Best Target Funds For 2025

Best Target Funds for 2025

Related Articles: Best Target Funds for 2025

- Ausstieg Aus Dem Verbrennungsmotor: Eine Notwendige Transformation Für Eine Nachhaltige Zukunft

- 2025 Volkswagen GTI: A Revolution In Performance And Technology

- 2025 UK Calendar Printable: A Comprehensive Guide To Planning Your Year

- Armageddon Time 2025: A Harrowing Depiction Of A Dystopian Future

- What Day Will Thanksgiving Be On In 2025?

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Best Target Funds for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Best Target Funds for 2025

Best Target Funds for 2025

Introduction

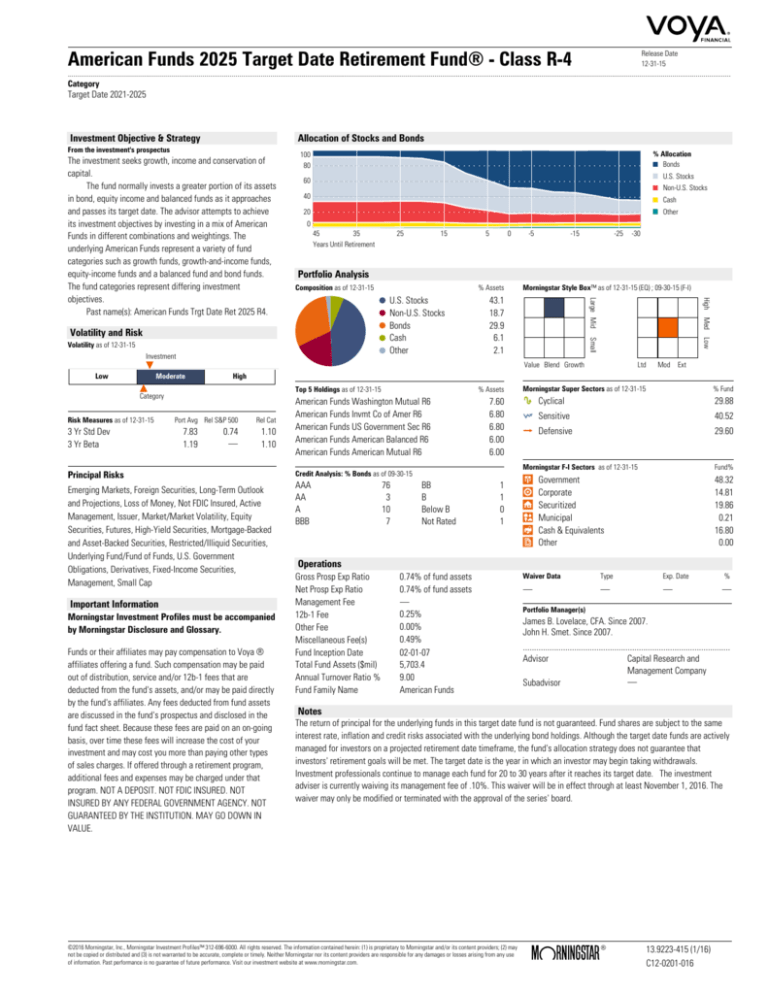

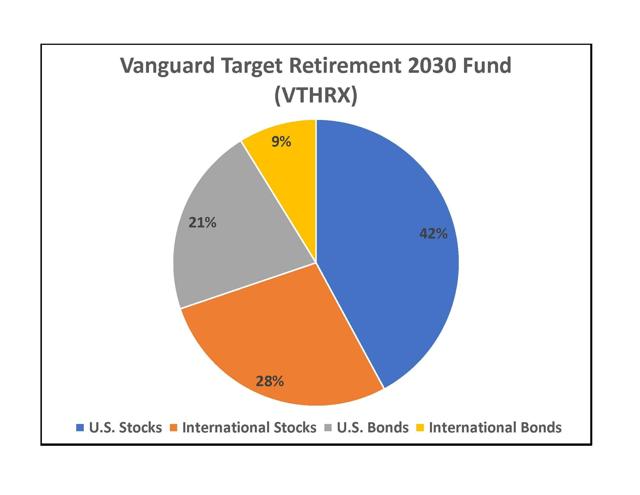

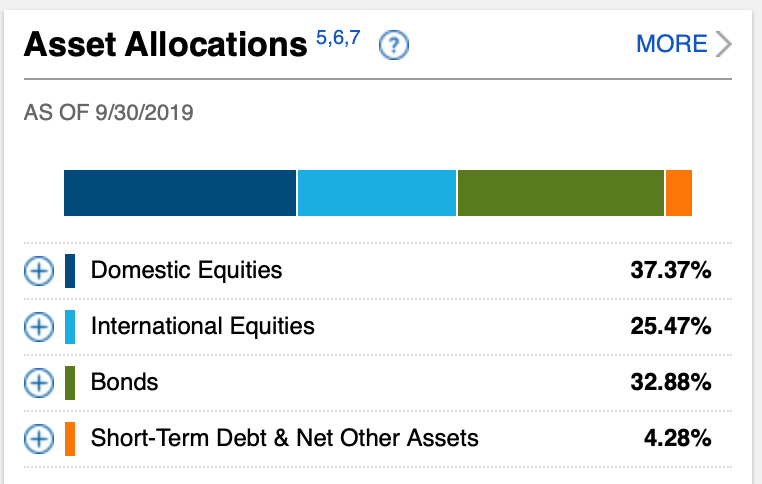

Target funds are a type of mutual fund designed to help investors reach a specific financial goal, such as retirement or a child’s education. These funds are typically invested in a mix of stocks and bonds, with the asset allocation gradually shifting towards bonds as the target date approaches. This helps to reduce risk over time while still providing the potential for growth.

With a target date of 2025, investors are now entering the final stretch of their investment journey. It is important to select a target fund that is well-positioned to help you reach your financial goals.

Factors to Consider When Choosing a Target Fund

When choosing a target fund, there are several factors to consider:

- Risk tolerance: Your risk tolerance is the amount of volatility you are comfortable with in your investments. Target funds are typically classified as conservative, moderate, or aggressive. Choose a fund that matches your risk tolerance.

- Time horizon: Your time horizon is the number of years until you will need the money. The closer you are to your target date, the more conservative your fund should be.

- Fees: Target funds typically have lower fees than other types of mutual funds. However, it is still important to compare fees before investing.

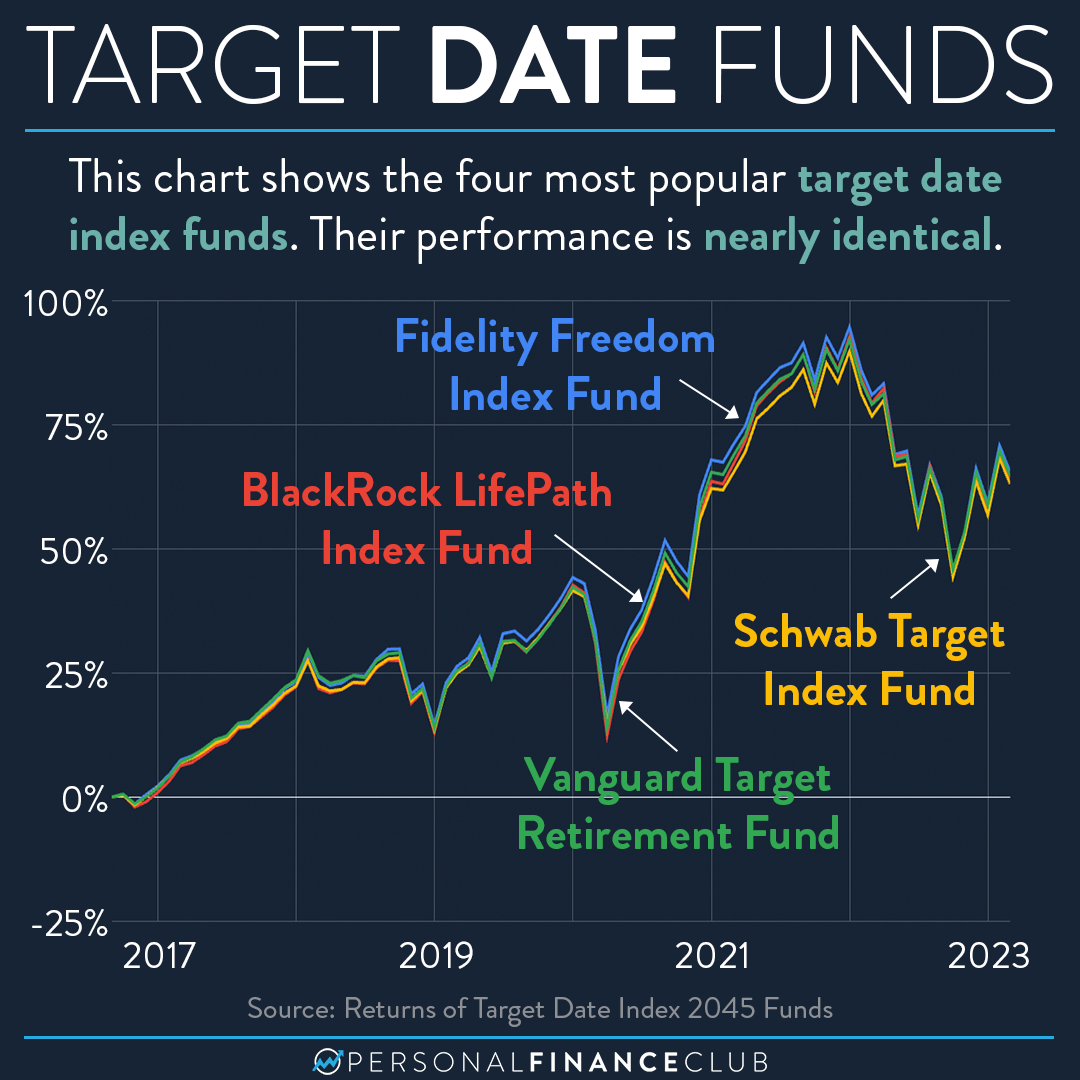

- Past performance: Past performance is not a guarantee of future results, but it can give you an idea of how a fund has performed in different market conditions.

Best Target Funds for 2025

Based on the factors discussed above, the following are some of the best target funds for 2025:

- Vanguard Target Retirement 2025 Fund (VFFVX): This fund is a good choice for investors with a moderate risk tolerance. It has a low expense ratio of 0.15% and has performed well over the past five years.

- Fidelity Freedom Index 2025 Fund (FFIAX): This fund is a good choice for investors who want a low-cost option. It has an expense ratio of just 0.08% and has performed well over the past five years.

- T. Rowe Price Retirement 2025 Fund (TRRIX): This fund is a good choice for investors who want a more aggressive option. It has an expense ratio of 0.65% and has performed well over the past five years.

How to Invest in a Target Fund

You can invest in a target fund through a brokerage account or through your employer’s retirement plan. If you are investing through a brokerage account, you can purchase shares of the fund directly from the fund company or through a broker. If you are investing through your employer’s retirement plan, you will need to choose the target fund from the plan’s investment menu.

Conclusion

Target funds can be a valuable tool for investors who are saving for a specific financial goal. By carefully considering the factors discussed above, you can choose a target fund that is well-positioned to help you reach your financial goals.

Closure

Thus, we hope this article has provided valuable insights into Best Target Funds for 2025. We thank you for taking the time to read this article. See you in our next article!