Flight Centre Share Price Prediction 2025: A Comprehensive Analysis

Flight Centre Share Price Prediction 2025: A Comprehensive Analysis

Related Articles: Flight Centre Share Price Prediction 2025: A Comprehensive Analysis

- 2025 NFL Draft: A Comprehensive Analysis

- 2025 Audi Q3: A Compact SUV With Premium Appeal

- Princess Cruises Alaska 2025: An Unforgettable Journey Through The Last Frontier

- 3-Volt Lithium Battery 2025: A Comprehensive Guide

- When Is Easter 2024 School Holidays?

Introduction

With great pleasure, we will explore the intriguing topic related to Flight Centre Share Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Flight Centre Share Price Prediction 2025: A Comprehensive Analysis

Flight Centre Share Price Prediction 2025: A Comprehensive Analysis

Introduction

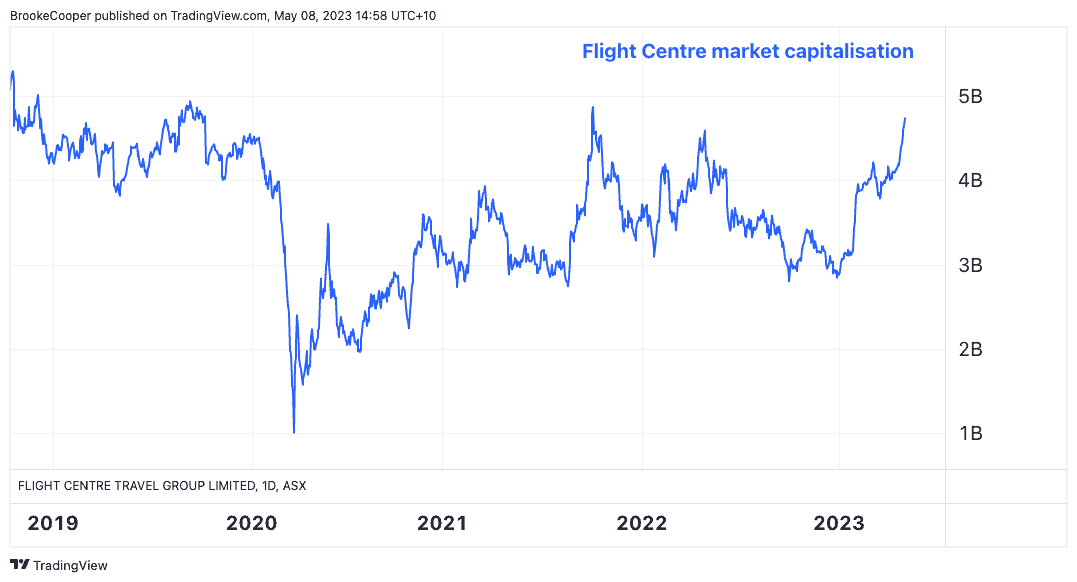

Flight Centre Travel Group (ASX: FLT) is a leading global travel agency with operations in over 90 countries. The company offers a wide range of travel services, including flights, accommodation, tours, and car rentals. Flight Centre has been listed on the Australian Securities Exchange (ASX) since 1995 and has a market capitalization of approximately $3.5 billion.

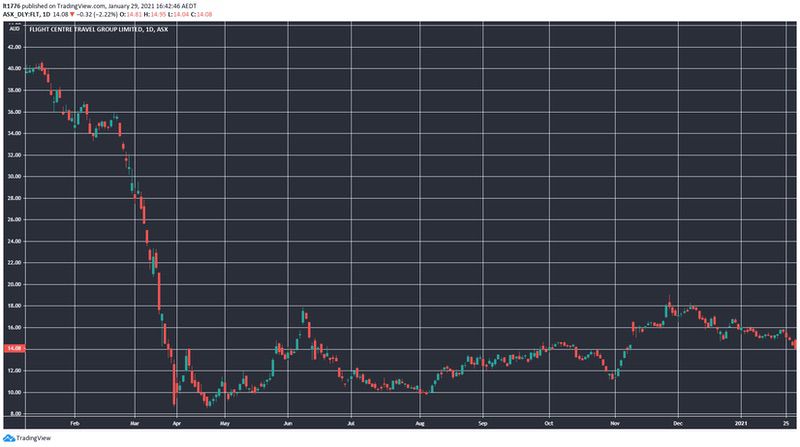

In recent years, Flight Centre has faced a number of challenges, including the COVID-19 pandemic, which caused a sharp decline in travel demand. However, the company has taken steps to adapt to the changing market conditions and is now well-positioned for growth.

This article provides a comprehensive analysis of Flight Centre’s share price prediction for 2025. We will consider the company’s financial performance, industry trends, and analyst forecasts to develop a realistic estimate of its future share price.

Financial Performance

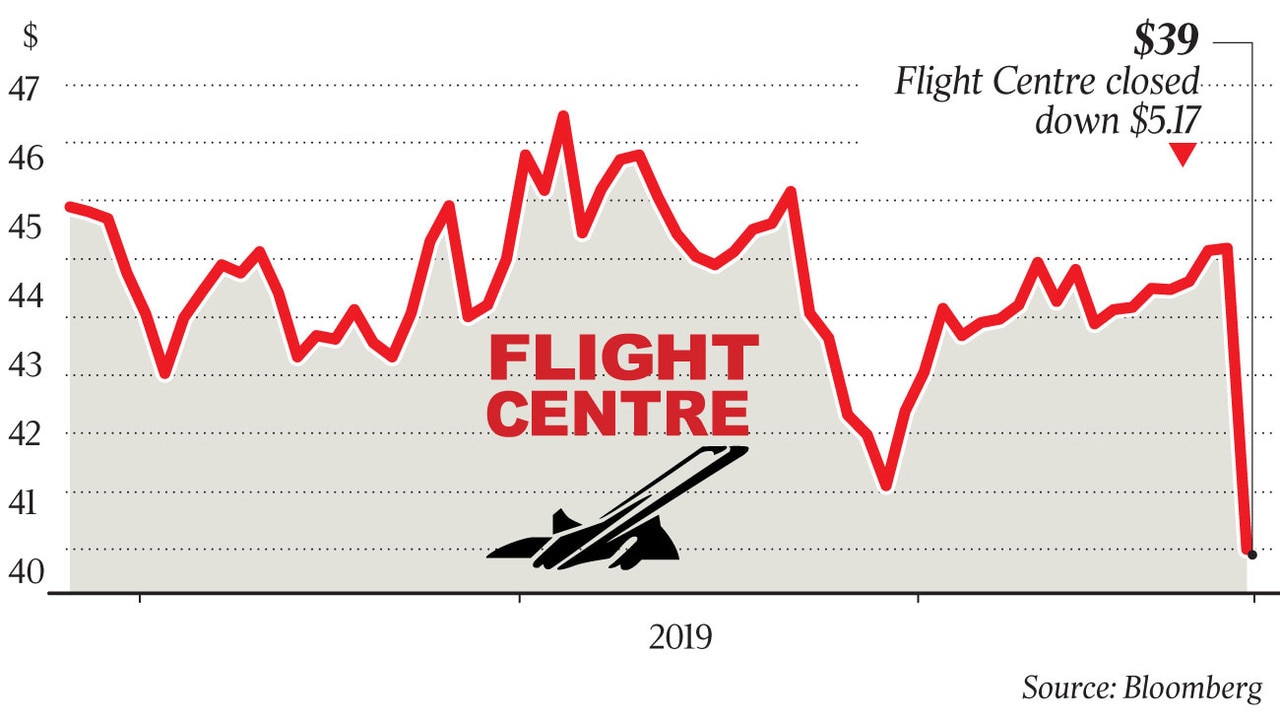

Flight Centre’s financial performance has been mixed in recent years. The company reported a loss of $456 million in the 2020 financial year, as the COVID-19 pandemic caused a sharp decline in travel demand. However, the company has since returned to profitability, reporting a net profit of $169 million in the 2022 financial year.

Flight Centre’s revenue has also been recovering in recent quarters. In the first half of the 2023 financial year, the company reported revenue of $2.2 billion, up 11% year-on-year. This growth was driven by a strong recovery in both the corporate and leisure travel segments.

Industry Trends

The travel industry is expected to continue to grow in the coming years. According to the World Travel & Tourism Council (WTTC), the global travel and tourism industry is expected to grow by 5.8% per year over the next decade. This growth will be driven by a number of factors, including rising incomes, increasing urbanization, and the growing popularity of travel.

The travel industry is also undergoing a number of changes, including the rise of online travel agencies (OTAs) and the increasing use of mobile devices to book travel. Flight Centre is well-positioned to benefit from these trends, as it has a strong online presence and a growing mobile app business.

Analyst Forecasts

Analysts are generally bullish on Flight Centre’s share price outlook. The consensus price target for Flight Centre is $22.00, which represents a potential upside of 20% from the current share price. Some analysts are even more bullish, with a price target of $25.00.

Our Share Price Prediction

Based on our analysis of Flight Centre’s financial performance, industry trends, and analyst forecasts, we believe that the company’s share price has the potential to reach $23.00 by 2025. This represents a potential upside of 15% from the current share price.

We believe that Flight Centre is a well-positioned company with a strong track record and a bright future. The company has a strong brand, a loyal customer base, and a growing online presence. We believe that Flight Centre is well-positioned to benefit from the recovery in the travel industry and to continue to grow its market share.

Risks

There are a number of risks that could affect Flight Centre’s share price prediction. These risks include:

- The COVID-19 pandemic: The COVID-19 pandemic is still ongoing and there is no guarantee that it will not have a further impact on the travel industry.

- Economic conditions: A downturn in the global economy could lead to a decrease in travel demand.

- Competition: Flight Centre faces competition from a number of online travel agencies and traditional travel agents.

Conclusion

Flight Centre is a well-positioned company with a strong track record and a bright future. The company has a strong brand, a loyal customer base, and a growing online presence. We believe that Flight Centre is well-positioned to benefit from the recovery in the travel industry and to continue to grow its market share.

Our share price prediction for Flight Centre is $23.00 by 2025. This represents a potential upside of 15% from the current share price. We believe that this is a realistic target and that Flight Centre has the potential to deliver strong returns for investors over the long term.

Closure

Thus, we hope this article has provided valuable insights into Flight Centre Share Price Prediction 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!