IRS 401(k) Limits For 2025: A Comprehensive Guide

IRS 401(k) Limits for 2025: A Comprehensive Guide

Related Articles: IRS 401(k) Limits for 2025: A Comprehensive Guide

- Bears Record 2025 Draft: A Blueprint For Success

- 2025 Calendar With Holidays

- 2025 Forester Touring Brown Leather: A Refined Wilderness Escape

- Norma Smith And Grant Wood: A Legacy Of Enduring American Art

- The Land Before Time X: The Great Longneck Migration

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to IRS 401(k) Limits for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about IRS 401(k) Limits for 2025: A Comprehensive Guide

IRS 401(k) Limits for 2025: A Comprehensive Guide

Individual retirement accounts (IRAs) and 401(k) plans are two of the most popular retirement savings vehicles in the United States. Both offer tax advantages, but they have different contribution limits and rules.

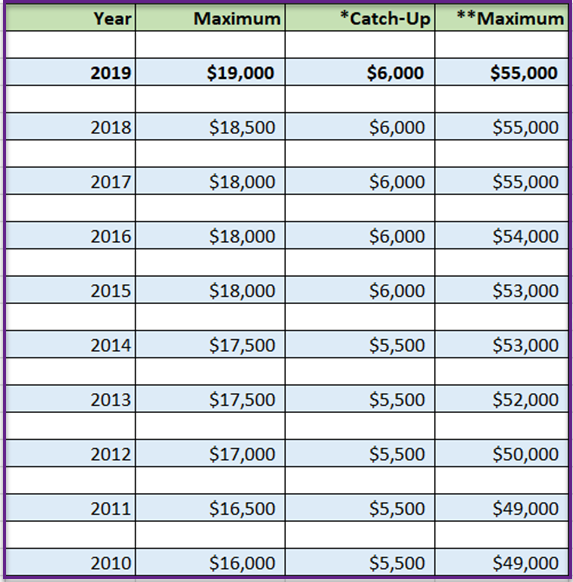

For 2025, the IRS has announced the following 401(k) contribution limits:

- Employee elective deferrals (traditional and Roth): $22,500 ($30,000 for those age 50 and older)

- Employer matching contributions: 100% of compensation, up to $66,000 ($73,500 for those age 50 and older)

- Total contributions (employee and employer): $66,000 ($73,500 for those age 50 and older)

Understanding the Different Types of 401(k) Contributions

There are two main types of 401(k) contributions: employee elective deferrals and employer matching contributions.

- Employee elective deferrals are contributions that you make to your 401(k) plan from your paycheck on a pre-tax basis. This means that the money is deducted from your paycheck before taxes are taken out. Employee elective deferrals are limited to the annual contribution limit set by the IRS.

- Employer matching contributions are contributions that your employer makes to your 401(k) plan on your behalf. These contributions are typically made on a matching basis, meaning that your employer will match a certain percentage of your employee elective deferrals. Employer matching contributions are not subject to the annual contribution limit, but they are limited to 100% of your compensation.

Catching Up with Retirement Savings

If you are age 50 or older, you can make catch-up contributions to your 401(k) plan. Catch-up contributions are additional contributions that you can make above the regular annual contribution limit. For 2025, the catch-up contribution limit is $7,500.

Tax Benefits of 401(k) Plans

401(k) plans offer a number of tax benefits, including:

- Tax-deferred growth: The money in your 401(k) plan grows tax-deferred, meaning that you do not pay taxes on the earnings until you withdraw the money. This can lead to significant tax savings over time.

- Tax-free withdrawals: If you withdraw the money from your 401(k) plan after you reach age 59½, you will not have to pay taxes on the withdrawals. However, if you withdraw the money before you reach age 59½, you will have to pay income taxes and a 10% early withdrawal penalty.

401(k) Plans vs. IRAs

401(k) plans and IRAs are both popular retirement savings vehicles, but they have different features and benefits. Here is a comparison of the two:

| Feature | 401(k) Plan | IRA |

|---|---|---|

| Contribution limits | Higher | Lower |

| Employer matching contributions | Yes | No |

| Investment options | More limited | More flexible |

| Withdrawal rules | More restrictive | More flexible |

Choosing the Right Retirement Savings Plan

The best retirement savings plan for you will depend on your individual circumstances. If you are employed by a company that offers a 401(k) plan, you should consider contributing to the plan, especially if your employer offers a matching contribution. If you are not employed by a company that offers a 401(k) plan, you can open an IRA.

Conclusion

401(k) plans are a great way to save for retirement. They offer a number of tax benefits, including tax-deferred growth and tax-free withdrawals. If you are employed by a company that offers a 401(k) plan, you should consider contributing to the plan.

Closure

Thus, we hope this article has provided valuable insights into IRS 401(k) Limits for 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!