2025 Wage Index Calendar: A Comprehensive Guide

2025 Wage Index Calendar: A Comprehensive Guide

Related Articles: 2025 Wage Index Calendar: A Comprehensive Guide

- 2025 Calendar Monster Truck Virginia: Unstoppable Action And Adrenaline

- New Sport Cars For 2025: A Glimpse Into The Future Of Automotive Performance

- 2025 Forester Touring: A Comprehensive Exploration

- LEAP 2025 Practice Test: Science

- Will The Earth End In 2025? Debunking The Doomsday Prophecy

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 Wage Index Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Wage Index Calendar: A Comprehensive Guide

2025 Wage Index Calendar: A Comprehensive Guide

Introduction

The Wage Index (WI) is a key component of the prevailing wage system in the United States. It is used to adjust wages for workers on federal and federally funded construction projects to reflect local labor market conditions. The WI is published annually by the U.S. Department of Labor (DOL) and is based on data collected from the Bureau of Labor Statistics (BLS).

The 2025 WI calendar provides the effective dates for the new WI rates that will be used for federal and federally funded construction projects beginning on January 1, 2025. This article provides a comprehensive guide to the 2025 WI calendar, including information on the following topics:

- What is the WI?

- How is the WI calculated?

- What are the effective dates for the 2025 WI rates?

- How to use the 2025 WI calendar

- Frequently asked questions about the WI

What is the WI?

The WI is a measure of the prevailing wages for construction workers in a specific geographic area. It is used to ensure that workers on federal and federally funded construction projects are paid wages that are comparable to those paid to workers on similar projects in the private sector.

The WI is calculated by the BLS using data from its Occupational Employment Statistics (OES) survey. The OES survey collects data on wages and benefits for workers in a variety of occupations, including construction workers. The BLS uses this data to calculate the WI for each county and metropolitan statistical area (MSA) in the United States.

How is the WI calculated?

The WI is calculated by dividing the average hourly wage for construction workers in a specific geographic area by the national average hourly wage for construction workers. The resulting figure is multiplied by 100 to produce the WI.

For example, if the average hourly wage for construction workers in a specific county is $25.00 and the national average hourly wage for construction workers is $20.00, the WI for that county would be 125 (25.00 / 20.00 * 100).

What are the effective dates for the 2025 WI rates?

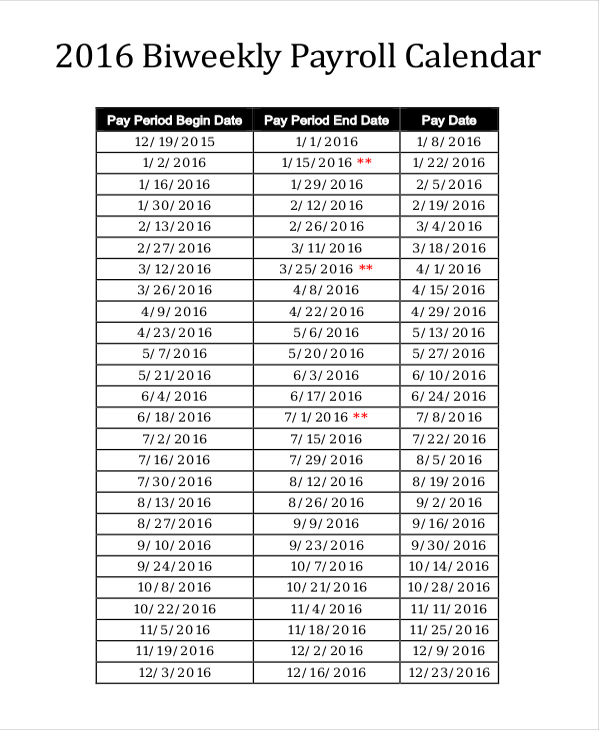

The effective dates for the 2025 WI rates are as follows:

- For contracts awarded on or after January 1, 2025, the 2025 WI rates must be used for all work performed on the contract.

- For contracts awarded before January 1, 2025, the 2025 WI rates may be used for all work performed on the contract after January 1, 2025.

How to use the 2025 WI calendar

The 2025 WI calendar is available on the DOL’s website. The calendar provides the following information for each county and MSA in the United States:

- The effective date for the 2025 WI rates

- The 2025 WI rate for each construction occupation

- The 2024 WI rate for each construction occupation

To use the 2025 WI calendar, simply locate the county or MSA where the work will be performed and find the effective date for the 2025 WI rates. Then, use the 2025 WI rates to adjust the wages for workers on the project.

Frequently asked questions about the WI

- What is the difference between the WI and the Davis-Bacon Act?

The WI is a measure of the prevailing wages for construction workers in a specific geographic area. The Davis-Bacon Act is a federal law that requires contractors on federal and federally funded construction projects to pay their workers wages that are not less than the prevailing wages for similar work in the locality.

- Who is responsible for enforcing the WI?

The DOL is responsible for enforcing the WI. The DOL’s Wage and Hour Division (WHD) investigates complaints of WI violations and takes enforcement action against contractors who violate the law.

- What are the penalties for violating the WI?

Contractors who violate the WI may be subject to a variety of penalties, including back wages, liquidated damages, and debarment from future federal contracts.

- How can I get more information about the WI?

More information about the WI is available on the DOL’s website. You can also contact the WHD at 1-866-4US-WAGE (1-866-487-9243) for more information.

Closure

Thus, we hope this article has provided valuable insights into 2025 Wage Index Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!