Bitcoin Price Prediction 2025: A Comprehensive Analysis

Bitcoin Price Prediction 2025: A Comprehensive Analysis

Related Articles: Bitcoin Price Prediction 2025: A Comprehensive Analysis

- 2025 Movie List: A Cinematic Odyssey Awaits

- 20x25x4 Air Filter: A Comprehensive Guide

- 2025 Ford Explorer: The Next Generation Of Adventure

- What Day Of The Week Is March 4, 2025?

- Fuel Cell Substrates: A Comprehensive Overview

Introduction

With great pleasure, we will explore the intriguing topic related to Bitcoin Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Bitcoin Price Prediction 2025: A Comprehensive Analysis

Bitcoin Price Prediction 2025: A Comprehensive Analysis

Introduction

Bitcoin, the world’s leading cryptocurrency, has witnessed remarkable growth since its inception in 2009. Its decentralized nature, limited supply, and increasing adoption have fueled its meteoric rise. As the cryptocurrency market continues to evolve, investors are keen on understanding the potential price trajectory of Bitcoin in the coming years. This article aims to provide a comprehensive analysis of Bitcoin price prediction for 2025, drawing insights from industry experts, market trends, and technological advancements.

Factors Influencing Bitcoin Price

Several factors influence the price of Bitcoin, including:

- Supply and Demand: The limited supply of 21 million Bitcoins creates scarcity, which drives up demand and price.

- Adoption and Usage: Increasing adoption and usage as a means of payment or store of value enhance its value.

- Institutional Investment: Institutional investors, such as hedge funds and pension funds, entering the market can significantly impact price.

- Regulatory Landscape: Government regulations and policies can affect the legality and accessibility of Bitcoin, impacting its price.

- Technological Developments: Advancements in blockchain technology, such as the Lightning Network, can improve scalability and functionality, boosting demand.

Historical Price Performance

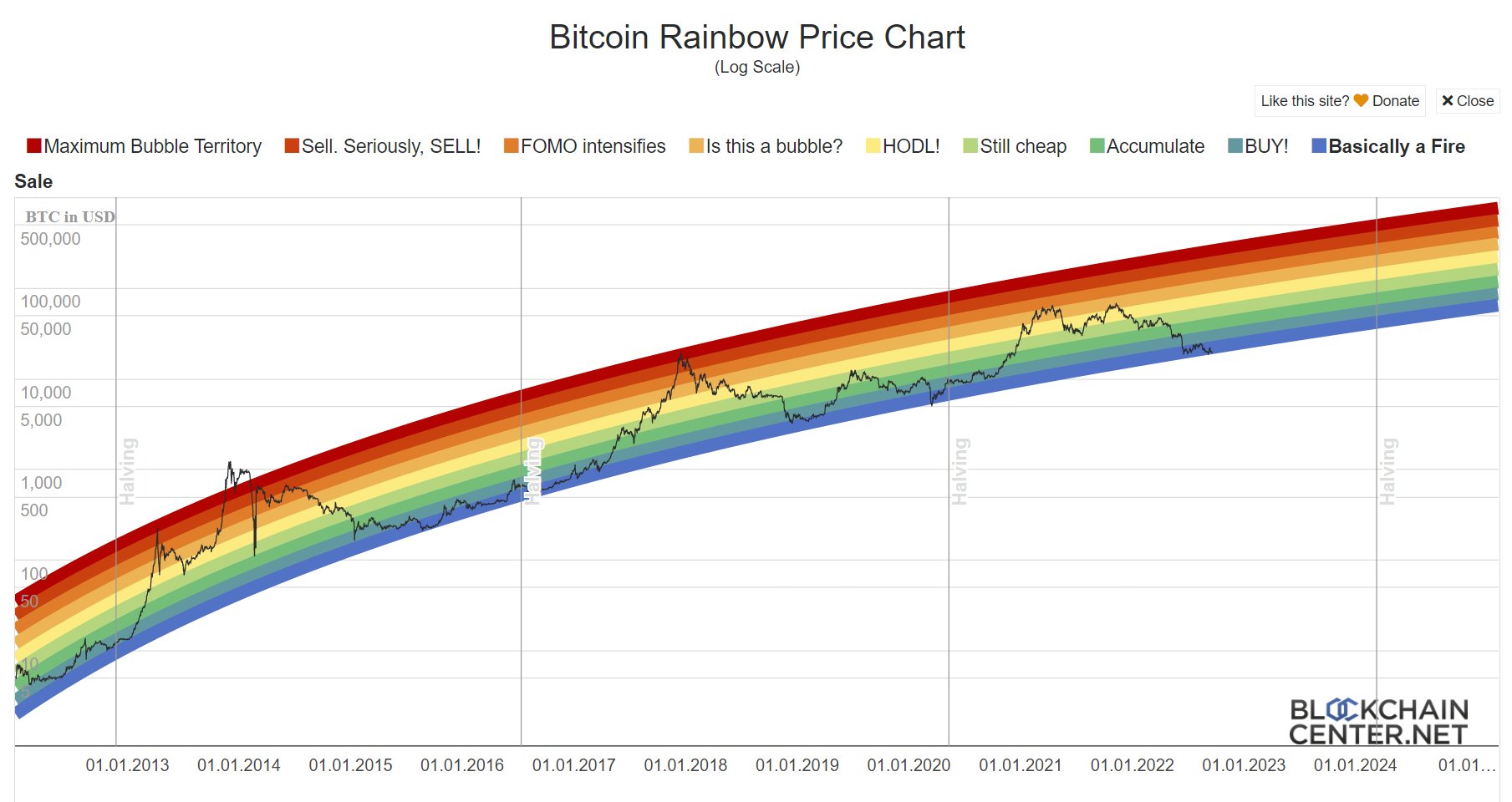

Bitcoin’s price history exhibits significant volatility, with sharp price swings and extended periods of consolidation. In 2017, it reached an all-time high of nearly $20,000, followed by a steep decline. Since then, it has recovered and entered a prolonged bull market, reaching a new all-time high of over $69,000 in November 2021.

Expert Predictions for 2025

Industry experts and analysts have provided varying Bitcoin price predictions for 2025, ranging from conservative to bullish. Some notable predictions include:

- Forbes: Forbes predicts that Bitcoin’s price could reach $200,000 by 2025, citing increasing institutional adoption and growing demand from retail investors.

- Citigroup: Citigroup analysts estimate that Bitcoin could reach $318,000 by 2025, based on its potential as a store of value and hedge against inflation.

- Bloomberg: Bloomberg analysts forecast that Bitcoin could hit $100,000 by 2025, citing its limited supply and the rising popularity of decentralized finance (DeFi).

Factors Supporting Bullish Predictions

Several factors support the bullish predictions for Bitcoin’s price in 2025:

- Institutional Adoption: Increasing institutional investment in Bitcoin is expected to continue, providing stability and legitimacy to the cryptocurrency.

- Growing Demand: Rising demand from retail investors and businesses seeking alternative investments and payment options is expected to fuel price growth.

- Halving Event: The next Bitcoin halving event, scheduled for 2024, is expected to reduce the supply of new Bitcoins, potentially driving up demand.

- Technological Advancements: Ongoing developments in blockchain technology, such as the Lightning Network, are improving Bitcoin’s scalability and usability.

- Inflation Hedge: Bitcoin’s limited supply and decentralized nature make it an attractive hedge against inflation, especially in times of economic uncertainty.

Factors Mitigating Bullish Predictions

Despite the bullish sentiment, certain factors could mitigate the price predictions for 2025:

- Regulatory Concerns: Continued regulatory scrutiny and potential restrictions could impact the accessibility and demand for Bitcoin.

- Competition: The emergence of alternative cryptocurrencies and digital assets could compete for market share and reduce Bitcoin’s dominance.

- Market Volatility: The cryptocurrency market remains volatile, and Bitcoin’s price is subject to sudden fluctuations.

- Economic Downturn: A global economic downturn or recession could negatively impact the demand for Bitcoin as investors seek safer assets.

- Technological Disruptions: Unforeseen technological disruptions or security breaches could erode Bitcoin’s value.

Conclusion

Bitcoin’s price prediction for 2025 remains a topic of speculation and debate. While expert predictions provide valuable insights, it’s crucial to recognize the inherent volatility and uncertainty associated with the cryptocurrency market. Factors such as institutional adoption, growing demand, technological advancements, and regulatory developments will significantly influence Bitcoin’s price trajectory. Investors should carefully consider these factors and conduct their own research before making investment decisions. By understanding the potential risks and rewards, investors can navigate the complexities of the cryptocurrency market and make informed choices regarding their Bitcoin holdings.

![[New Research] Bitcoin Price Prediction 2025: Bitcoin In 5 Years](https://img.currency.com/imgs/articles/1472xx/shutterstock_763067344.jpg)

Closure

Thus, we hope this article has provided valuable insights into Bitcoin Price Prediction 2025: A Comprehensive Analysis. We hope you find this article informative and beneficial. See you in our next article!