Fiscal Year 2025 Calendar: A Comprehensive Guide

Fiscal Year 2025 Calendar: A Comprehensive Guide

Related Articles: Fiscal Year 2025 Calendar: A Comprehensive Guide

- Project 2025: A Blueprint For A Sustainable And Equitable Future

- IRFC Share Price Forecast 2025: A Comprehensive Analysis

- The Ford Mustang Concept Car 2025: A Glimpse Into The Future Of American Muscle

- June 2025 Calendar Planner: A Comprehensive Guide To Planning Your Month

- Frontier Flight 2025: A Harrowing Tale Of Aviation Peril

Introduction

With great pleasure, we will explore the intriguing topic related to Fiscal Year 2025 Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fiscal Year 2025 Calendar: A Comprehensive Guide

Fiscal Year 2025 Calendar: A Comprehensive Guide

Introduction

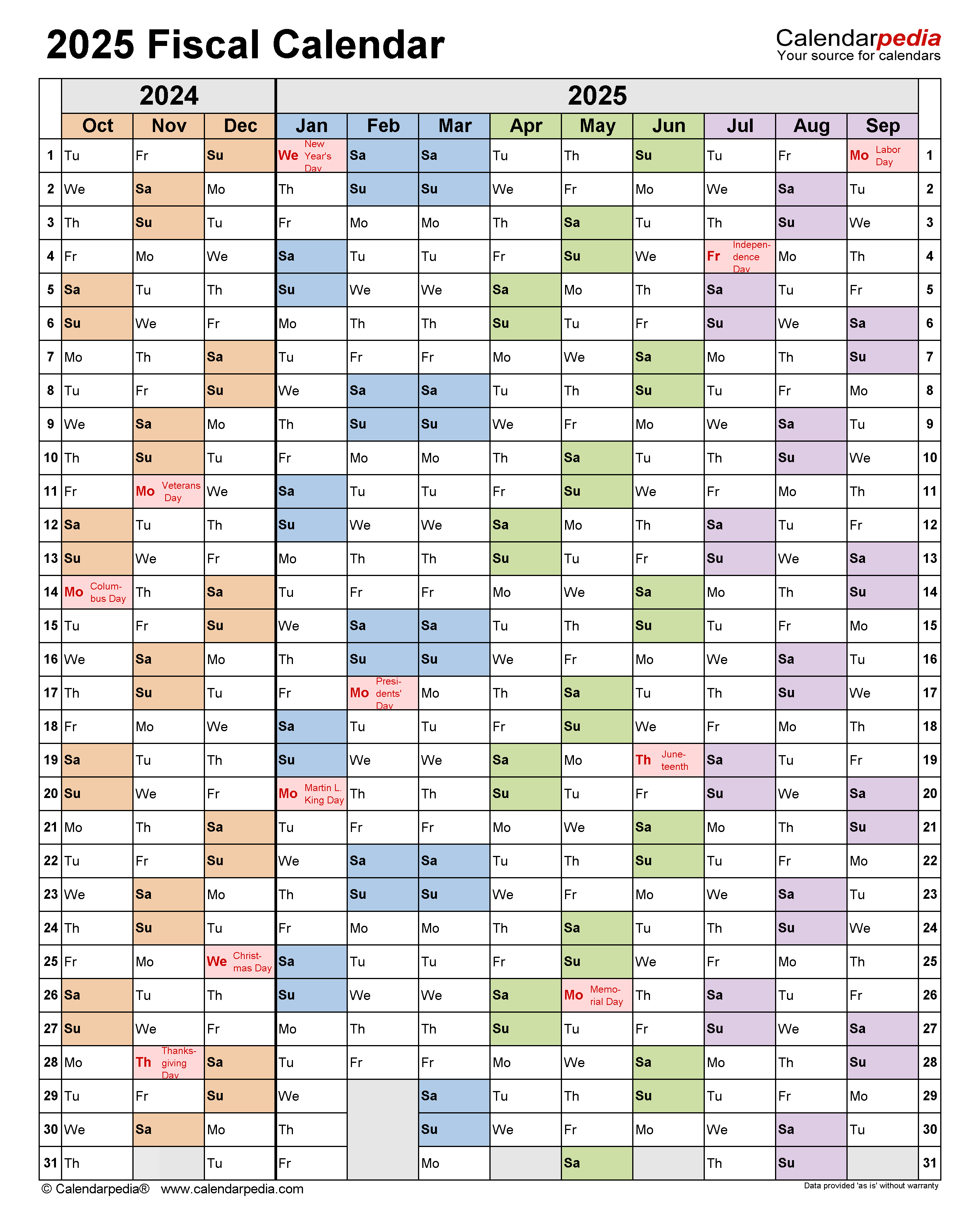

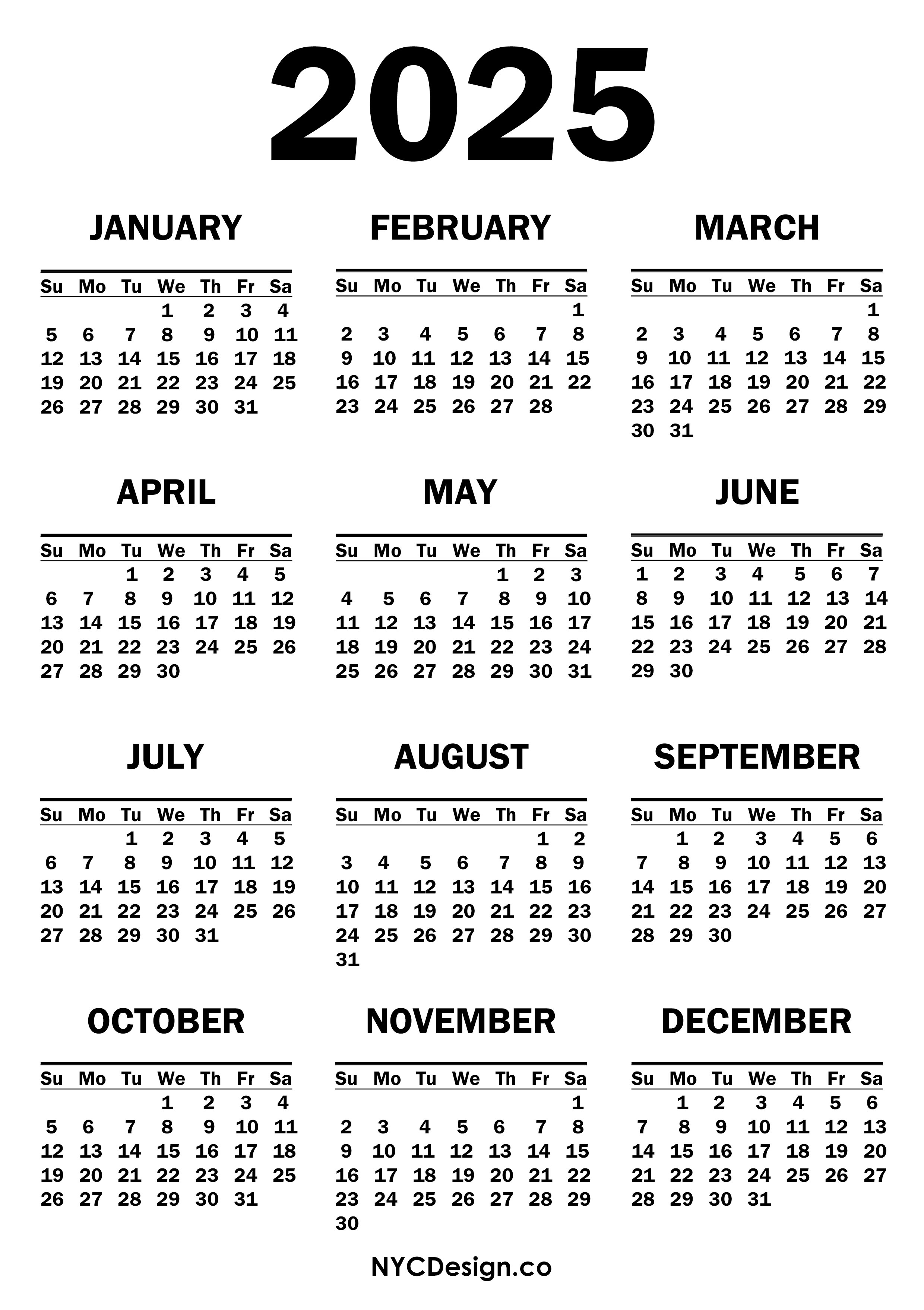

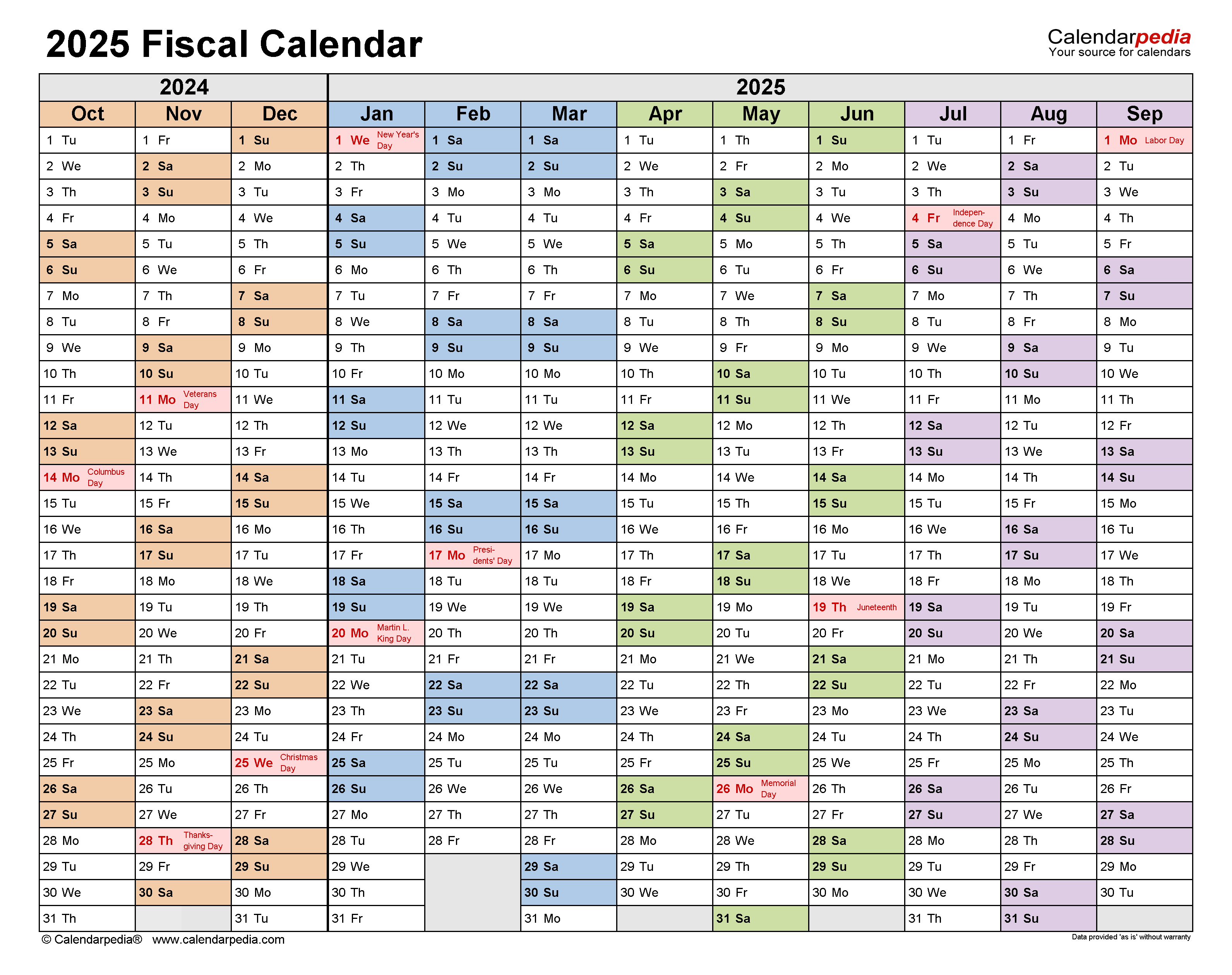

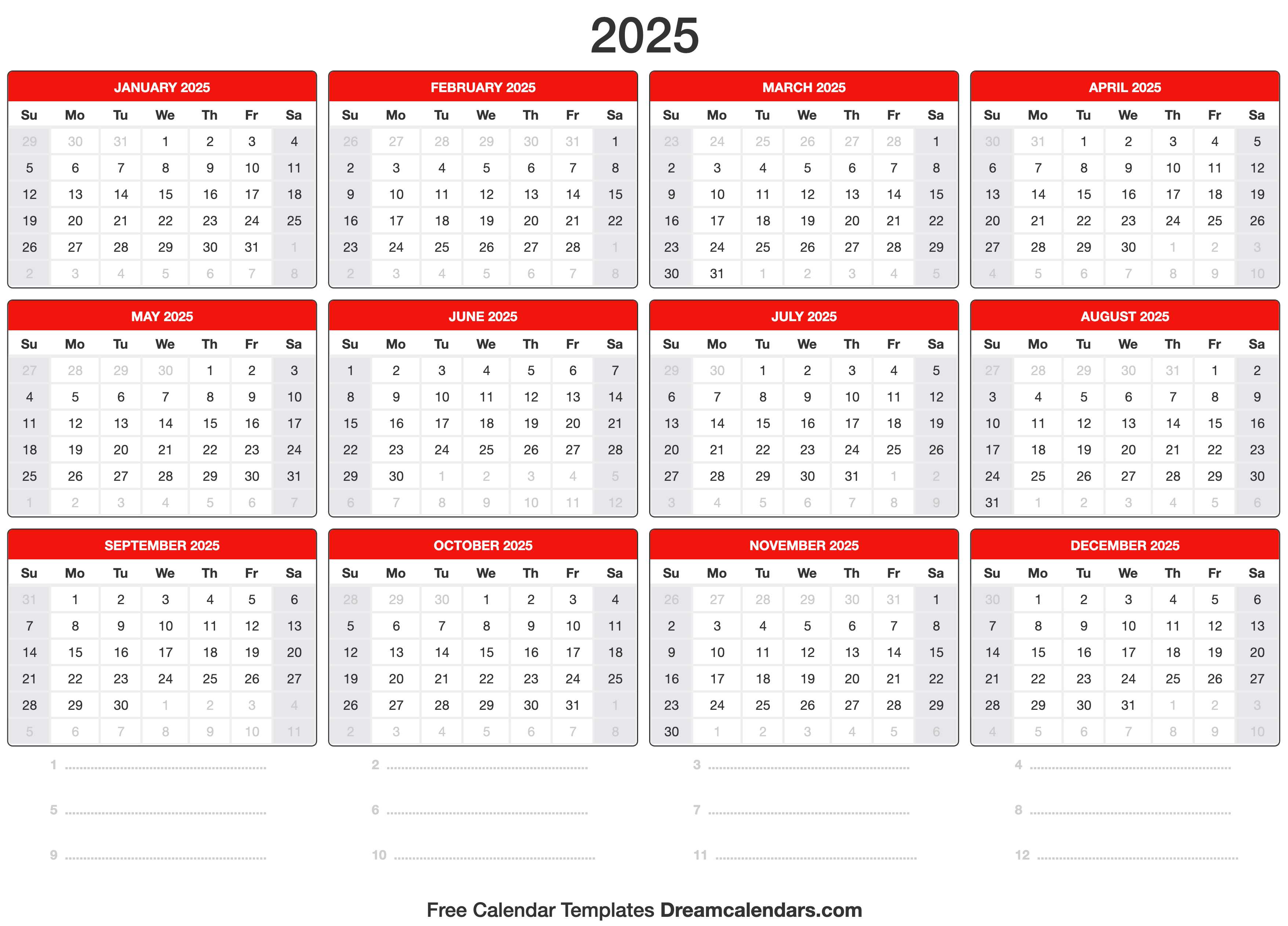

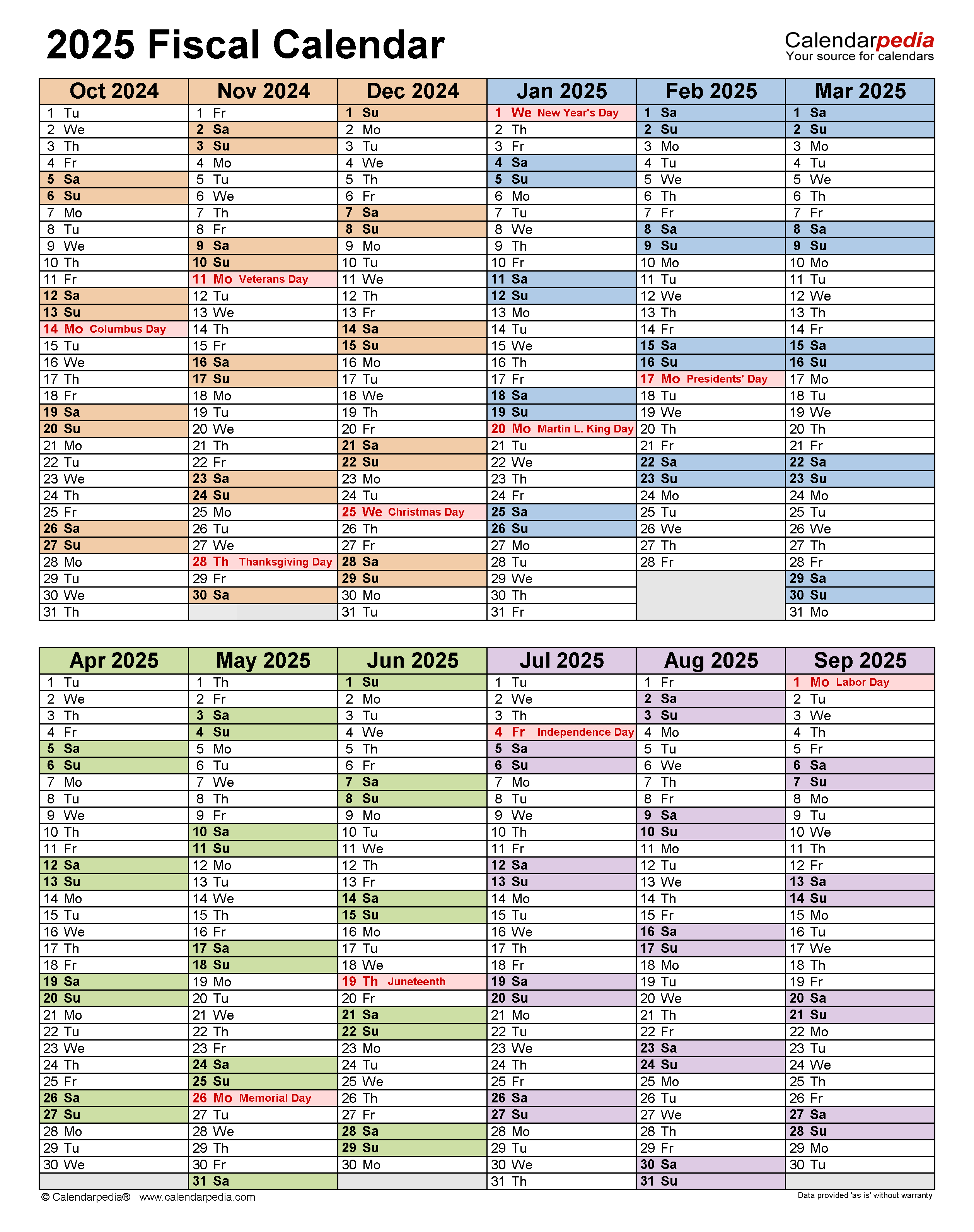

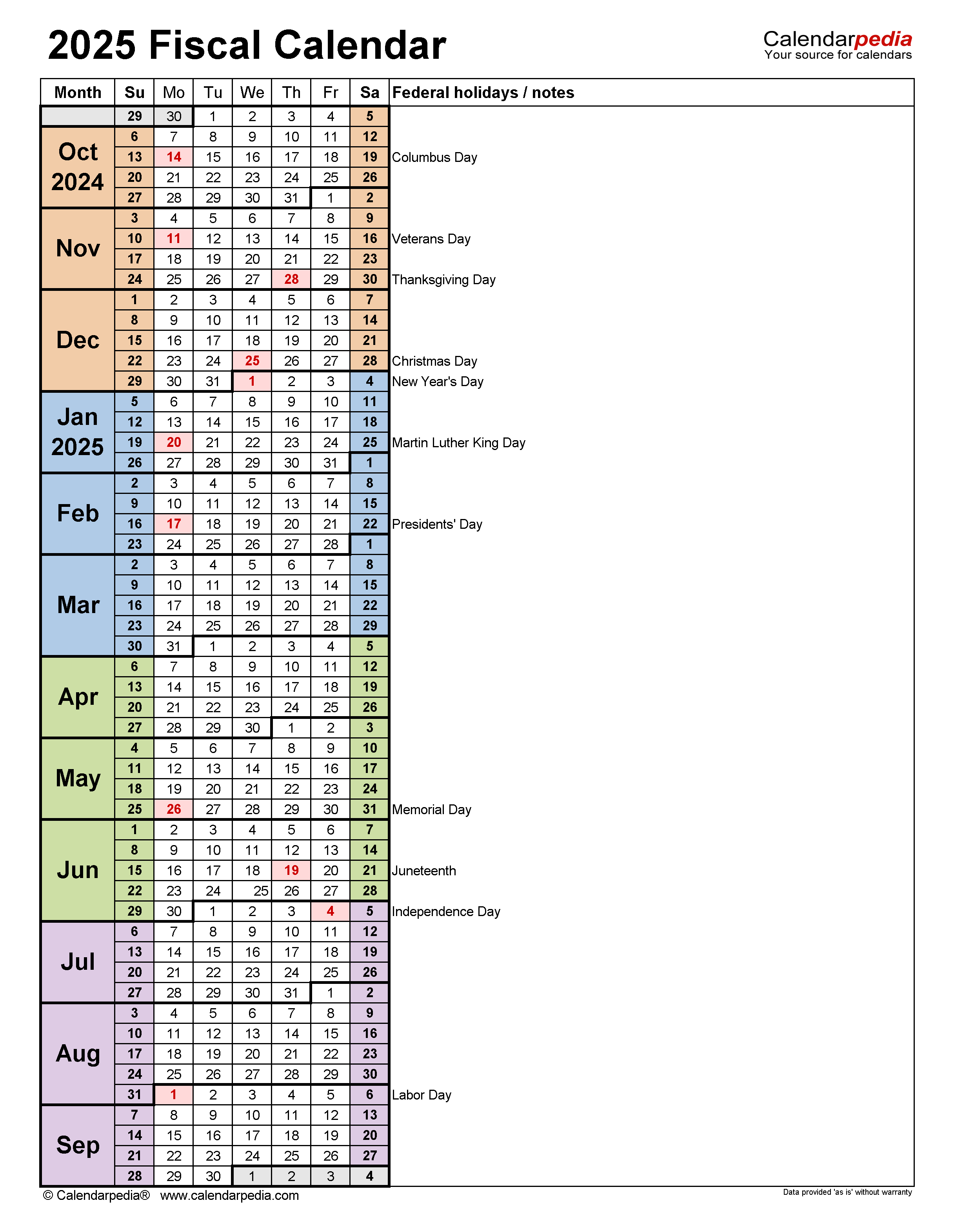

A fiscal year (FY) is a 12-month period used by governments, businesses, and other organizations for accounting and financial reporting purposes. The fiscal year does not necessarily align with the calendar year (January 1 to December 31). Organizations can choose to start their fiscal year on any date, but it is typically chosen to coincide with the start of their business cycle or to align with industry norms.

The fiscal year 2025 (FY2025) will begin on October 1, 2024, and end on September 30, 2025. This article provides a comprehensive calendar of key dates and events for FY2025, including federal holidays, tax deadlines, and financial reporting deadlines.

Federal Holidays

The following federal holidays will be observed during FY2025:

- October 14, 2024: Columbus Day

- November 11, 2024: Veterans Day

- November 28, 2024: Thanksgiving Day

- December 25, 2024: Christmas Day

- January 1, 2025: New Year’s Day

- January 20, 2025: Martin Luther King Jr. Day

- February 17, 2025: Presidents Day

- May 26, 2025: Memorial Day

- June 20, 2025: Juneteenth National Independence Day

- July 4, 2025: Independence Day

- September 1, 2025: Labor Day

Tax Deadlines

The following tax deadlines fall within FY2025:

- October 15, 2024: Deadline to file 2023 individual income tax returns (Form 1040)

- January 27, 2025: Deadline to file 2024 individual income tax returns (Form 1040)

- April 15, 2025: Deadline to file 2024 business income tax returns (Form 1120)

Financial Reporting Deadlines

The following financial reporting deadlines apply to publicly traded companies for FY2025:

- November 14, 2024: Deadline to file Form 10-Q for the quarter ended September 30, 2024

- February 13, 2025: Deadline to file Form 10-K for the year ended December 31, 2024

- May 12, 2025: Deadline to file Form 10-Q for the quarter ended March 31, 2025

- August 11, 2025: Deadline to file Form 10-Q for the quarter ended June 30, 2025

Other Important Dates

In addition to the holidays, tax deadlines, and financial reporting deadlines listed above, the following other important dates fall within FY2025:

- October 1, 2024: Beginning of FY2025

- September 30, 2025: End of FY2025

- October 1, 2025: Beginning of FY2026

Conclusion

The fiscal year 2025 calendar provides a comprehensive overview of key dates and events for organizations that operate on a fiscal year basis. By understanding the fiscal year calendar, businesses and individuals can ensure that they meet all important deadlines and obligations.

Closure

Thus, we hope this article has provided valuable insights into Fiscal Year 2025 Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!