Estimated IRMAA Brackets For 2025: Understanding The Impact On Medicare Part B And Part D Premiums

Estimated IRMAA Brackets for 2025: Understanding the Impact on Medicare Part B and Part D Premiums

Related Articles: Estimated IRMAA Brackets for 2025: Understanding the Impact on Medicare Part B and Part D Premiums

- 2025 Calendar Printable UK: A Comprehensive Guide

- The All-New 2025 Subaru Forester: Unveiling A Legacy Of Adventure And Innovation

- Aries In 2025: A Cosmic Dance Of Fortune And Fulfillment

- Movies 2025: The Most Anticipated Upcoming Films

- Frontier Flight 2025: A Harrowing Tale Of Aviation Peril

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Estimated IRMAA Brackets for 2025: Understanding the Impact on Medicare Part B and Part D Premiums. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Estimated IRMAA Brackets for 2025: Understanding the Impact on Medicare Part B and Part D Premiums

Estimated IRMAA Brackets for 2025: Understanding the Impact on Medicare Part B and Part D Premiums

Introduction

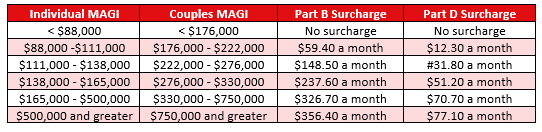

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to the standard Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually to account for changes in the cost of living. This article provides an overview of the estimated IRMAA brackets for 2025 and their potential impact on Medicare beneficiaries.

IRMAA Calculation

The IRMAA surcharge is calculated based on the individual’s or couple’s modified adjusted gross income (MAGI) from two years prior. MAGI is the adjusted gross income (AGI) plus any tax-exempt interest income.

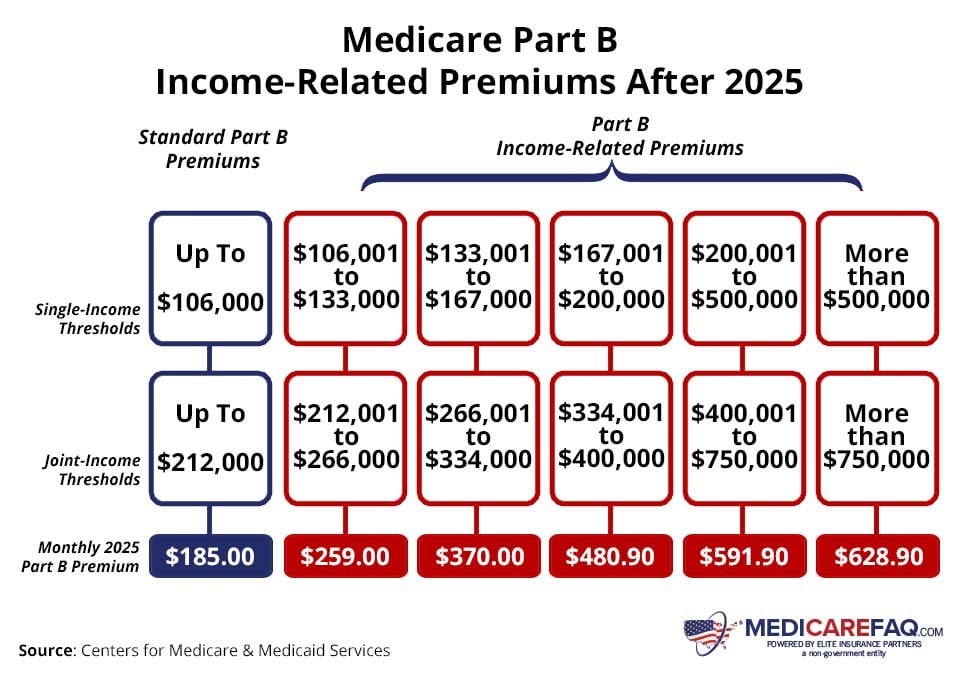

2025 IRMAA Brackets

The estimated IRMAA brackets for 2025 are as follows:

Part B IRMAA Brackets:

- Single:

- MAGI below $97,000: No surcharge

- MAGI $97,000 to $129,000: 35% surcharge

- MAGI $129,001 to $170,000: 50% surcharge

- MAGI $170,001 to $218,000: 65% surcharge

- MAGI $218,001 to $266,000: 80% surcharge

- MAGI above $266,000: 85% surcharge

- Married Filing Jointly:

- MAGI below $194,000: No surcharge

- MAGI $194,000 to $258,000: 35% surcharge

- MAGI $258,001 to $340,000: 50% surcharge

- MAGI $340,001 to $436,000: 65% surcharge

- MAGI $436,001 to $532,000: 80% surcharge

- MAGI above $532,000: 85% surcharge

Part D IRMAA Brackets:

- Single:

- MAGI below $87,000: No surcharge

- MAGI $87,000 to $109,000: 15% surcharge

- MAGI $109,001 to $132,000: 25% surcharge

- MAGI $132,001 to $157,000: 35% surcharge

- MAGI $157,001 to $182,000: 50% surcharge

- MAGI above $182,000: 65% surcharge

- Married Filing Jointly:

- MAGI below $174,000: No surcharge

- MAGI $174,000 to $218,000: 15% surcharge

- MAGI $218,001 to $264,000: 25% surcharge

- MAGI $264,001 to $314,000: 35% surcharge

- MAGI $314,001 to $364,000: 50% surcharge

- MAGI above $364,000: 65% surcharge

Impact on Medicare Premiums

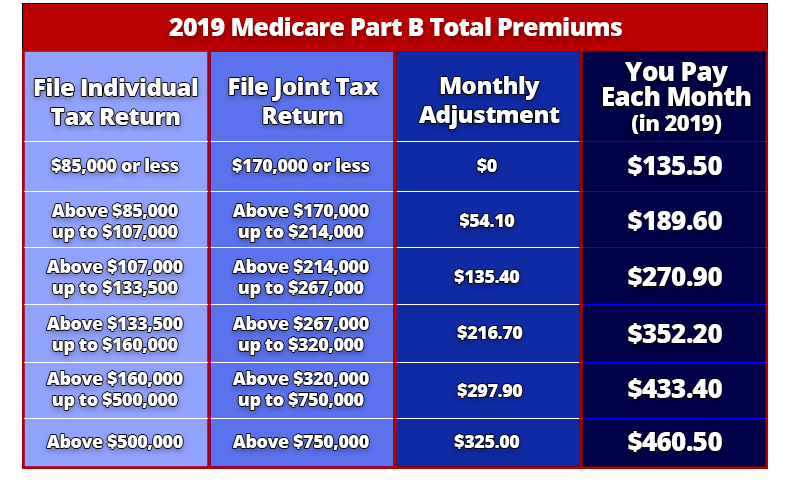

The IRMAA surcharge is added to the standard Medicare Part B and Part D premiums. For 2023, the standard Part B premium is $164.90 per month, while the standard Part D premium varies depending on the plan selected.

Individuals with MAGIs above the IRMAA thresholds will pay higher Medicare premiums. For example, a single individual with a MAGI of $130,000 in 2025 would pay a 50% surcharge on their Part B premium, resulting in an additional $82.45 per month. Similarly, a married couple filing jointly with a MAGI of $260,000 would pay a 35% surcharge on their Part D premium, resulting in an additional $26.45 per month.

Conclusion

The estimated IRMAA brackets for 2025 provide individuals with higher incomes an opportunity to plan for potential increases in their Medicare premiums. By understanding the IRMAA thresholds and how they are calculated, beneficiaries can make informed decisions about their healthcare coverage and financial planning. It is important to note that these are only estimated brackets and may be subject to change based on actual economic conditions.

Closure

Thus, we hope this article has provided valuable insights into Estimated IRMAA Brackets for 2025: Understanding the Impact on Medicare Part B and Part D Premiums. We thank you for taking the time to read this article. See you in our next article!