2025 Tax Calculator: A Comprehensive Guide To Estimating Future Tax Liability

2025 Tax Calculator: A Comprehensive Guide to Estimating Future Tax Liability

Related Articles: 2025 Tax Calculator: A Comprehensive Guide to Estimating Future Tax Liability

- 2025 BMW Hybrid: The Future Of Luxury And Sustainability

- Roadmap For Social Inclusion 2025 – 2025

- 2025 Dodge Vehicles: A Comprehensive Overview

- Porsche Macan Price 2025: A Comprehensive Analysis

- 2025 Toyota 4Runner: The Next Generation Of Rugged Adventure

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Tax Calculator: A Comprehensive Guide to Estimating Future Tax Liability. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Tax Calculator: A Comprehensive Guide to Estimating Future Tax Liability

2025 Tax Calculator: A Comprehensive Guide to Estimating Future Tax Liability

Introduction

Tax planning is an essential aspect of personal finance, allowing individuals to minimize their tax burden and maximize their financial well-being. With the ever-changing tax landscape, staying informed about future tax implications is crucial. The 2025 Tax Calculator is a valuable tool that empowers taxpayers with the ability to estimate their potential tax liability in 2025, enabling them to make informed financial decisions today.

What is the 2025 Tax Calculator?

The 2025 Tax Calculator is a sophisticated online tool that utilizes advanced algorithms and current tax laws to estimate an individual’s federal income tax liability for the year 2025. It incorporates various factors, including income, deductions, credits, and exemptions, to provide a comprehensive and personalized tax projection.

Benefits of Using the 2025 Tax Calculator

- Plan for the Future: By estimating future tax liability, individuals can develop a comprehensive financial plan that accounts for their anticipated tax expenses.

- Optimize Savings and Investments: Knowing their potential tax savings allows taxpayers to make informed decisions about saving and investing strategies.

- Reduce Tax Surprises: The calculator helps individuals avoid unexpected tax bills by providing an accurate estimate of their tax obligation.

- Prepare for Retirement: Tax planning is essential for retirement, and the 2025 Tax Calculator can help individuals estimate their future tax liability in this critical life stage.

- Make Informed Financial Decisions: The calculator empowers taxpayers to make sound financial decisions based on their projected tax liability, allowing them to maximize their wealth.

How to Use the 2025 Tax Calculator

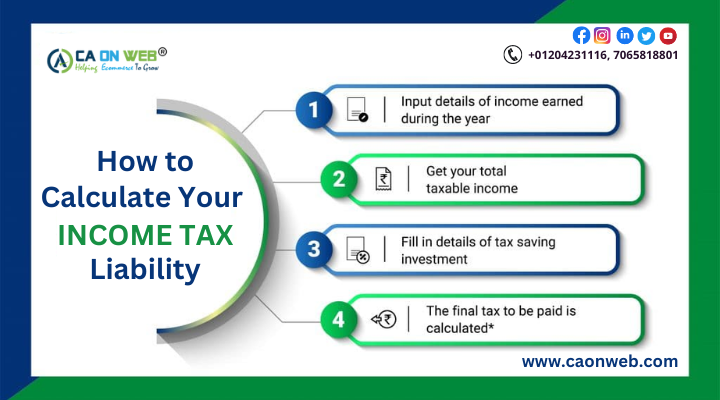

Using the 2025 Tax Calculator is a straightforward process:

- Gather Financial Information: Gather essential financial data, including income, deductions, credits, and exemptions for the year 2025.

- Enter Data into the Calculator: Input the collected financial information into the designated fields in the calculator.

- Estimate Tax Liability: The calculator will process the data and generate an estimated tax liability for the year 2025.

Factors Considered by the 2025 Tax Calculator

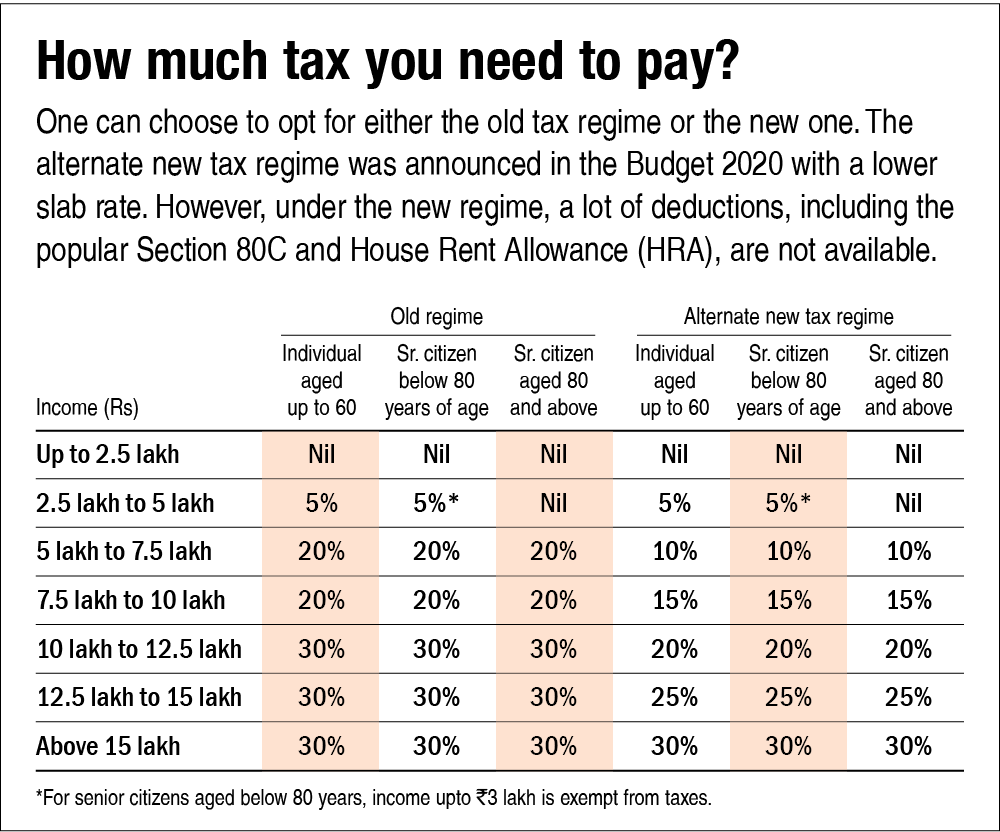

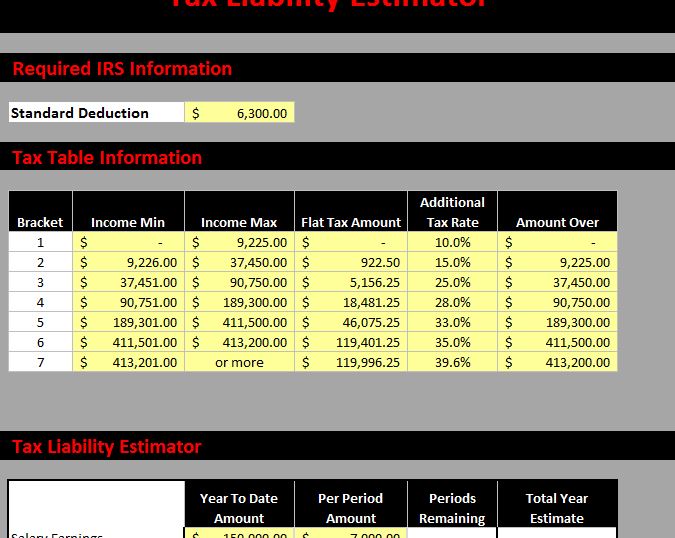

The 2025 Tax Calculator considers numerous factors to provide an accurate tax projection:

- Income: All sources of income, including wages, salaries, investments, and business income.

- Deductions: Itemized deductions, such as mortgage interest, charitable contributions, and medical expenses, as well as standard deductions.

- Credits: Tax credits, such as the child tax credit and earned income tax credit, that reduce tax liability.

- Exemptions: Personal exemptions that reduce taxable income.

- Tax Brackets: The calculator applies the appropriate tax brackets and rates based on the taxpayer’s filing status and income level.

- Tax Laws: The calculator incorporates current tax laws and regulations, including any projected changes or updates.

Limitations of the 2025 Tax Calculator

While the 2025 Tax Calculator provides valuable insights into future tax liability, it is essential to acknowledge its limitations:

- Assumptions: The calculator relies on assumptions about future income and financial circumstances.

- Tax Law Changes: Tax laws can change over time, potentially affecting the accuracy of the projection.

- Complexity: The tax code is complex, and the calculator may not account for all possible tax scenarios.

Additional Considerations

When using the 2025 Tax Calculator, consider the following additional factors:

- Accuracy: The accuracy of the projection depends on the reliability of the inputted financial information.

- Professional Advice: It is advisable to consult with a tax professional for personalized tax advice and to review the results of the calculator.

- Planning: The calculator is a valuable tool for tax planning, but it should be used in conjunction with other financial planning strategies.

Conclusion

The 2025 Tax Calculator is an indispensable tool for taxpayers seeking to estimate their future tax liability. By providing a comprehensive and personalized tax projection, the calculator empowers individuals to make informed financial decisions, plan for the future, and minimize their tax burden. However, it is essential to recognize the limitations of the calculator and to consider additional factors when making financial plans. By leveraging the 2025 Tax Calculator and seeking professional advice when necessary, taxpayers can navigate the complex tax landscape and maximize their financial well-being.

Closure

Thus, we hope this article has provided valuable insights into 2025 Tax Calculator: A Comprehensive Guide to Estimating Future Tax Liability. We appreciate your attention to our article. See you in our next article!