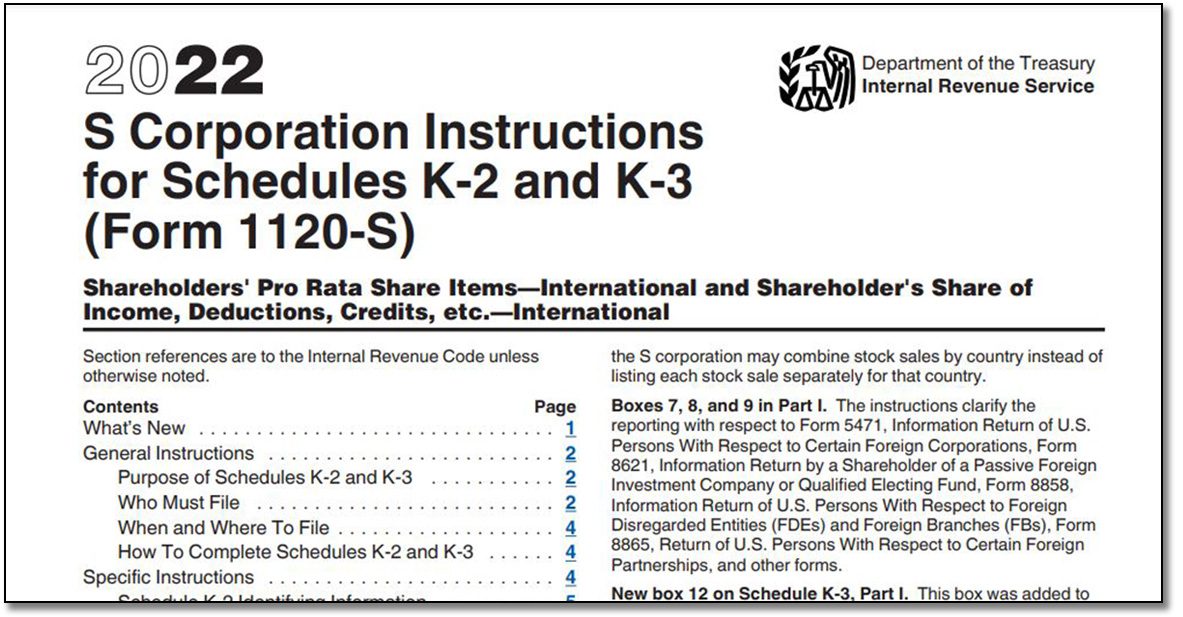

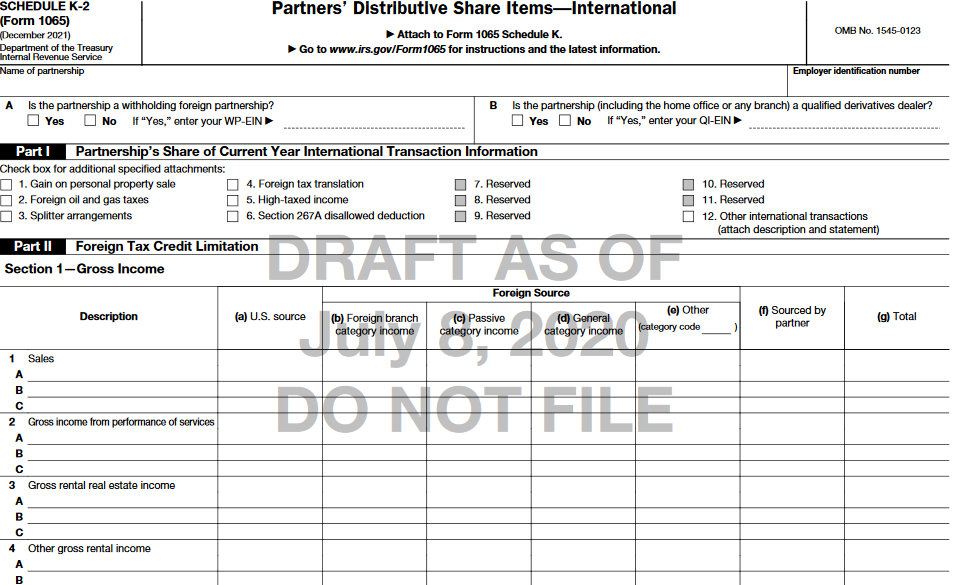

Form K-2, also known as the Foreign Partner’s Share of Income, Deductions, Credits, etc., is an Internal Revenue Service (IRS) form used to report the income, deductions, and credits of a foreign partnership to its U.S. partners. This form is required to be filed by U.S. citizens and residents who are partners in foreign partnerships that have U.S. trade or business income.

In recent years, there has been some confusion regarding the requirement to file Form K-2. This confusion stems from the Tax Cuts and Jobs Act (TCJA) of 2017, which made significant changes to the U.S. tax code. One of the changes made by the TCJA was the elimination of the Foreign Tax Credit (FTC) for individuals.

As a result of the elimination of the FTC, some taxpayers have questioned whether Form K-2 is still required. The answer to this question is yes, Form K-2 is still required for 2025 and beyond.

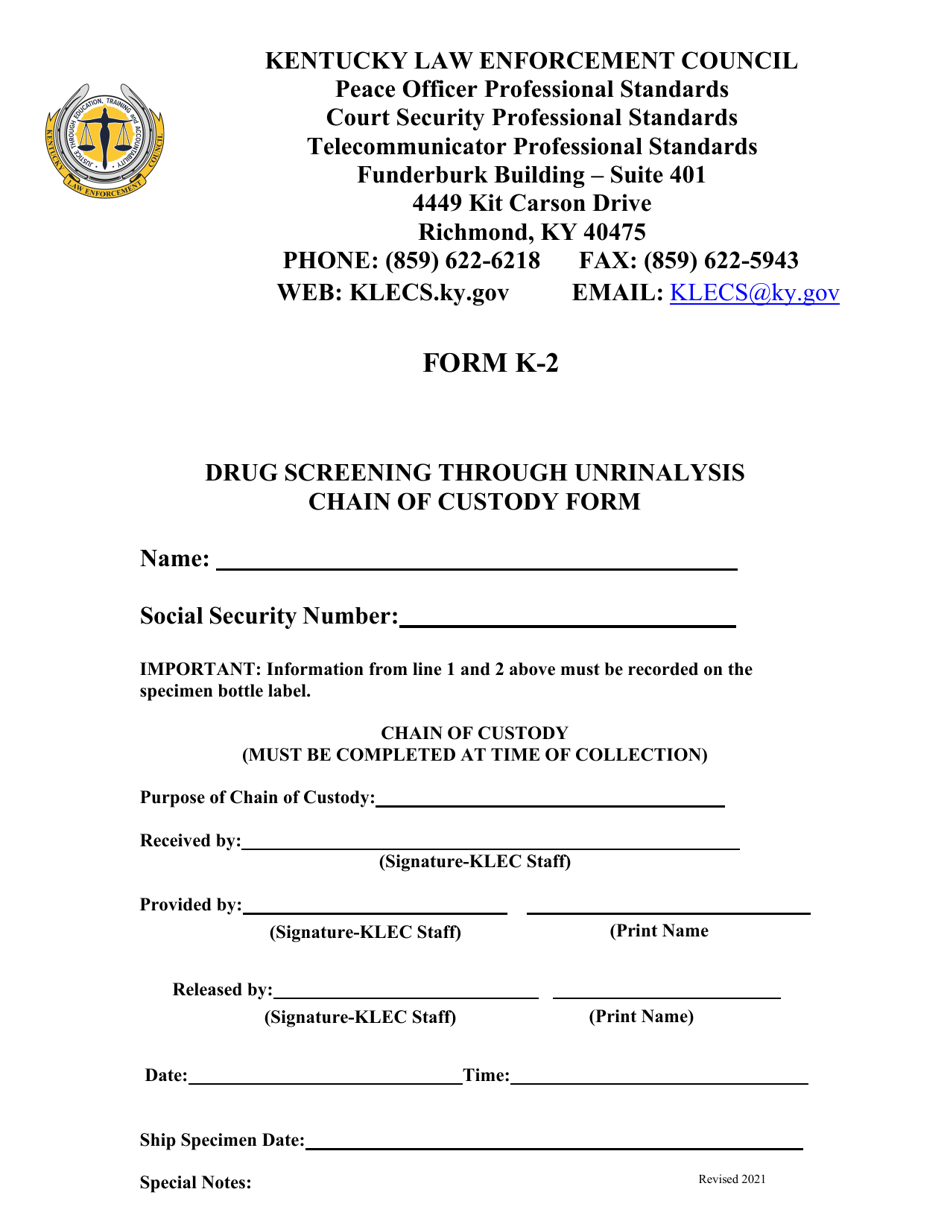

Who Must File Form K-2?

Form K-2 must be filed by any U.S. citizen or resident who is a partner in a foreign partnership that has U.S. trade or business income. This includes both general and limited partners.

When is Form K-2 Due?

Form K-2 is due on the same date as your individual income tax return. For most taxpayers, this is April 15th. However, if you file an extension for your individual income tax return, you will also have an extension for filing Form K-2.

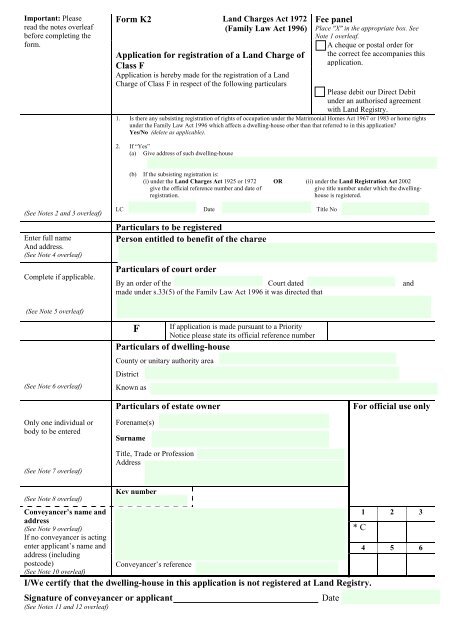

What Information is Required on Form K-2?

Form K-2 requires you to provide the following information:

- Your name, address, and Social Security number

- The name and address of the foreign partnership

- The partner’s share of income, deductions, and credits from the foreign partnership

- Any other information required by the IRS

Penalties for Failing to File Form K-2

There are significant penalties for failing to file Form K-2. The IRS may impose a penalty of up to $10,000 for each year that you fail to file the form.

Conclusion

Form K-2 is still required for 2025 and beyond. If you are a U.S. citizen or resident who is a partner in a foreign partnership that has U.S. trade or business income, you must file Form K-2. Failure to file Form K-2 can result in significant penalties.

Additional Resources

Closure

Thus, we hope this article has provided valuable insights into Is Form K-2 Required for 2025? A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!