2025 Federal Income Tax Brackets And Rates: A Comprehensive Guide

2025 Federal Income Tax Brackets and Rates: A Comprehensive Guide

Related Articles: 2025 Federal Income Tax Brackets and Rates: A Comprehensive Guide

- GRT Price Prediction 2025: A Comprehensive Analysis Of The Graph Network Token

- Queensland State School Holidays 2025: A Comprehensive Guide

- 2025 Calendar Monster Truck Virginia: Unstoppable Action And Adrenaline

- Free Printable Monthly Calendar For 2025: A Comprehensive Guide To Planning Your Year

- 2025 Subaru Forester Road Test: Refined Evolution In Wilderness-Ready Adventure

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 Federal Income Tax Brackets and Rates: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Federal Income Tax Brackets and Rates: A Comprehensive Guide

2025 Federal Income Tax Brackets and Rates: A Comprehensive Guide

The United States federal income tax system is a progressive tax system, meaning that taxpayers with higher incomes pay a higher percentage of their income in taxes. The tax brackets and rates are adjusted annually for inflation, and the 2025 federal income tax brackets and rates have recently been released by the Internal Revenue Service (IRS).

Tax Brackets

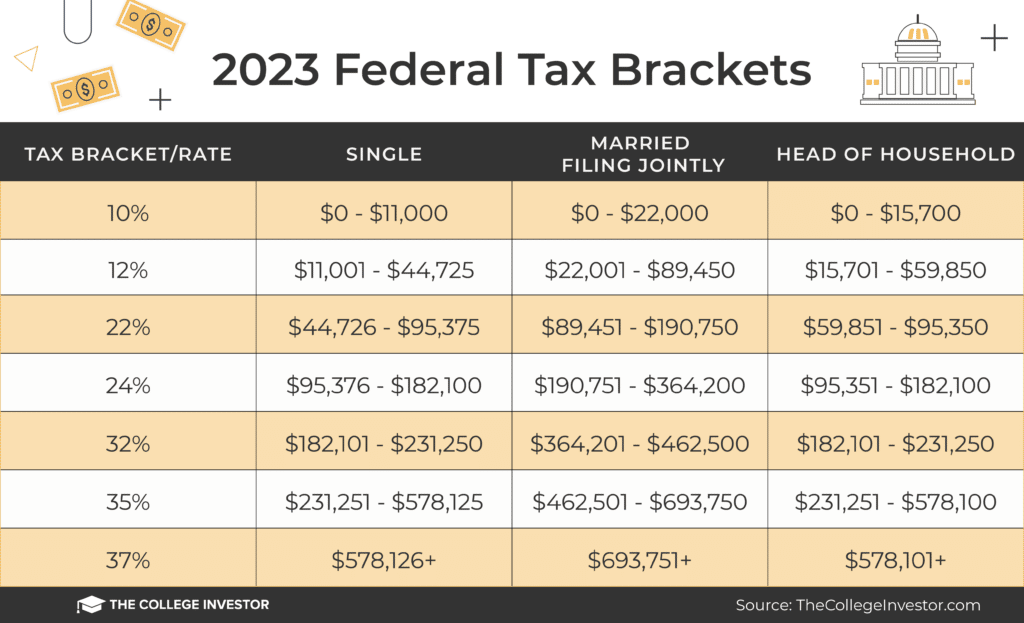

The tax brackets for 2025 are as follows:

-

Single:

- 10% bracket: $0 to $11,000

- 12% bracket: $11,001 to $44,725

- 22% bracket: $44,726 to $95,375

- 24% bracket: $95,376 to $167,100

- 32% bracket: $167,101 to $214,750

- 35% bracket: $214,751 to $541,750

- 37% bracket: $541,751 and above

-

Married Filing Jointly:

- 10% bracket: $0 to $22,000

- 12% bracket: $22,001 to $89,450

- 22% bracket: $89,451 to $190,750

- 24% bracket: $190,751 to $334,200

- 32% bracket: $334,201 to $429,500

- 35% bracket: $429,501 to $1,083,500

- 37% bracket: $1,083,501 and above

-

Married Filing Separately:

- 10% bracket: $0 to $11,000

- 12% bracket: $11,001 to $44,725

- 22% bracket: $44,726 to $95,375

- 24% bracket: $95,376 to $167,100

- 32% bracket: $167,101 to $214,750

- 35% bracket: $214,751 to $541,750

- 37% bracket: $541,751 and above

-

Head of Household:

- 10% bracket: $0 to $14,250

- 12% bracket: $14,251 to $57,875

- 22% bracket: $57,876 to $115,750

- 24% bracket: $115,751 to $231,500

- 32% bracket: $231,501 to $304,250

- 35% bracket: $304,251 to $753,000

- 37% bracket: $753,001 and above

Tax Rates

The tax rates for 2025 are as follows:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

Standard Deduction

The standard deduction is a specific amount of income that is deducted from your taxable income before your taxes are calculated. The standard deduction for 2025 is as follows:

- Single: $13,850

- Married Filing Jointly: $27,700

- Married Filing Separately: $13,850

- Head of Household: $20,800

Personal Exemptions

Personal exemptions are no longer allowed as of the Tax Cuts & Jobs Act of 2017.

Calculating Your Taxes

To calculate your taxes, you will need to determine your taxable income. Your taxable income is your total income minus any deductions and exemptions. Once you have determined your taxable income, you can use the tax brackets and rates to calculate your taxes.

Example

Let’s say that you are single and your taxable income is $50,000. Your taxes would be calculated as follows:

- The first $11,000 of your income would be taxed at 10%.

- The next $33,725 of your income would be taxed at 12%.

- The remaining $5,275 of your income would be taxed at 22%.

Your total taxes would be $7,055.

Conclusion

The 2025 federal income tax brackets and rates are a complex topic, but it is important to understand them so that you can calculate your taxes accurately. If you have any questions about your taxes, you should consult with a tax professional.

Closure

Thus, we hope this article has provided valuable insights into 2025 Federal Income Tax Brackets and Rates: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!