Interest Rates Canada 2025: Economic Outlook And Monetary Policy Expectations

Interest Rates Canada 2025: Economic Outlook and Monetary Policy Expectations

Related Articles: Interest Rates Canada 2025: Economic Outlook and Monetary Policy Expectations

- College Softball Recruiting Rankings 2025: A Comprehensive Analysis

- How Many Days Left Until 2025: A Countdown To The Future

- Teladoc Health: Revolutionizing Healthcare Delivery

- Difference Between 2025 And 2025 Ford Edge

- Norma Smith And Grant Wood: A Legacy Of Enduring American Art

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Interest Rates Canada 2025: Economic Outlook and Monetary Policy Expectations. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Interest Rates Canada 2025: Economic Outlook and Monetary Policy Expectations

Interest Rates Canada 2025: Economic Outlook and Monetary Policy Expectations

Introduction

Interest rates play a crucial role in shaping economic activity, influencing everything from consumer spending to business investment. In Canada, the Bank of Canada (BoC) is responsible for setting interest rates, with its primary mandate being to maintain price stability and promote economic growth. This article examines the current and expected interest rate environment in Canada, focusing on the outlook for 2025.

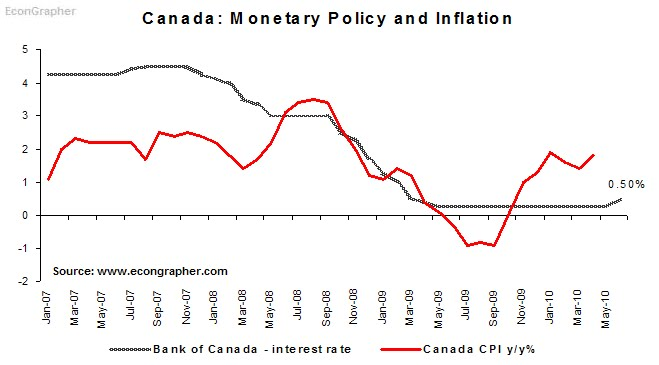

Current Interest Rate Environment

As of January 2023, the BoC’s target for the overnight rate, the benchmark interest rate, is 4.25%. This represents a significant increase from the record low of 0.25% set during the COVID-19 pandemic. The BoC has raised interest rates eight times since March 2022 in an effort to combat inflation, which has surged to multi-decade highs.

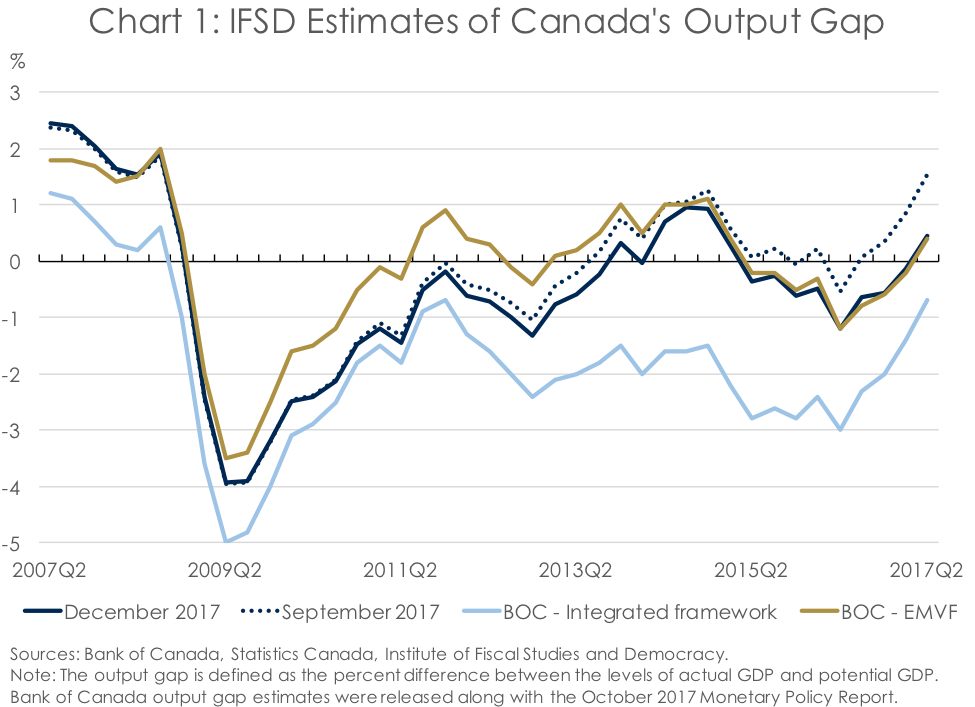

Economic Outlook

The Canadian economy has shown resilience in the face of global headwinds, with real GDP growth estimated at 3.3% in 2022. However, the outlook for 2023 is more subdued, with the BoC projecting growth of 1.0%. This slowdown is primarily attributed to the impact of higher interest rates on consumer spending and business investment.

Inflation remains a key concern for the BoC. While headline inflation has moderated in recent months, core inflation, which excludes volatile items such as food and energy, remains elevated. The BoC expects inflation to gradually return to its target of 2% by the end of 2024.

Monetary Policy Expectations

The BoC has signaled that it will continue to raise interest rates in the near term to bring inflation under control. However, the pace of rate hikes is expected to slow as the economy slows.

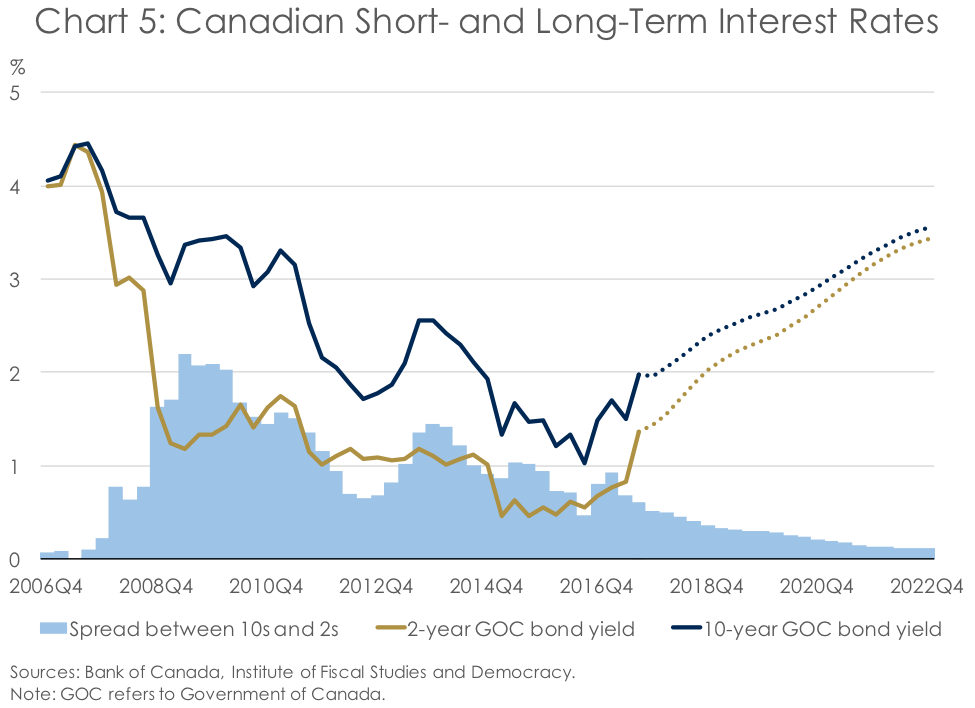

Financial markets anticipate that the BoC will raise the overnight rate to a peak of around 4.50% by mid-2023. This would be followed by a gradual easing of interest rates in 2024 and 2025 as inflation moderates and the economy recovers.

Interest Rate Forecast for 2025

Based on the current economic outlook and monetary policy expectations, the overnight rate is projected to be around 3.75% by the end of 2025. This represents a gradual decline from the peak of 4.50% expected in mid-2023, but still above the pre-pandemic level of 0.25%.

Implications for Businesses and Consumers

Higher interest rates have a direct impact on businesses and consumers. Businesses may face increased borrowing costs, which can affect investment decisions and profitability. Consumers may also see higher interest rates on mortgages, credit cards, and other loans, which can reduce their purchasing power and slow down spending.

However, higher interest rates can also benefit savers, as they earn more interest on their deposits. Additionally, higher interest rates can help stabilize the economy by reducing inflation and promoting financial stability.

Conclusion

Interest rates in Canada are expected to remain elevated in 2025, as the BoC continues to fight inflation. While the pace of rate hikes is expected to slow, the overnight rate is still projected to be significantly higher than the pre-pandemic level. This will have implications for businesses, consumers, and the economy as a whole.

As the economic outlook evolves and inflation moderates, the BoC will likely begin to ease interest rates in 2024 and 2025. However, the timing and pace of rate cuts will depend on the progress made in bringing inflation back to target and supporting sustainable economic growth.

Closure

Thus, we hope this article has provided valuable insights into Interest Rates Canada 2025: Economic Outlook and Monetary Policy Expectations. We thank you for taking the time to read this article. See you in our next article!