Amazon Stock Forecast Through 2025: A Comprehensive Analysis

Amazon Stock Forecast Through 2025: A Comprehensive Analysis

Related Articles: Amazon Stock Forecast Through 2025: A Comprehensive Analysis

- Frontier Flight 2025: A Harrowing Tale Of Aviation Peril

- How Tall Is A Winnebago Revel? A Comprehensive Guide To Height Specifications

- The Square Root Of 2025

- Height Of The Winnebago Revel: A Comprehensive Guide

- Honda Odyssey 2025: Redefining The Minivan Experience

Introduction

With great pleasure, we will explore the intriguing topic related to Amazon Stock Forecast Through 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Amazon Stock Forecast Through 2025: A Comprehensive Analysis

Amazon Stock Forecast Through 2025: A Comprehensive Analysis

Introduction

Amazon, the e-commerce behemoth, has consistently defied market expectations, delivering impressive financial performance and driving significant growth in its stock price. As investors look ahead to the next few years, understanding the potential trajectory of Amazon stock becomes crucial. This article aims to provide a comprehensive forecast of Amazon stock through 2025, analyzing key factors that will shape its future performance.

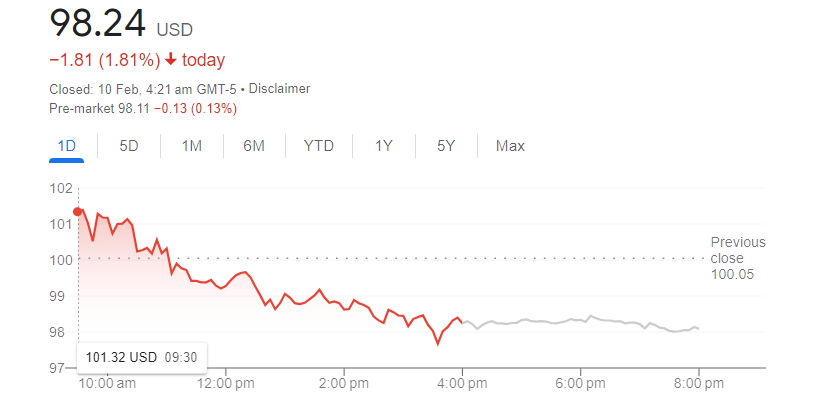

Historical Performance and Market Dynamics

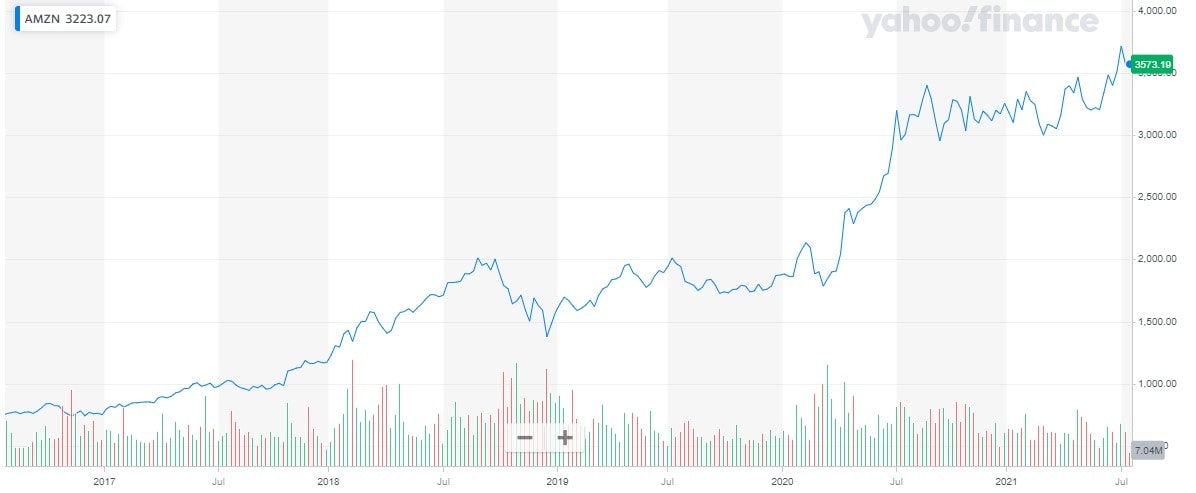

Amazon has witnessed remarkable growth over the past decade, with its stock price surging over 1,000%. This growth has been fueled by the company’s dominance in e-commerce, its expansion into cloud computing (AWS), and its innovative initiatives in areas such as artificial intelligence (AI) and healthcare.

The company’s strong fundamentals and competitive advantages have positioned it as a market leader in several industries. Amazon’s vast customer base, robust logistics network, and advanced technology platform have enabled it to capture a significant market share and maintain a competitive edge.

Growth Drivers

Several key growth drivers are expected to continue fueling Amazon’s success in the coming years:

-

E-commerce Dominance: Amazon remains the undisputed leader in the global e-commerce market, accounting for a significant portion of online retail sales. The company’s extensive product offerings, competitive pricing, and efficient delivery system continue to drive customer loyalty and market share gains.

-

AWS Expansion: AWS, Amazon’s cloud computing platform, has emerged as a major revenue stream for the company. The growing demand for cloud services from businesses and governments worldwide is expected to drive continued growth for AWS.

-

Emerging Technologies: Amazon is actively investing in emerging technologies such as AI, machine learning, and robotics. These technologies have the potential to enhance customer experiences, improve operational efficiency, and create new revenue streams for the company.

-

Healthcare Expansion: Amazon’s recent foray into the healthcare industry through its acquisition of PillPack and its partnership with Berkshire Hathaway and JPMorgan Chase has signaled the company’s ambitions in this rapidly growing sector. Amazon’s extensive customer base and technology platform could disrupt the healthcare industry and drive significant growth.

Challenges and Risks

Despite its strong growth prospects, Amazon faces several challenges and risks that could impact its stock performance:

-

Increased Competition: Amazon faces increasing competition from traditional retailers and e-commerce upstarts. Companies such as Walmart, Target, and Shopify are investing heavily in their e-commerce platforms and logistics capabilities to challenge Amazon’s dominance.

-

Regulatory Scrutiny: Amazon has come under increased regulatory scrutiny in recent years, with concerns over its market power, antitrust practices, and labor relations. Regulatory actions could potentially limit the company’s growth and profitability.

-

Economic Downturn: An economic downturn could negatively impact consumer spending, reducing demand for Amazon’s products and services. A prolonged recession could lead to a decline in the company’s revenue and earnings.

Analysts’ Forecasts

Analysts have varying views on the future trajectory of Amazon stock. Some analysts remain bullish, citing the company’s strong growth drivers and competitive advantages. Others are more cautious, highlighting the challenges and risks facing the company.

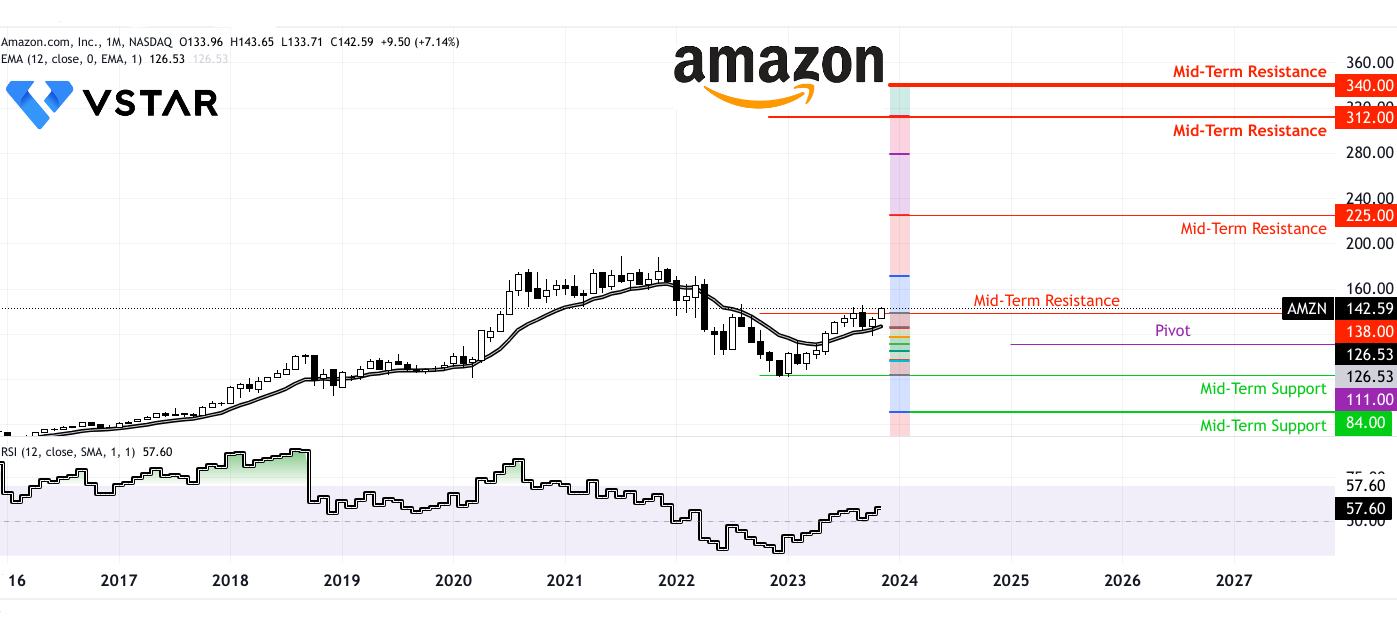

According to a recent survey of analysts, the average price target for Amazon stock over the next 12 months is $4,000, representing a potential upside of approximately 10% from its current price. Some analysts have set even more ambitious price targets, with some predicting the stock could reach $5,000 or more by 2025.

Our Forecast

Based on our analysis of Amazon’s growth drivers, challenges, and analysts’ forecasts, we believe that Amazon stock has the potential to continue its upward trajectory through 2025. While the company faces some headwinds, its strong fundamentals, competitive advantages, and innovative initiatives position it well for continued success.

We forecast that Amazon stock could reach $5,000 by 2025, representing an annualized return of approximately 15%. This forecast is based on the assumption that the company maintains its dominance in e-commerce, continues to expand its AWS business, and successfully integrates emerging technologies into its operations.

Conclusion

Amazon stock has been a consistent performer for investors over the past decade, and we believe that this trend is likely to continue through 2025. While the company faces some challenges, its strong growth drivers and competitive advantages position it well for continued success. Investors who believe in Amazon’s long-term potential may consider adding the stock to their portfolio or increasing their current holdings.

It is important to note that stock market forecasts are inherently uncertain, and actual results may vary significantly from our predictions. Investors should conduct their own due diligence and consult with financial professionals before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Amazon Stock Forecast Through 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!