Google Stock Price Forecast 2025: A Comprehensive Analysis

Google Stock Price Forecast 2025: A Comprehensive Analysis

Related Articles: Google Stock Price Forecast 2025: A Comprehensive Analysis

- World 2025 Schedule: A Comprehensive Overview Of The Global Tournament

- 2025 Verdugo Place: A Luxurious Estate In The Heart Of Fullerton

- 2025 Us Ssdi Cola Increase Prediction

- Battery 2032 Near Me: A Comprehensive Guide To Finding The Right Battery

- When Is New Year’s 2025: A Comprehensive Guide To The Global Festivities

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Google Stock Price Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Google Stock Price Forecast 2025: A Comprehensive Analysis

Google Stock Price Forecast 2025: A Comprehensive Analysis

Introduction

Google, the tech behemoth behind the world’s most popular search engine and a vast array of other products and services, has long been a darling of investors. As the company continues to innovate and expand its reach, analysts are eagerly forecasting the future trajectory of its stock price. This article presents a comprehensive analysis of the Google stock price forecast for 2025, considering various factors that could influence its performance.

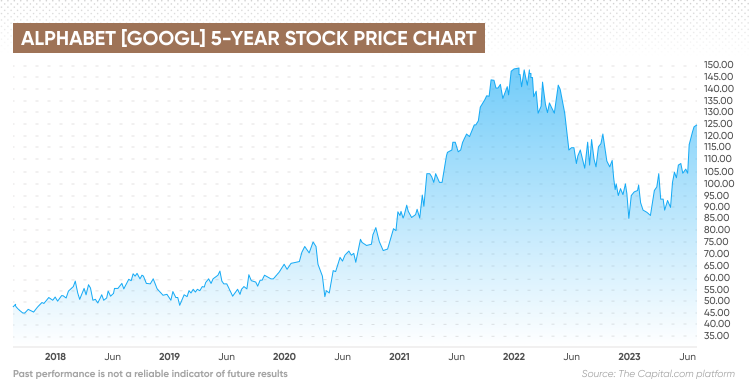

Historical Performance and Key Metrics

Over the past decade, Google’s stock price has exhibited remarkable growth, outperforming the broader market. In 2013, the stock traded around $800 per share. By the end of 2022, it had surged to over $1,200 per share, representing an annualized return of approximately 12%. Key financial metrics such as revenue, earnings per share (EPS), and free cash flow have also shown consistent increases.

Factors Influencing Future Performance

Several key factors are likely to influence the future performance of Google’s stock price:

- Continued dominance in search advertising: Google’s search engine remains the primary destination for online users, generating a significant portion of the company’s revenue. Continued dominance in this market will be crucial for maintaining growth.

- Expansion into new markets: Google has been actively investing in new areas such as cloud computing, artificial intelligence (AI), and hardware. Success in these markets could drive future revenue streams and support stock price appreciation.

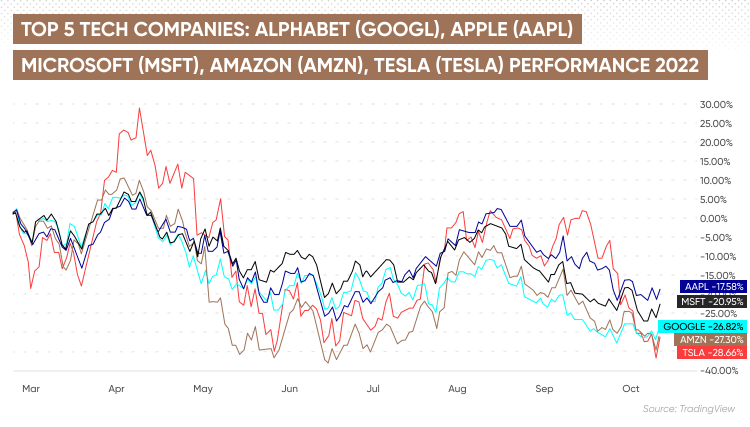

- Competition: Google faces competition from rivals such as Microsoft, Amazon, and Meta. The intensity of this competition could impact its market share and profitability.

- Regulatory environment: Google has been the subject of regulatory scrutiny in recent years, particularly concerning antitrust issues. Changes in the regulatory landscape could affect the company’s operations and stock price.

- Economic conditions: The broader economic environment, including factors such as interest rates, inflation, and consumer spending, can impact Google’s financial performance and stock price.

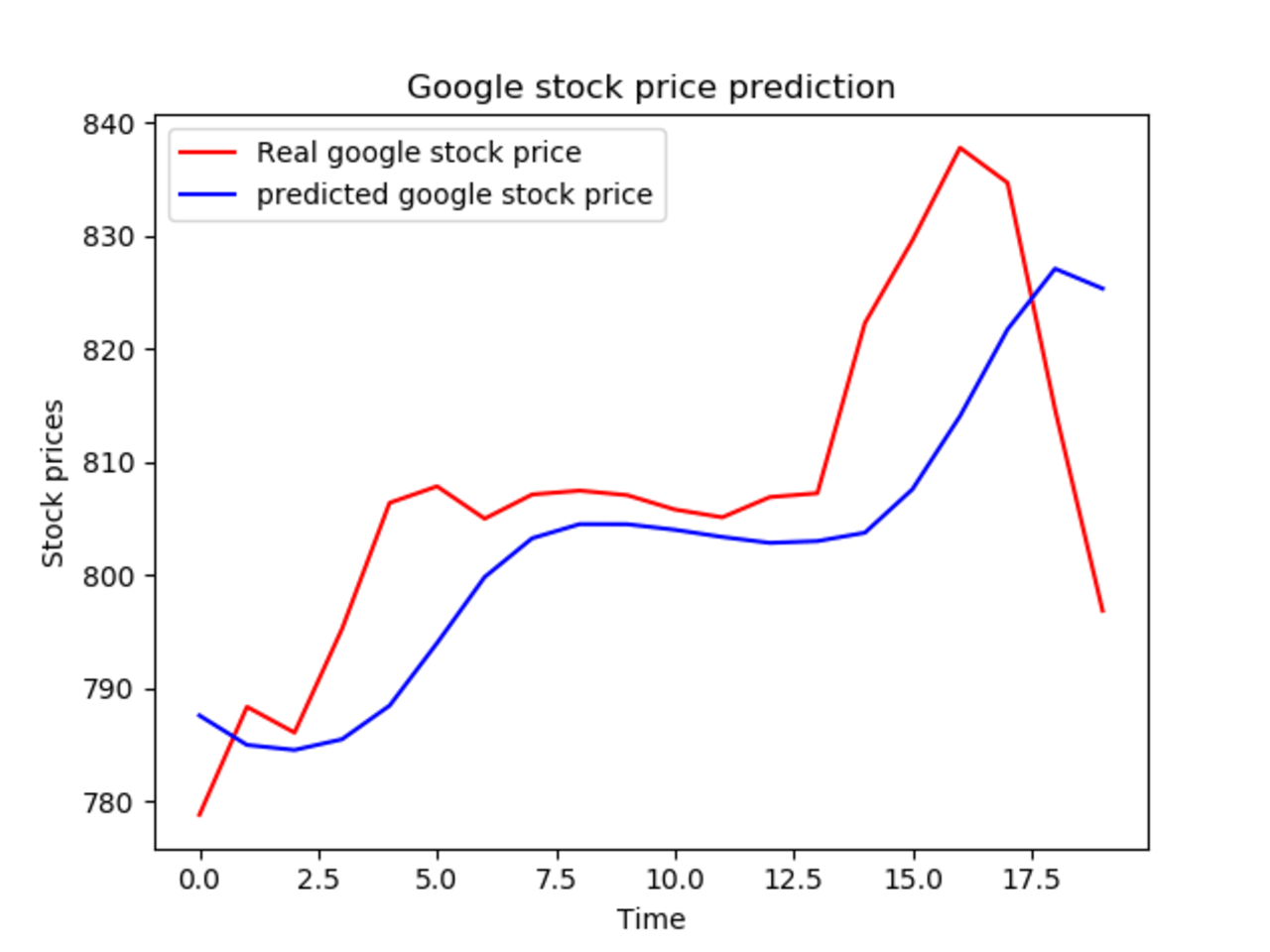

Analyst Forecasts

Analysts have provided varying forecasts for Google’s stock price in 2025. Some believe that the company’s continued dominance in search advertising and expansion into new markets will drive further growth. Others caution that competition and regulatory challenges could limit upside potential.

According to a recent survey of analysts by TipRanks, the median price target for Google stock in 2025 is $1,500 per share. This represents a potential upside of approximately 20% from current levels. However, the range of estimates is wide, with some analysts forecasting prices as high as $1,800 per share and others as low as $1,250 per share.

Valuation Considerations

Google’s current valuation is based on several factors, including its financial performance, market share, and growth potential. The company currently trades at a price-to-earnings (P/E) ratio of approximately 25, which is higher than the average for the tech sector. This premium valuation reflects Google’s strong financial position and growth prospects.

Risks and Opportunities

Investing in Google stock carries both risks and opportunities. Key risks include competition, regulatory challenges, and economic headwinds. However, the company’s strong brand, diversified business model, and continued innovation provide significant opportunities for growth.

Conclusion

The Google stock price forecast for 2025 is subject to a range of factors, including the company’s continued dominance in search advertising, expansion into new markets, competition, regulatory environment, and economic conditions. Analyst forecasts suggest a potential upside of 20% by 2025, although the range of estimates is wide. Investors should carefully consider the risks and opportunities associated with investing in Google stock before making any decisions.

Closure

Thus, we hope this article has provided valuable insights into Google Stock Price Forecast 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!