Gold Price In Future 2025: A Comprehensive Analysis

Gold Price in Future 2025: A Comprehensive Analysis

Related Articles: Gold Price in Future 2025: A Comprehensive Analysis

- 2025 Nissan Murano: A Comprehensive Review

- Flights In January 2025: A Comprehensive Guide

- The Dodge Viper: A Legendary American Sports Car

- The 2025 Audi Q3: A Comprehensive Guide

- 2025 Forester Touring Brown Leather: A Refined Wilderness Escape

Introduction

With great pleasure, we will explore the intriguing topic related to Gold Price in Future 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Gold Price in Future 2025: A Comprehensive Analysis

Gold Price in Future 2025: A Comprehensive Analysis

Introduction

Gold has been a valuable asset for centuries, serving as a store of value, a hedge against inflation, and a safe haven during times of economic uncertainty. As we approach 2025, investors are eagerly speculating about the future trajectory of gold prices. This article aims to provide a comprehensive analysis of the factors that are likely to influence the gold price in 2025 and beyond, offering valuable insights for investors seeking to capitalize on this precious metal’s potential.

Historical Performance and Key Drivers

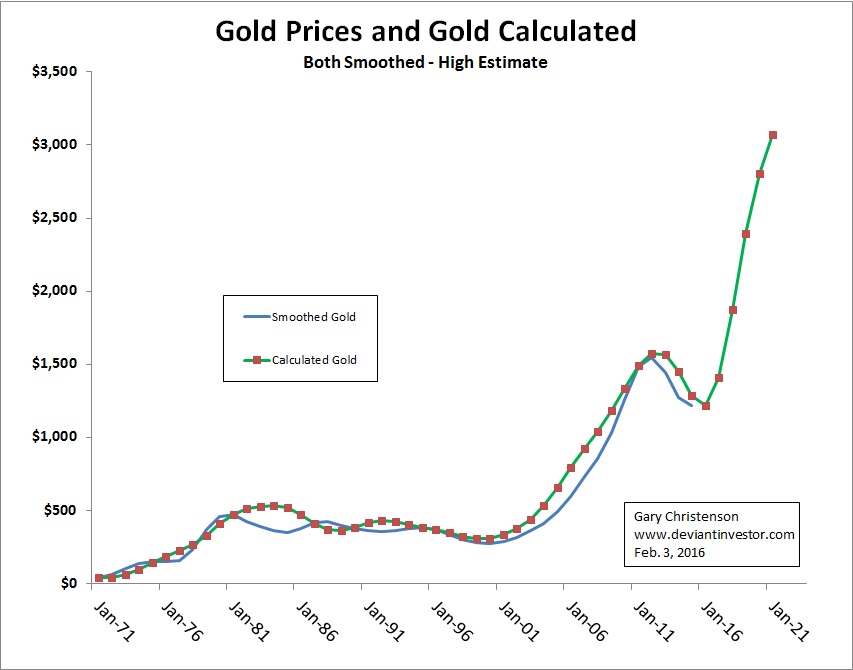

Gold has a rich history of price fluctuations, influenced by a multitude of economic, political, and social factors. Over the past decade, gold prices have generally been on an upward trend, reaching a record high of $2,075 per troy ounce in August 2020. The primary drivers behind this increase have been:

- Low Interest Rates: Low interest rates make gold more attractive as an investment, as it offers a potential return without the risk of interest rate fluctuations.

- Inflation: Gold is often seen as a hedge against inflation, as its value tends to rise when inflation erodes the purchasing power of fiat currencies.

- Economic Uncertainty: During periods of economic uncertainty, investors often flock to gold as a safe haven asset, seeking to preserve their wealth.

- Geopolitical Tensions: International conflicts and political instability can also boost gold prices, as investors seek refuge from risk.

Factors Influencing Future Gold Prices

The future price of gold will be shaped by a complex interplay of various factors, including:

- Economic Growth: Strong economic growth can lead to increased demand for gold as an investment and a hedge against inflation. Conversely, economic slowdowns can dampen demand and put downward pressure on prices.

- Interest Rates: The trajectory of interest rates will continue to be a major factor influencing gold prices. Rising interest rates make gold less attractive as an investment, while falling interest rates can boost demand.

- Inflation: Inflationary pressures will remain a key consideration for investors, as gold is often sought as a hedge against the erosion of purchasing power.

- Central Bank Policies: Central bank policies, such as quantitative easing and interest rate adjustments, can significantly impact the gold market.

- Geopolitical Risks: Global conflicts, trade disputes, and political instability can create uncertainty and drive demand for gold as a safe haven asset.

- Technological Advancements: Innovations in mining and extraction technologies can affect the supply and cost of gold production, influencing prices.

Forecasts for 2025

Based on an analysis of these factors, experts have provided a range of forecasts for the gold price in 2025:

- Goldman Sachs: Predicts a gold price of $1,950 per troy ounce in 2025, driven by low interest rates and geopolitical uncertainty.

- JPMorgan Chase: Forecasts a gold price of $1,800 per troy ounce, citing the potential for a global economic slowdown and continued inflationary pressures.

- Citigroup: Projects a gold price of $2,000 per troy ounce, based on expectations of rising inflation and a weaker U.S. dollar.

- Bank of America: Estimates a gold price of $1,750 per troy ounce, balancing the potential for economic recovery with concerns over rising interest rates.

Investment Considerations

While these forecasts provide a general outlook, it is important for investors to consider their own individual circumstances and risk tolerance when making investment decisions. Gold can be a valuable addition to a diversified portfolio, but it should be viewed as a long-term investment. Investors should also be aware of the potential risks associated with gold, such as price volatility and the potential for losses.

Conclusion

The future price of gold in 2025 remains uncertain, but a comprehensive analysis of the key factors influencing the market suggests that it will continue to play a significant role as a safe haven asset and a hedge against inflation. Investors should carefully consider the forecasts and their own risk tolerance before making investment decisions. By understanding the dynamics of the gold market, investors can position themselves to potentially capitalize on the opportunities and mitigate the risks associated with this precious metal.

Closure

Thus, we hope this article has provided valuable insights into Gold Price in Future 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!