2025 Standard Deduction For Taxpayers Age 65 And Older

2025 Standard Deduction for Taxpayers Age 65 and Older

Related Articles: 2025 Standard Deduction for Taxpayers Age 65 and Older

- 2025 Cadillac XT6: Specifications, Features, And Performance

- The Chicago Bears’ 2015 NFL Draft: A Comprehensive Analysis

- Honda Vezel 2025: The Next-Generation Subcompact SUV

- Solar Storm Of July 2025: A Catastrophic Event

- 2025 Jeep SRT: Unveil The Beast Of The Road

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Standard Deduction for Taxpayers Age 65 and Older. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Standard Deduction for Taxpayers Age 65 and Older

2025 Standard Deduction for Taxpayers Age 65 and Older

The standard deduction is a specific amount that you can deduct from your taxable income before you calculate your taxes. It is a dollar-for-dollar reduction, which means that it reduces your taxable income by the full amount of the deduction. The standard deduction varies depending on your filing status and age.

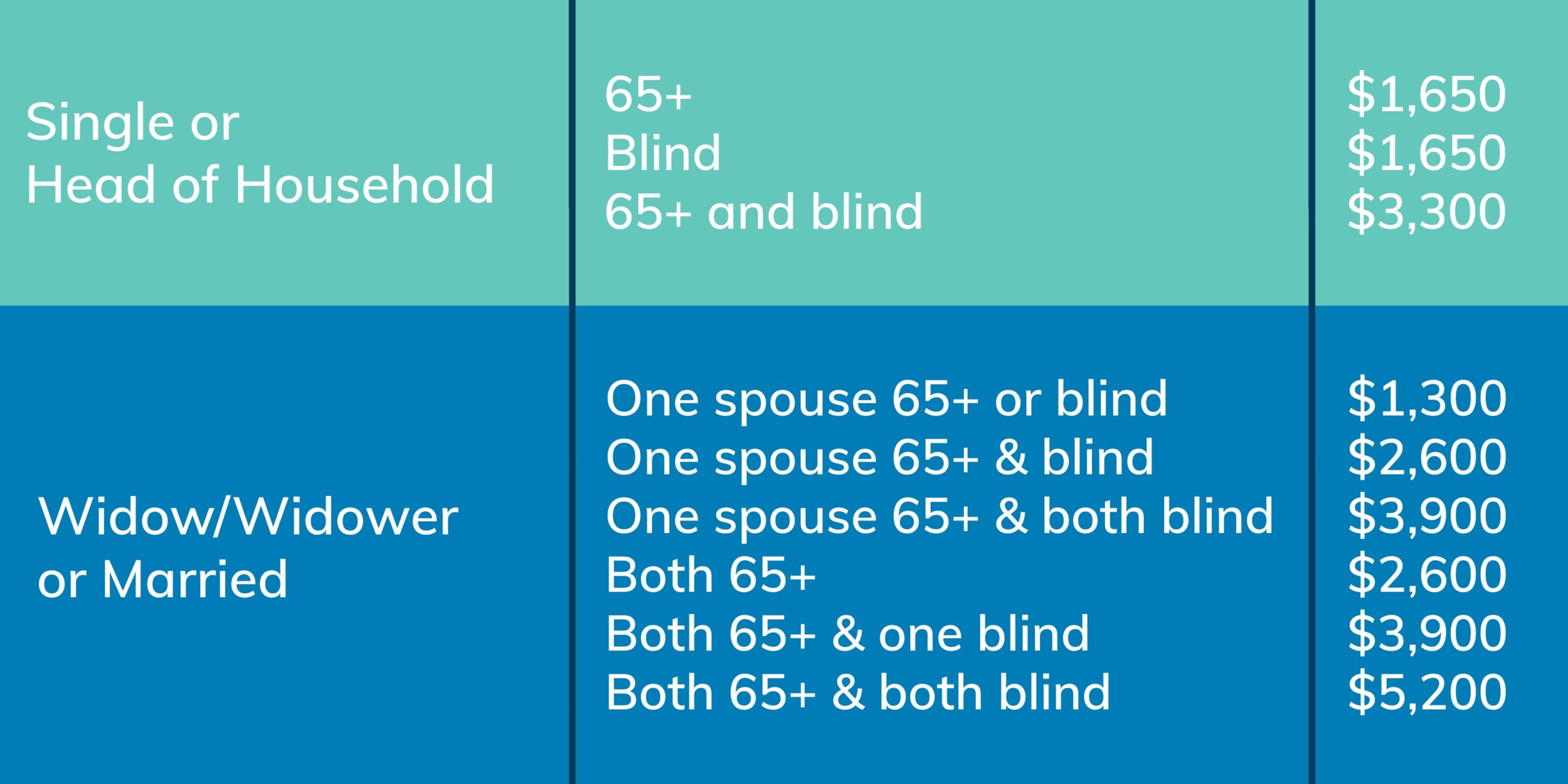

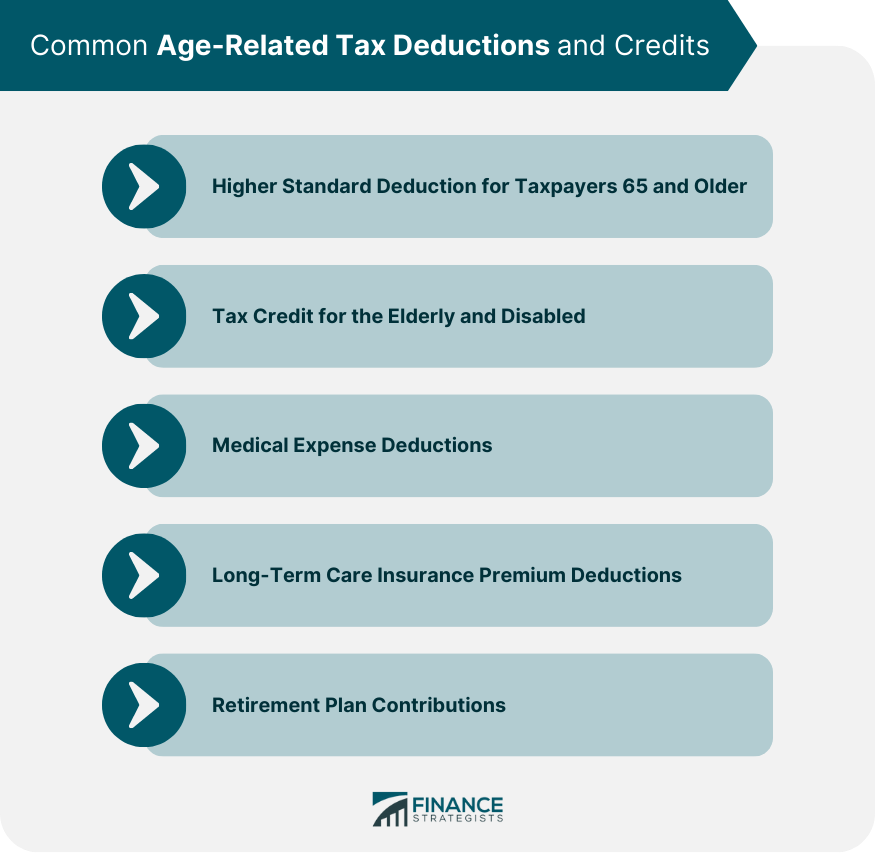

For taxpayers who are age 65 or older by the end of the tax year, the standard deduction for 2025 is:

- Single: $19,400

- Married filing jointly: $27,300

- Married filing separately: $13,650

- Head of household: $20,800

How the Standard Deduction Works

The standard deduction is a simplified way to reduce your taxable income. It is available to all taxpayers, regardless of their income or whether they itemize their deductions.

If you choose to itemize your deductions, you can deduct certain expenses from your taxable income, such as mortgage interest, property taxes, and charitable contributions. However, you can only itemize your deductions if the total amount of your itemized deductions is greater than the standard deduction for your filing status and age.

Benefits of the Standard Deduction

The standard deduction offers several benefits to taxpayers, including:

- Simplicity: The standard deduction is a simple and convenient way to reduce your taxable income. You do not need to keep track of your expenses or calculate your itemized deductions.

- Tax savings: The standard deduction can save you money on your taxes by reducing your taxable income.

- Flexibility: The standard deduction is available to all taxpayers, regardless of their income or filing status.

Who Should Itemize Their Deductions?

Itemizing your deductions can be beneficial if you have a lot of deductible expenses. However, it is important to compare your itemized deductions to the standard deduction for your filing status and age to see if you will save money by itemizing.

Generally, it is only beneficial to itemize your deductions if your total itemized deductions are greater than the standard deduction. However, there are some exceptions to this rule. For example, if you are subject to the alternative minimum tax (AMT), you may need to itemize your deductions even if your total itemized deductions are less than the standard deduction.

Conclusion

The standard deduction is a valuable tax break that can save you money on your taxes. If you are age 65 or older by the end of the tax year, you can claim the higher standard deduction for your filing status. Whether you choose to itemize your deductions or take the standard deduction, it is important to understand how these deductions work so that you can make the best decision for your tax situation.

Closure

Thus, we hope this article has provided valuable insights into 2025 Standard Deduction for Taxpayers Age 65 and Older. We thank you for taking the time to read this article. See you in our next article!