Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis

Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis

Related Articles: Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis

- How Many Days Until 2025: A Countdown To The Future

- 2025 Toyota RAV4 Hybrid: Release Date, Updates, And Specs

- Dodge Stealth: A Sports Car Born From A Japanese-American Collaboration

- What Are The Latest Fashion Trends 2025?

- Which Zodiac Sign Will Reign Supreme In Intelligence In 2025?

Introduction

With great pleasure, we will explore the intriguing topic related to Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis

Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis

Introduction

In the realm of retirement planning, target-date funds have emerged as a popular choice for investors seeking a simplified and diversified investment strategy. Fidelity Freedom 2025 Fund Class K (FFFK) is one such fund, designed to meet the needs of individuals nearing retirement in the year 2025. This comprehensive article delves into the intricacies of FFFK, exploring its investment strategy, risk-return profile, and suitability for various investors.

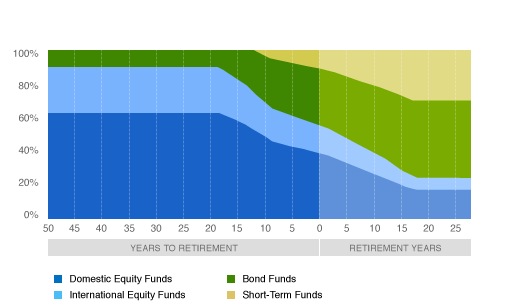

Investment Strategy

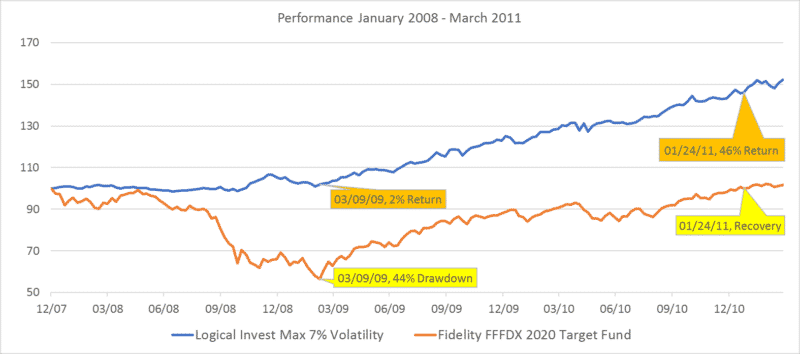

FFFK follows a glide path investment strategy, gradually transitioning from riskier assets (such as stocks) to less risky assets (such as bonds) as the target retirement date approaches. This strategy aims to balance the potential for growth with the need for capital preservation.

Asset Allocation

As of June 30, 2023, FFFK’s asset allocation was as follows:

- Domestic Stocks: 59.8%

- International Stocks: 30.9%

- Bonds: 7.5%

- Short-Term Investments: 1.8%

This allocation reflects the fund’s focus on growth potential while incorporating a modest allocation to bonds to mitigate risk.

Risk-Return Profile

The risk-return profile of FFFK is moderate. It has the potential to generate higher returns than more conservative investments but also carries the risk of experiencing greater volatility. The fund’s historical returns have generally aligned with its risk profile.

Historical Performance

Over the past five years, FFFK has delivered an annualized return of 6.36%. This return compares favorably to the average return of 5.97% for similar target-date funds.

Fees and Expenses

FFFK has an expense ratio of 0.75%. This fee covers the fund’s management and administrative expenses. The expense ratio is considered average for target-date funds.

Suitability

FFFK is an appropriate investment option for individuals who:

- Are nearing retirement in 2025

- Seek a diversified investment strategy

- Are comfortable with a moderate risk profile

- Understand the potential for market fluctuations

Alternatives

Investors may consider the following alternatives to FFFK:

- Vanguard Target Retirement 2025 Fund (VFFVX): A lower-cost alternative with a slightly more conservative asset allocation.

- T. Rowe Price Retirement 2025 Fund (TRRIX): A more aggressive alternative with a higher allocation to stocks.

- Schwab Target Retirement 2025 Index Fund (SWTSX): An index-tracking alternative that offers a broader market exposure.

Conclusion

Fidelity Freedom 2025 Fund Class K (FFFK) is a well-managed target-date fund that provides investors with a convenient and diversified investment solution for retirement planning. Its moderate risk-return profile and historical performance make it a suitable option for individuals nearing retirement in 2025. However, investors should carefully consider their individual circumstances and risk tolerance before investing in FFFK or any other target-date fund.

Closure

Thus, we hope this article has provided valuable insights into Fidelity Freedom 2025 Fund Class K: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!