Fidelity Freedom 2025 (FFNOX): A Target-Date Fund For Retirement

Fidelity Freedom 2025 (FFNOX): A Target-Date Fund for Retirement

Related Articles: Fidelity Freedom 2025 (FFNOX): A Target-Date Fund for Retirement

- World Junior Hockey 2025 Tickets: A Guide To Securing Your Seat

- 2025 Jeep Gladiator: An All-New Beast In The Pickup Truck Arena

- 2025 Battery: A Comprehensive Overview Of The Next-Generation Energy Storage Solution

- Liturgical Calendar 2025: A Guide To The Church Year

- Bighorn Family Dental: Providing Comprehensive Dental Care In Fort Collins

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Fidelity Freedom 2025 (FFNOX): A Target-Date Fund for Retirement. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Fidelity Freedom 2025 (FFNOX): A Target-Date Fund for Retirement

Fidelity Freedom 2025 (FFNOX): A Target-Date Fund for Retirement

Introduction

Retirement planning is a crucial aspect of financial well-being, and selecting the right investment vehicles is essential for achieving financial security in the golden years. Target-date funds (TDFs) have emerged as popular options for retirement savings, offering a convenient and diversified approach to investing. One such TDF is Fidelity Freedom 2025 (FFNOX), which aims to provide a suitable investment mix for individuals planning to retire around the year 2025.

Overview of FFNOX

FFNOX is a TDF managed by Fidelity Investments, a leading provider of financial services. It is designed to gradually adjust its asset allocation over time, becoming more conservative as the target retirement date approaches. This dynamic asset allocation strategy aims to align the fund’s risk profile with the changing risk tolerance of investors as they move closer to retirement.

Investment Strategy

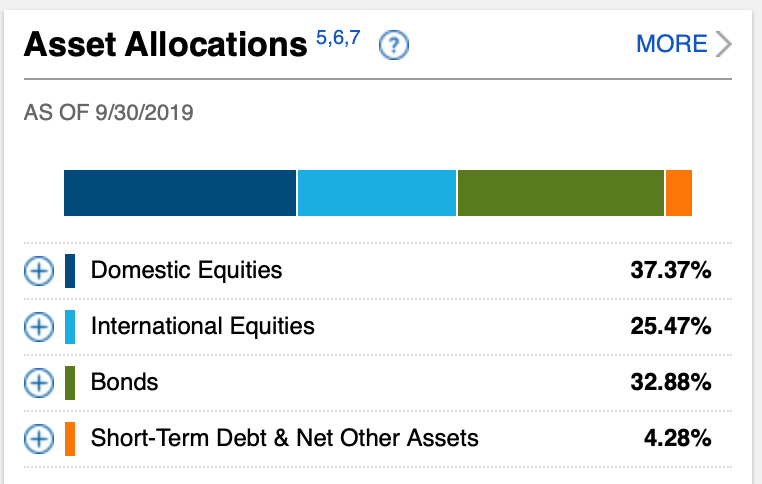

The investment strategy of FFNOX revolves around a diversified portfolio of stocks, bonds, and other assets. The fund’s allocation is designed to balance the potential for growth and income while managing risk. The asset allocation is regularly rebalanced to ensure that it remains aligned with the target retirement date.

Stock Allocation

FFNOX invests a significant portion of its assets in stocks, which provide the potential for growth over the long term. The fund’s stock allocation is diversified across various sectors and industries, including large-cap, mid-cap, and small-cap companies. This diversification helps to reduce the overall risk associated with stock investments.

Bond Allocation

Bonds play a crucial role in FFNOX’s portfolio, providing stability and income. The fund invests in a mix of government bonds, corporate bonds, and international bonds. The duration of the bonds held by FFNOX varies, with a focus on intermediate-term bonds that offer a balance between yield and maturity risk.

Other Assets

In addition to stocks and bonds, FFNOX may also allocate a small portion of its assets to other investments, such as real estate investment trusts (REITs) and commodities. These alternative investments can provide diversification and potentially enhance the fund’s overall return.

Risk and Return

The risk and return profile of FFNOX is influenced by its asset allocation. As the target retirement date approaches, the fund’s asset allocation becomes more conservative, with a higher allocation to bonds and other income-generating investments. This shift reduces the overall risk of the fund but also limits its potential for growth.

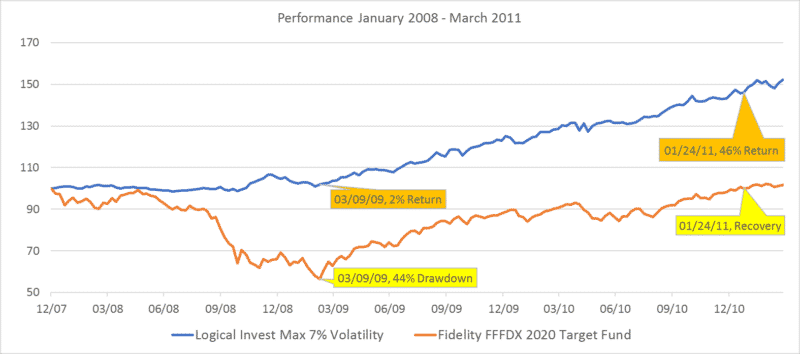

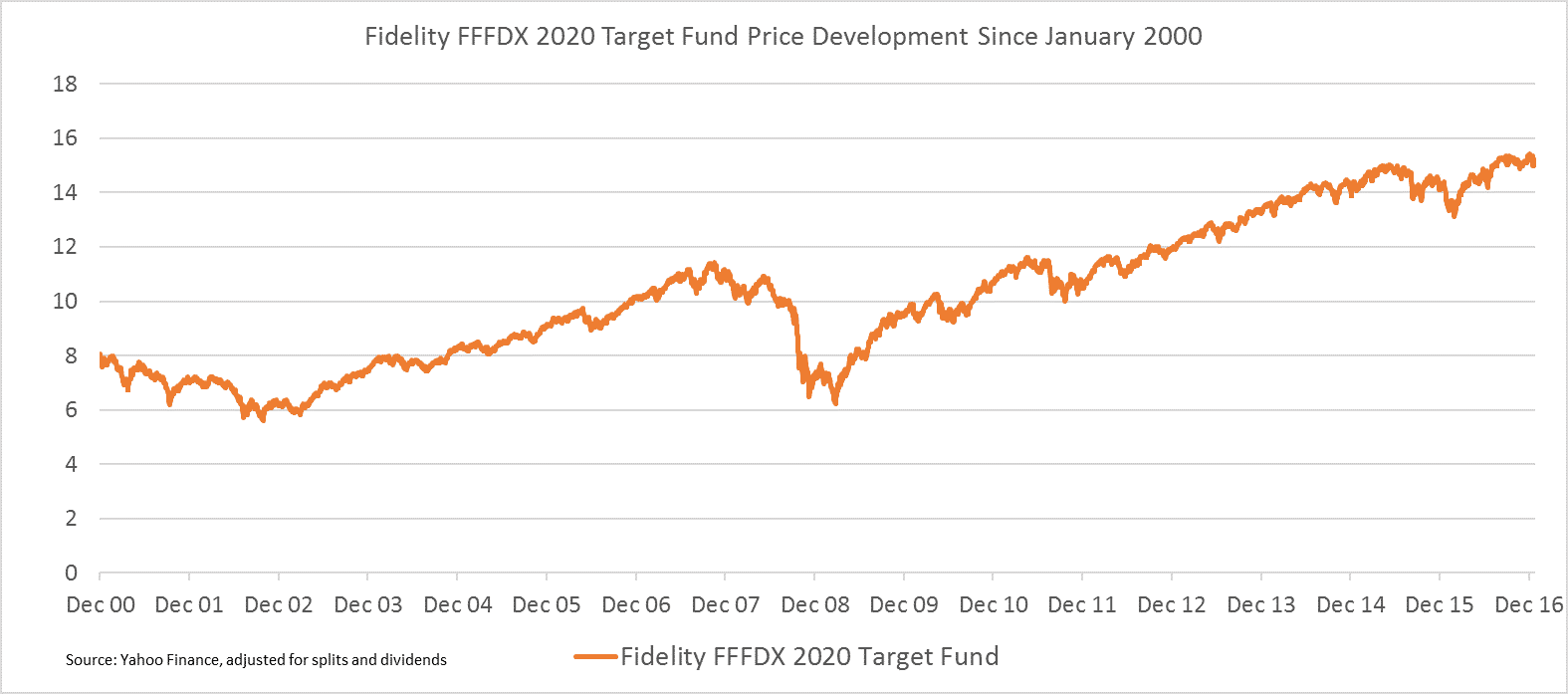

Historical Performance

The historical performance of FFNOX has been consistent with its investment strategy. The fund has delivered positive returns over the long term, with a moderate level of volatility. However, it is important to note that past performance is not indicative of future results, and the fund’s value can fluctuate based on market conditions.

Suitability

FFNOX is suitable for investors who are planning to retire around the year 2025 and who seek a diversified and professionally managed investment solution. The fund’s dynamic asset allocation strategy can provide a balanced approach to investing, aligning the risk profile of the fund with the investor’s changing risk tolerance as they approach retirement.

Fees and Expenses

FFNOX has an expense ratio of 0.75%, which is comparable to other TDFs in its category. The expense ratio covers the costs associated with managing the fund, including investment management fees, administrative expenses, and marketing costs.

Conclusion

Fidelity Freedom 2025 (FFNOX) is a well-established TDF that offers a convenient and diversified approach to retirement savings. Its dynamic asset allocation strategy, which gradually becomes more conservative over time, aligns the fund’s risk profile with the changing risk tolerance of investors as they move closer to retirement. While the fund’s historical performance has been positive, it is essential to remember that past performance is not indicative of future results. Investors should carefully consider their individual circumstances and risk tolerance before investing in FFNOX or any other investment vehicle.

Closure

Thus, we hope this article has provided valuable insights into Fidelity Freedom 2025 (FFNOX): A Target-Date Fund for Retirement. We appreciate your attention to our article. See you in our next article!