IRS Standard Deduction 2025: A Comprehensive Guide

IRS Standard Deduction 2025: A Comprehensive Guide

Related Articles: IRS Standard Deduction 2025: A Comprehensive Guide

- Which Zodiac Sign Will Reign Supreme As The Prettiest In 2025?

- The 2025 Lexus ES 250: A Symphony Of Luxury, Technology, And Refinement

- Top 100 High School Basketball Recruits For The Class Of 2025

- Osaka Expo 2025 Mascot: Myakki, The Cheerful And Energetic Ambassador

- Dodge Challenger Under 5k: A Rare And Affordable Muscle Car

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to IRS Standard Deduction 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRS Standard Deduction 2025: A Comprehensive Guide

IRS Standard Deduction 2025: A Comprehensive Guide

The Internal Revenue Service (IRS) standard deduction is a specific amount that taxpayers can deduct from their taxable income before calculating their tax liability. It is a simplified alternative to itemizing deductions, which involves listing and totaling individual expenses that are eligible for deduction.

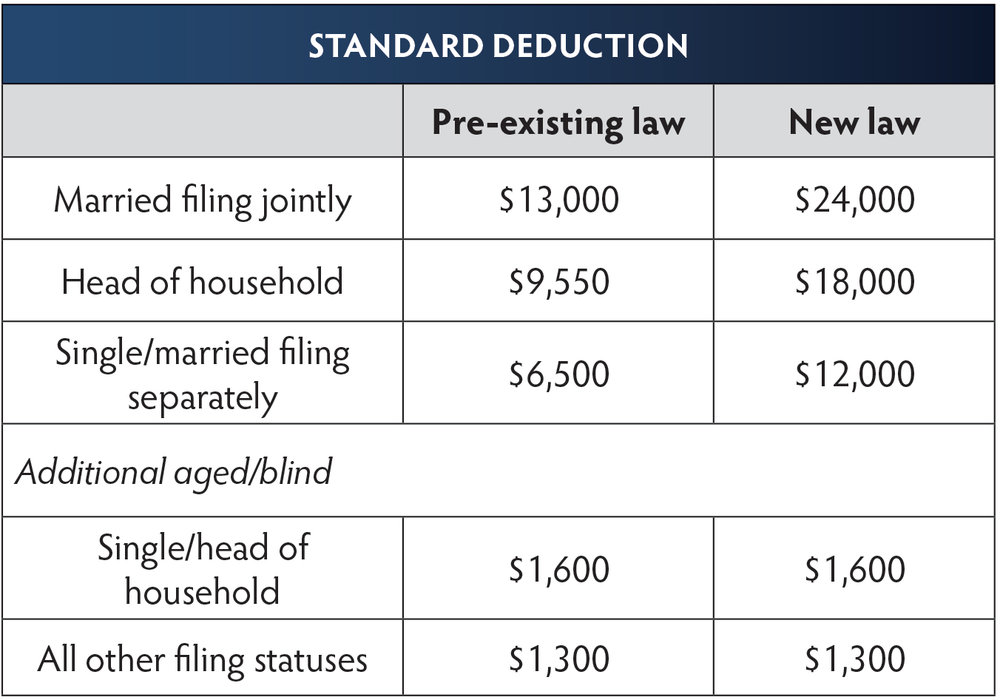

For tax year 2025, the IRS has announced the following standard deduction amounts:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

Benefits of the Standard Deduction

- Simplicity: The standard deduction is a flat amount that does not require taxpayers to track and document individual expenses.

- Convenience: Taxpayers who choose the standard deduction can save time and effort compared to itemizing deductions.

- Eligibility: Most taxpayers qualify for the standard deduction, regardless of their income or expenses.

Who Should Itemize Deductions?

While the standard deduction is convenient and simple, it may not be the most beneficial option for all taxpayers. Taxpayers who have significant itemized deductions that exceed the standard deduction amount may benefit from itemizing.

Common itemized deductions include:

- Mortgage interest

- State and local income taxes

- Charitable contributions

- Medical expenses (above a certain threshold)

- Casualty and theft losses

How to Choose Between the Standard Deduction and Itemizing

To determine whether the standard deduction or itemizing is the better option, taxpayers should compare the total amount of their itemized deductions to the standard deduction amount. If the total itemized deductions are greater than the standard deduction, itemizing may be more beneficial.

Phase-Out of the Standard Deduction

For high-income taxpayers, the standard deduction is gradually phased out. The phase-out begins at certain income levels and reduces the standard deduction by a percentage of the taxpayer’s adjusted gross income (AGI).

For tax year 2025, the standard deduction phase-out thresholds are as follows:

- Single: AGI over $282,700

- Married filing jointly: AGI over $436,500

- Married filing separately: AGI over $218,250

- Head of household: AGI over $359,000

Impact of the Standard Deduction on Tax Liability

The standard deduction plays a significant role in reducing a taxpayer’s taxable income. By deducting the standard amount from their income, taxpayers lower their tax liability.

For example, a single taxpayer with a taxable income of $50,000 would pay approximately $7,700 in federal income tax without the standard deduction. However, with the standard deduction of $13,850, their taxable income is reduced to $36,150, resulting in a tax liability of approximately $5,300.

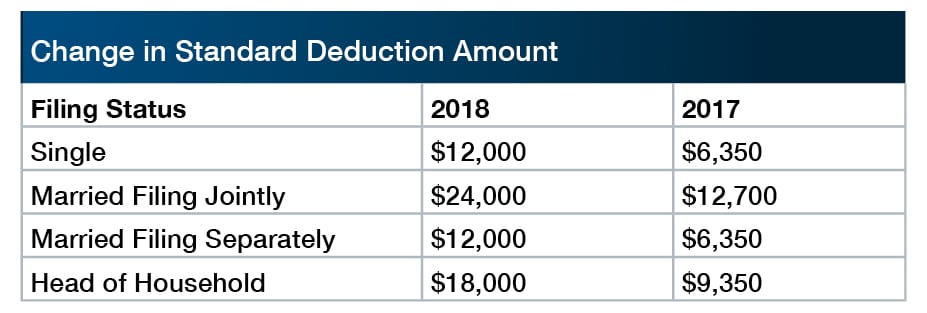

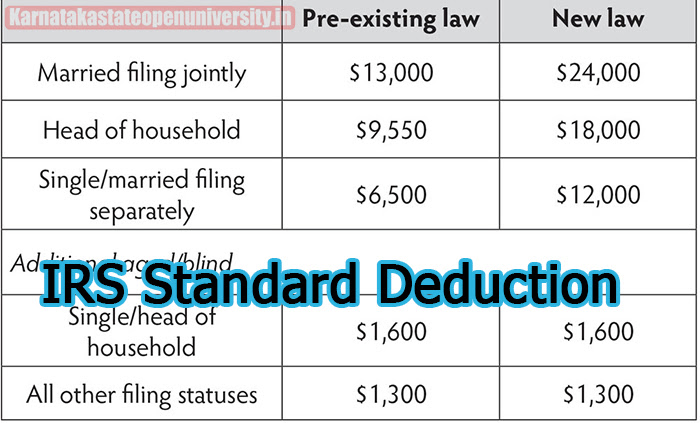

Changes to the Standard Deduction over Time

The IRS adjusts the standard deduction amounts annually to account for inflation. In recent years, the standard deduction has increased significantly.

Conclusion

The IRS standard deduction is a valuable tool that can simplify tax preparation and reduce tax liability for many taxpayers. While the standard deduction is a convenient option, taxpayers should consider whether itemizing deductions would be more beneficial based on their individual circumstances. By understanding the rules and implications of the standard deduction, taxpayers can make informed decisions about their tax planning.

Closure

Thus, we hope this article has provided valuable insights into IRS Standard Deduction 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!