2025 Vs 2026 Tax Rates

2025 vs 2026 tax rates

Related Articles: 2025 vs 2026 tax rates

- The Chicago Bears’ 2015 NFL Draft: A Comprehensive Analysis

- Solar Storm Of July 2025: A Catastrophic Event

- Colorado Rockies Top Prospects: A Look At The Future

- Jeep Renegade 2025: A Bold Adventure In Urban Exploration

- 2025 World Junior Hockey Championships: Tickets On Sale Now

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 vs 2026 tax rates. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 vs 2026 tax rates

2025 vs. 2026 Tax Rates: A Comprehensive Analysis

Introduction

The tax landscape in the United States is constantly evolving, with changes occurring at the federal and state levels. In 2022, the Internal Revenue Service (IRS) released the tax rates for 2023 and 2024, providing taxpayers with some clarity for the upcoming years. However, for those looking further ahead, it is important to understand the potential tax changes that may occur in 2025 and 2026.

This article will provide a comprehensive analysis of the tax rates for 2025 and 2026, comparing them to the current rates for 2023 and 2024. We will also discuss the potential implications of these changes for taxpayers.

Federal Income Tax Rates

2023 and 2024

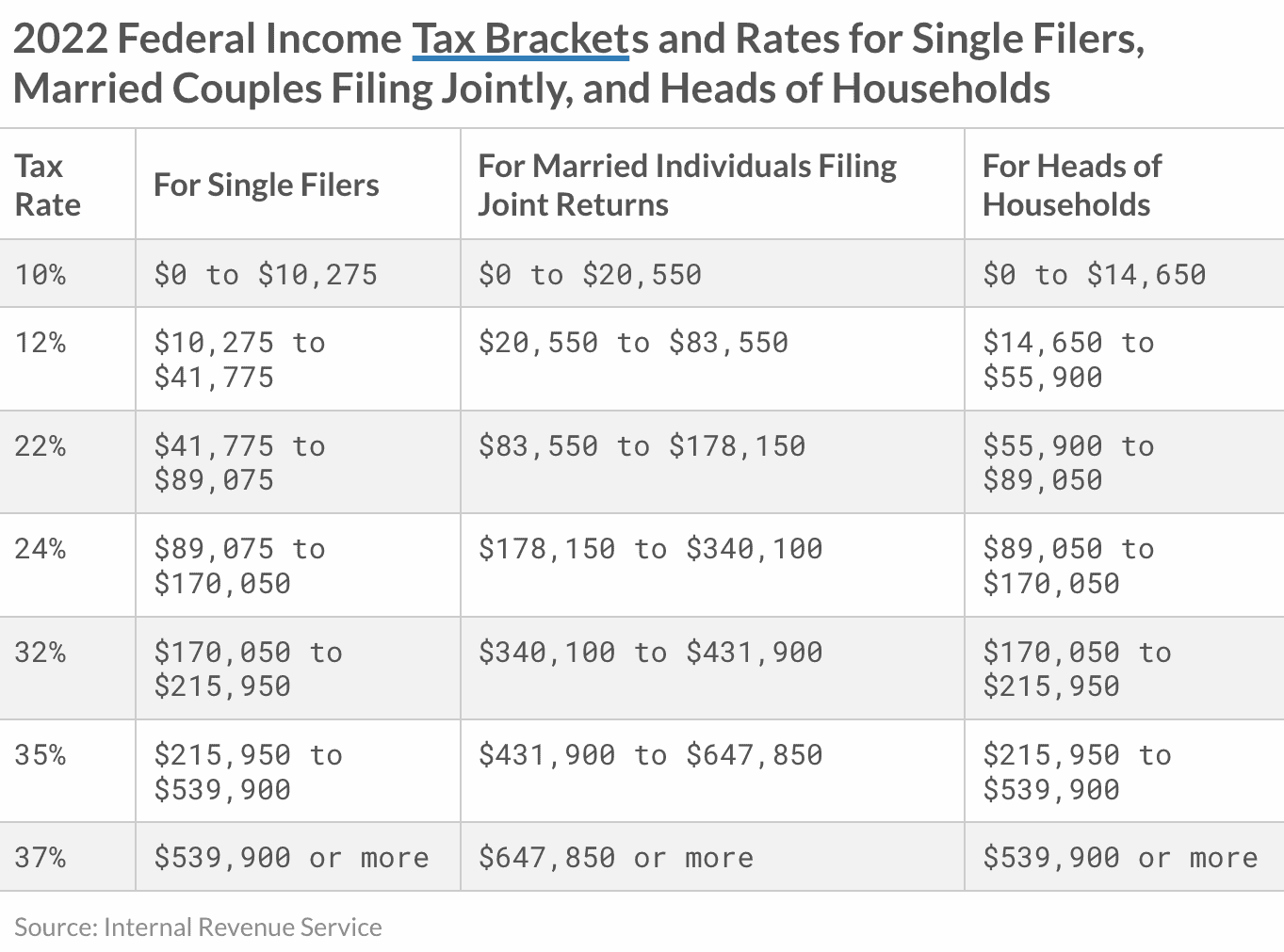

The federal income tax brackets for 2023 and 2024 are as follows:

| Tax Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 10% | 10% | $0 – $10,275 |

| 12% | 12% | $10,275 – $41,775 |

| 22% | 22% | $41,775 – $89,075 |

| 24% | 24% | $89,075 – $170,500 |

| 32% | 32% | $170,500 – $215,950 |

| 35% | 35% | $215,950 – $539,900 |

| 37% | 37% | $539,900 – $1,077,350 |

| 39.6% | 39.6% | Over $1,077,350 |

2025 and 2026

The federal income tax brackets for 2025 and 2026 are expected to remain the same as those for 2023 and 2024. However, it is important to note that these brackets may be adjusted for inflation in the future.

State Income Tax Rates

State income tax rates vary widely across the United States. For example, the following states have no state income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Wyoming

Other states have relatively low income tax rates, such as:

- New Hampshire (5%)

- Utah (4.95%)

- Wyoming (5.9%)

Meanwhile, some states have higher income tax rates, such as:

- California (13.3%)

- Hawaii (11%)

- New Jersey (8.97%)

It is important to consult with a tax professional or refer to the IRS website for specific information on state income tax rates.

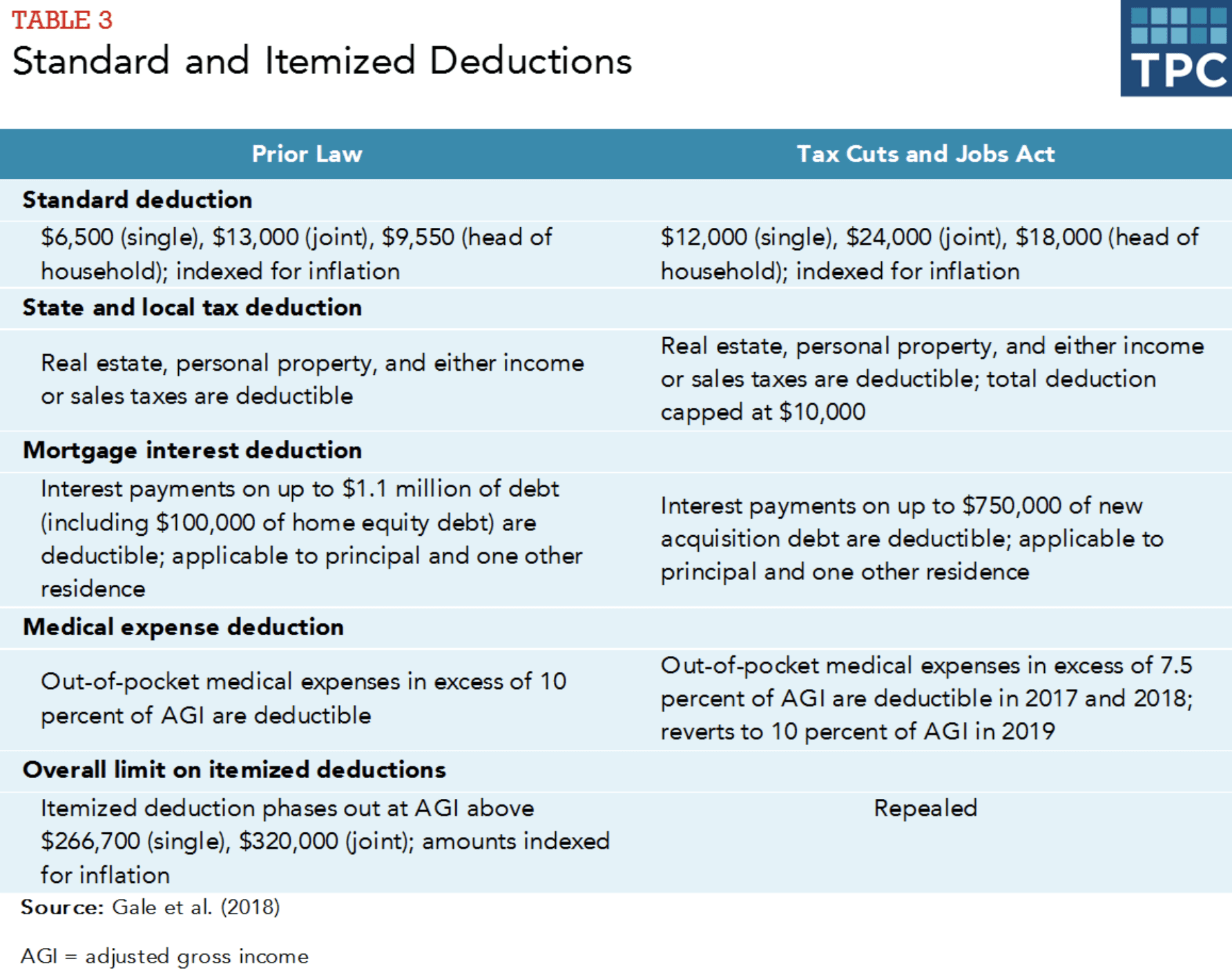

Standard Deduction and Personal Exemptions

The standard deduction and personal exemptions are two important tax deductions that can reduce your taxable income. For 2023 and 2024, the standard deduction amounts are as follows:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

Personal exemptions are no longer available for federal income taxes.

Tax Credits

Tax credits are another way to reduce your tax liability. There are a variety of tax credits available, including the following:

- Child Tax Credit

- Earned Income Tax Credit

- American Opportunity Tax Credit

- Saver’s Credit

The eligibility and amount of these tax credits can vary depending on your income and other factors.

Potential Implications of Tax Changes

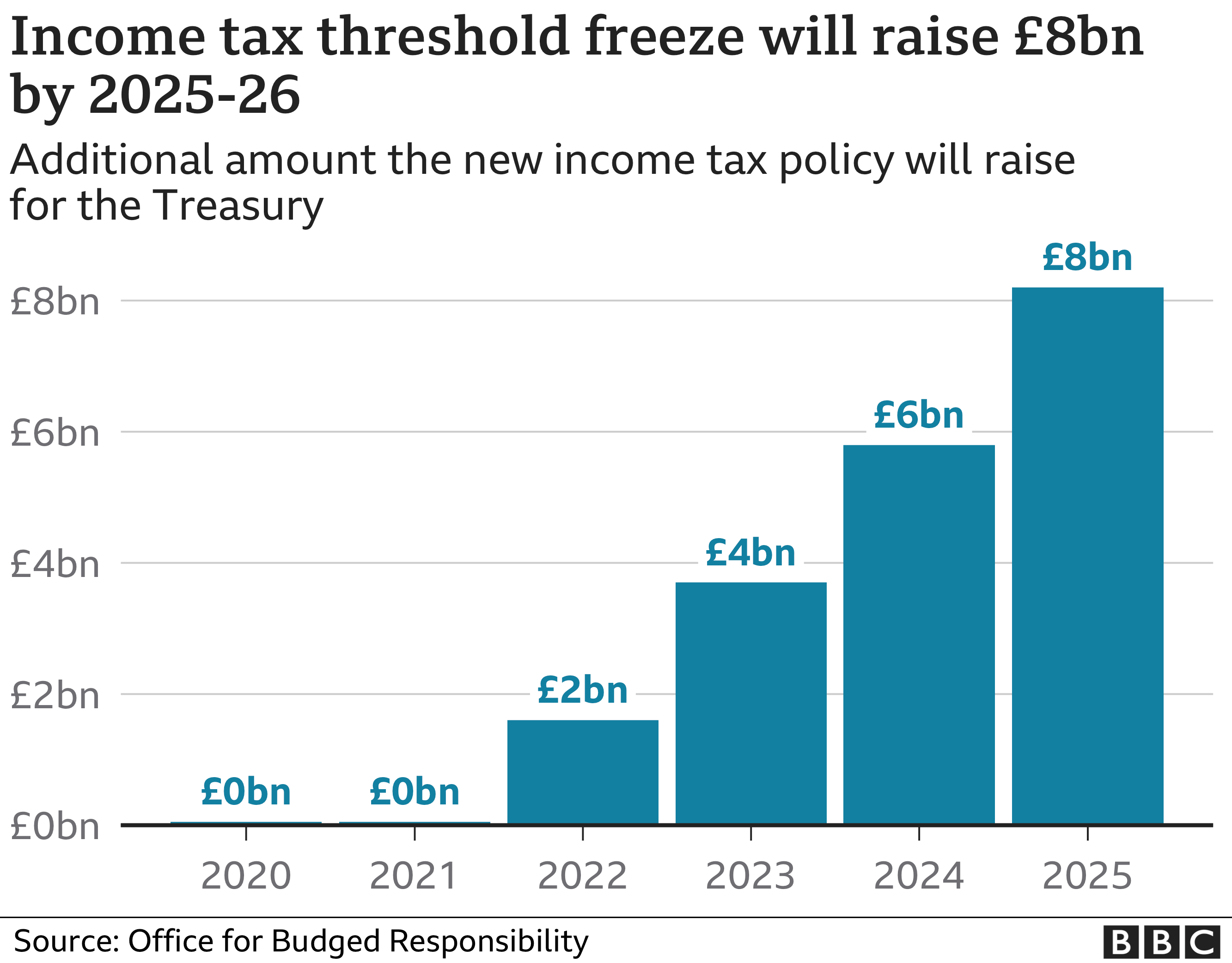

The tax changes that are expected to occur in 2025 and 2026 may have a significant impact on taxpayers. For example, if the federal income tax brackets are not adjusted for inflation, taxpayers may find themselves paying more taxes in the future. Additionally, changes to the standard deduction and tax credits could also affect your tax liability.

It is important to stay informed about the potential tax changes that may occur in the future. By doing so, you can make informed decisions about your financial planning and avoid any surprises when it comes time to file your taxes.

Conclusion

The tax landscape in the United States is constantly evolving. While the tax rates for 2025 and 2026 are expected to remain the same as those for 2023 and 2024, it is important to be aware of the potential changes that may occur in the future. By staying informed and working with a tax professional, you can ensure that you are taking advantage of all of the tax deductions and credits available to you.

Closure

Thus, we hope this article has provided valuable insights into 2025 vs 2026 tax rates. We thank you for taking the time to read this article. See you in our next article!